Is Tether (USDT) Behind the 2019 Bitcoin Price Rally (Again)?

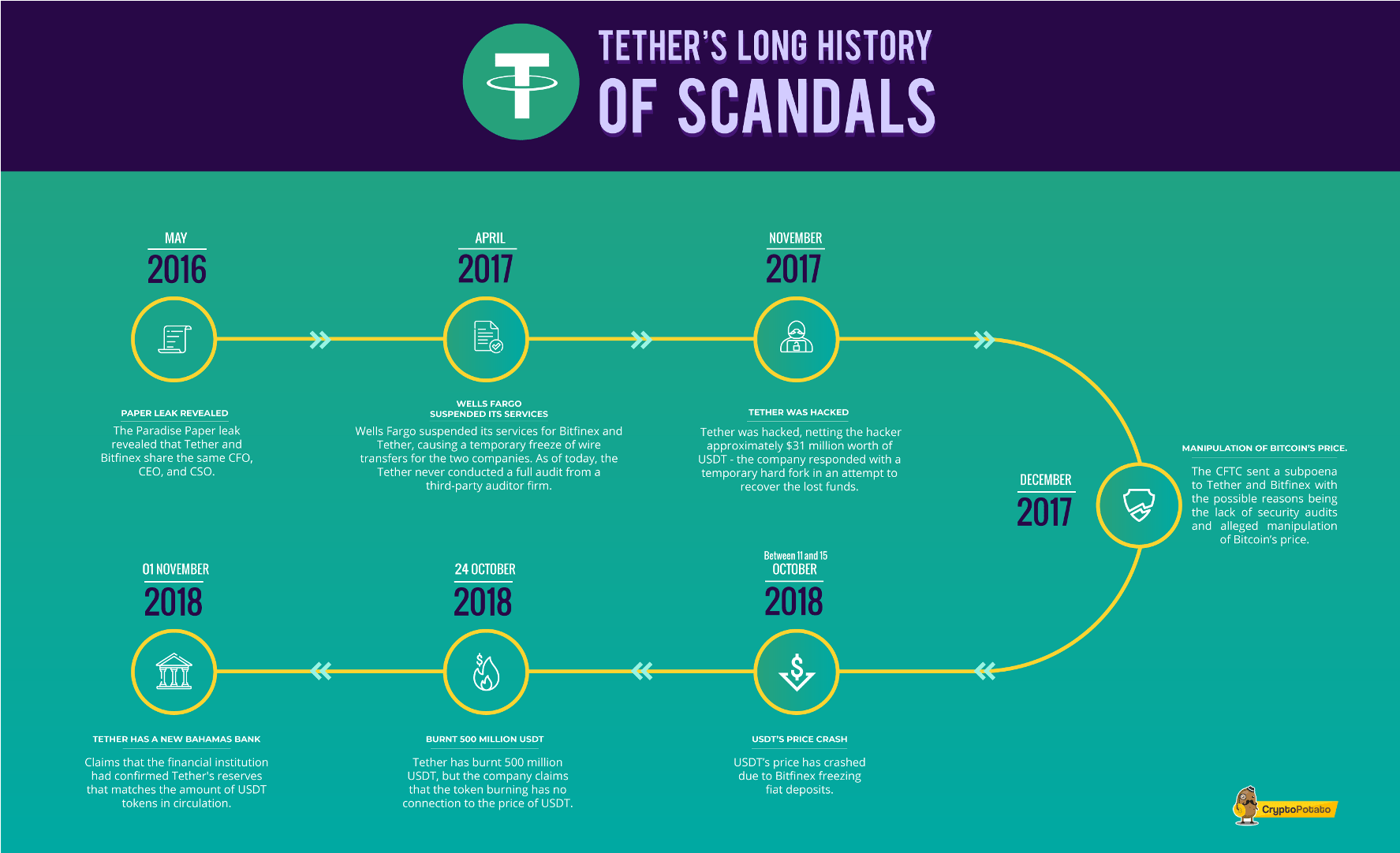

Tether, the company behind the stablecoin USDT, has ignited a significant amount of controversy in the crypto community.

Due to the scandalous past of the firm, as well as allegations that Tether had manipulated the 2017 Bitcoin surge and the fact that the company printed $150 million USDT in June, many in the crypto community are suspecting that the stablecoin issuer is “playing” with BTC’s price (again), artificially pumping it with USDT tokens.

Tether controls Bitcoin price action pic.twitter.com/8rcBrXxBsS

— Crypt0cracy (@Crypt0cracy) July 2, 2019

No Audits And Alleged Market Manipulation

To analyze the viewpoint of those who accuse Tether of manipulating BTC price, it’s time to look into the firm’s past.

First of all, it is safe to say that – despite claiming that its coins are 100% backed by USD reserves (until the firm changed its terms in March) – Tether had never completed a full audit of its reserves by a third-party firm.

Furthermore, following pressure from the community as well as the Commodity Futures Trading Commission’s (CFTC) subpoena, Tether general counsel Stuart Hoegner stated in May that the organization’s USDT tokens are only 74% backed by real USD reserves.

In addition to that, the “Paradise Papers” leak by the International Consortium of Investigative Journalists’ revealed that the stable coin issuer Tether and the cryptocurrency exchange Bitfinex share the same CEO, CSO, and CFO.

In light of these events, Professor John Griffin at the University of Texas and graduate student Amin Shams published a research paper in June 2018, stating that Tether and Bitfinex worked together to artificially increase Bitcoin’s price during its 2017 bull run.

Taking all the scandals of the company into account, it is a reasonable reaction from the crypto community to suspect that Tether is behind the recent BTC bull run. Especially when Bitcoin’s price starts an uptrend ten minutes after the company had printed $100 million tokens.

Kraken CEO: Bitcoin price is driven by real demand

On the other hand, another part of the crypto community is saying that the Bitcoin has real demand with that being the reason for the current price rally instead of Tether’s alleged market manipulation.

The CEO of popular cryptocurrency exchange Kraken, Jesse Powell, shares the same view.

“I don’t have inside knowledge of what’s happening at Tether, but I can tell you that, historically, when you’ve seen growth in the supply of Tether, we’ve seen growth in the supply of U.S. dollars coming onto Kraken. And other exchanges would report the same,” Powell said in an interview with Forbes.

Powell stated that Tether is “a much more transparent version of what’s happening on all the exchanges when the Bitcoin price is increasing” and, unlike Tether, “normal” USD deposits arriving on exchange bank accounts do not show on public blockchains.

“I don’t feel like Tether is artificially inflating the price of bitcoin. I think Tether is actually a small part of the total fiat supply among all the exchanges,” Powell added.

The post Is Tether (USDT) Behind the 2019 Bitcoin Price Rally (Again)? appeared first on CryptoPotato.