Is the War in Ukraine Affecting the Crypto Industry? DappRadar Insights

Dapp discovery and analysis platform DappRadar has released a detailed report covering how the war between Russia and Ukraine has impacted the crypto industry. It argues that blockchain-based solutions could “play an important role” as the war continues, especially in light of global sanctions and asset freezes against Russia.

The Macroeconomic Picture

The report begins by assessing both Russia’s and Ukraine’s economic roles in the world. While Russia is one of the world’s most significant energy and commodities producers, Ukraine is a major source of wheat. Until now, half of Russia’s oil has been consumed by European nations and fueled a third of Europe’s total oil consumption.

Today, Russia has been banned from exporting its oil to the United States, and Europe is slashing its reliance on the nation’s natural gas by 66%. This has led to a rise in oil prices, which the report predicts will impact Bitcoin and other proof of work blockchains.

Meanwhile, Russian banks have also been sanctioned by the West, and about 65% of the country’s $650 billion in reserves were frozen. The nation has been ejected from the SWIFT payment messaging system, and multiple payment providers including PayPal, Visa, and Mastercard have even stopped servicing Russia.

As such Dappradar believes blockchain ecosystems can provide a payment gateway for millions of Russians and Ukrainians deprived of other methods. It specifically mentions the use of stablecoins, which can be used as a hedge against the high inflation seen in Russia today.

In fact, Bitcoin payments company Strike recently brought a Tether compatible remittance service to Argentina to serve a similar purpose.

Regarding Ukraine, the crypto community has utilized digital assets to provide the nation with tremendous support already. Its Vice Prime Minister has been highly engaged with the community over Twitter, soliciting donations in everything from Bitcoin, to Polkadot, to Dogecoin.

Crypto’s Starring Role

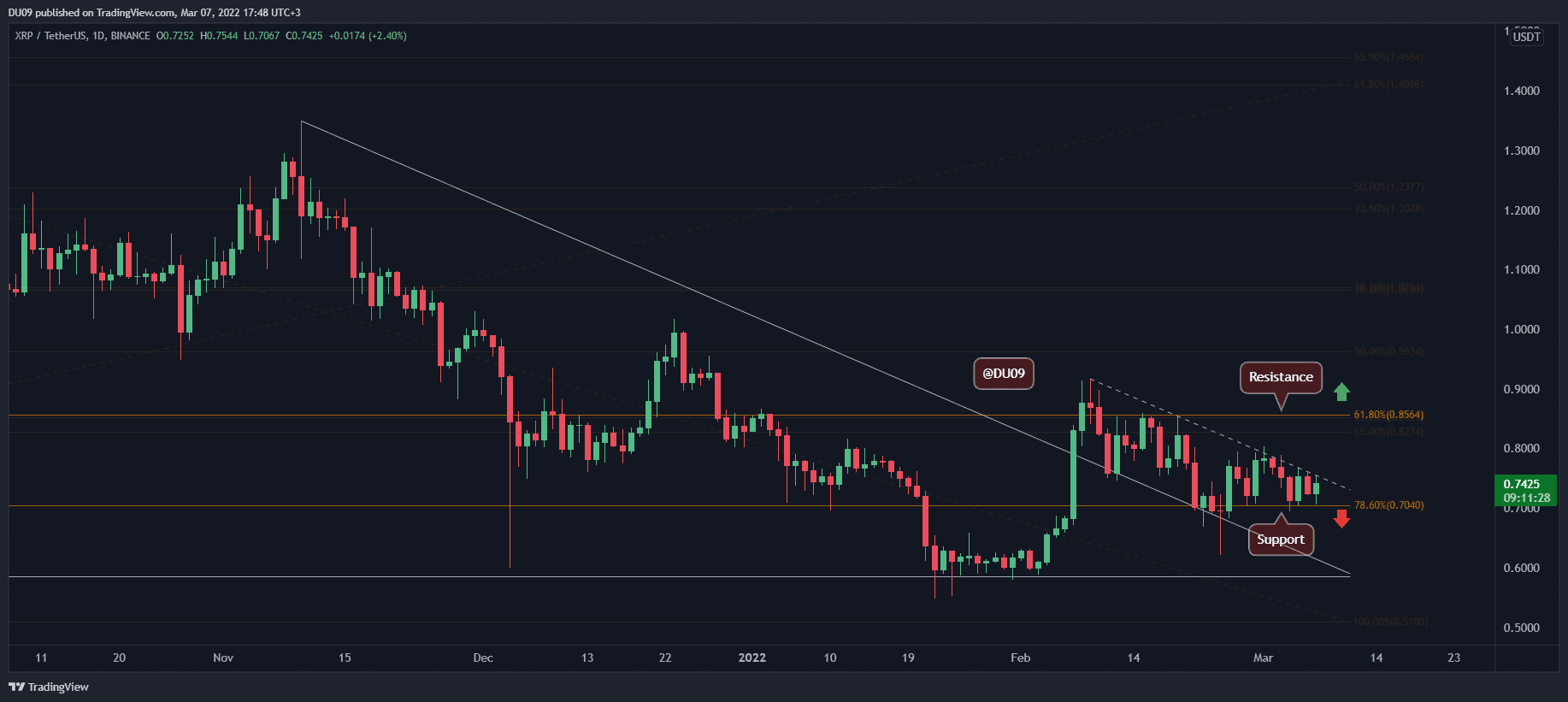

The report recognizes that cryptocurrency demand has been rising significantly in both Ukraine and Russia since their war began. Bitcoin purchased with rubles tripled in Russia, while it nearly doubled in Ukraine. Dappradar claims that this has helped Bitcoin find price support around $38,000 despite the months-long bear trend that the crypto market has been trapped within.

Overall, the firm argues that the fallout from this situation will inspire people to seek a more verifiable, decentralized financial system.

“This scenario will generate even more distrust into the centralized banking system, paving the way to adopting and recognizing digital assets and cryptocurrencies,” the report states.

Credit Suisse shared similar expectations in an analysis last week, in which it argued that inflation is coming to the U.S. and that Bitcoin would likely benefit from the current turmoil.