Is The Largest Difficulty Adjustment In Bitcoin’s History Incoming?

The Bitcoin network faces its largest difficulty adjustment of all time.

The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

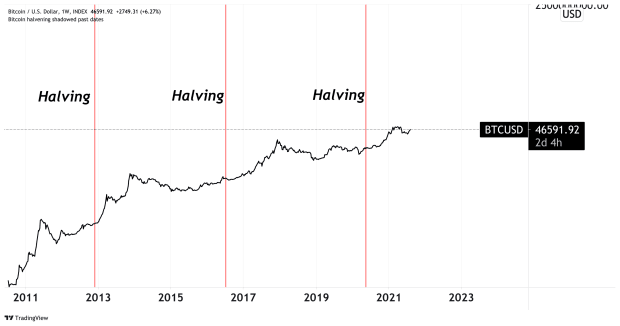

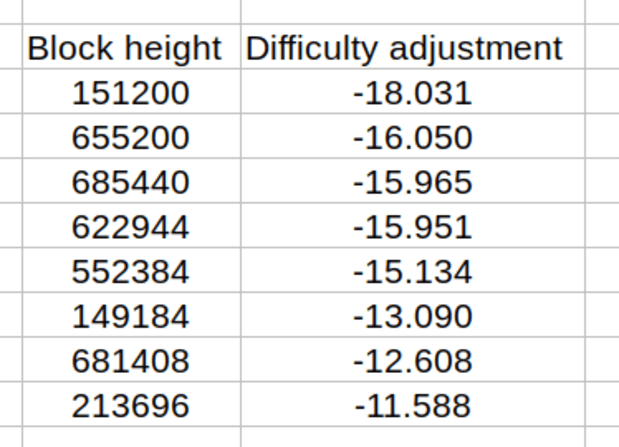

At the time of writing, Bitcoin is expected to have a -20.8% difficulty adjustment, with 651 blocks to go. Listed below are the largest difficulty adjustments in Bitcoin’s history, making the impending difficulty adjustment the largest downward adjustment in history if blocks continue to be mined at the same pace.

As covered in previous Daily Dives, hash rate has declined at a historic rate following the mining bans in China. The Bitcoin network is extremely resilient to such disruptions due to simple economic incentives, but the hash rate migration is having a short/medium term impact on the market.

Mine revenues have decreased by 64.5% from the all-time high of $67,434,000 per day (seven-day moving average) made on May 10. The pressure this has placed on the remaining miners on the network has led to further downside in the bitcoin price.

Another factor at play with the mass migration of miners from the East is that many of these firms and operations kept nearly all of their reserves and liquid cash balances in bitcoin, and as a result, these entities have had to sell to cover the high cost of moving operations.