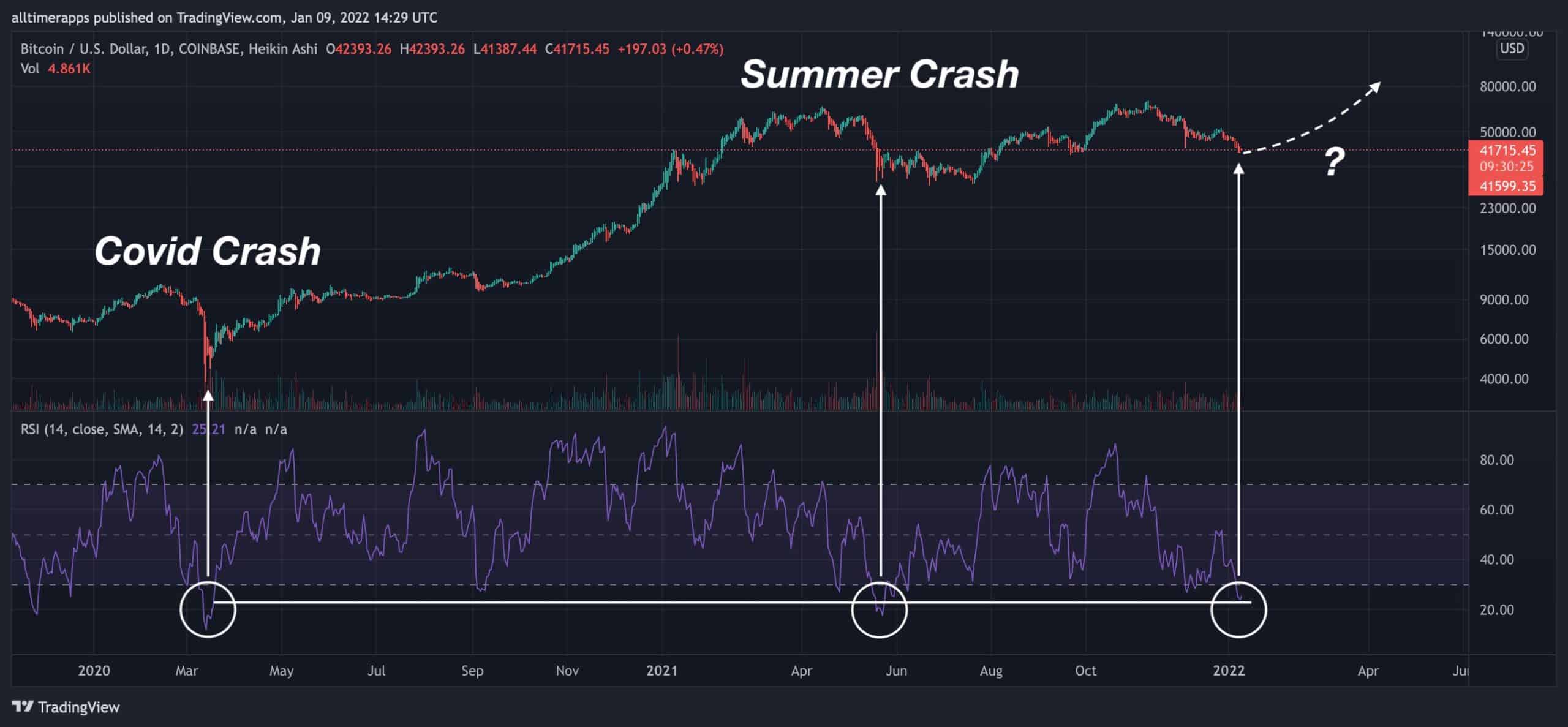

Is the Bottom In? Bitcoin’s RSI at Lowest Point Since May 2021 Crash

The past weeks have been quite challenging throughout the entire cryptocurrency market, to say the least. The total capitalization is down over $300 billion in the last seven days alone. Bitcoin, along with most of the other cryptocurrencies, is struggling in terms of pricing. However, some technical indicators might suggest that the bottom is closing in.

- At the time of this writing, Bitcoin is down 11% in the past seven days and is trading at around $42,000. The rest of the market is also down considerably.

- Ethereum is down 17.5%, BNB is down 16.6%, Solana – 19%, and so forth.

- One widely-used indicator – the Relative Strength Index (RSI) – might suggest that the bottom is closing in.

- This is a metric that represents a momentum oscillator, and it measures the speed and change of price movements. It oscillates between 0 and 100.

- Traditionally, when the RSI is above 70, the asset is considered overbought, and when it’s below 30, it’s considered oversold.

- Yesterday, on January 9th, the RSI was at its lowest point since the crash that took place back in May. The previous time it was this low was in March 2020 – during the COVID crash.

- What this goes on to show is that on two separate occasions in the not-so-distant past, when Bitcoin’s RSI dropped to the levels, it’s currently at, this has marked some sort of a local bottom, and the price has increased substantially in the months after that.

- Another possible bottom indicator could be the Bitcoin fear and greed index – a gauge for the current sentiment across the market based on various criteria such as volatility, market momentum, social media, surveys, dominance, trends, and so forth.

- At the time of this writing, the index shows that the market is in a state of “extreme fear.”