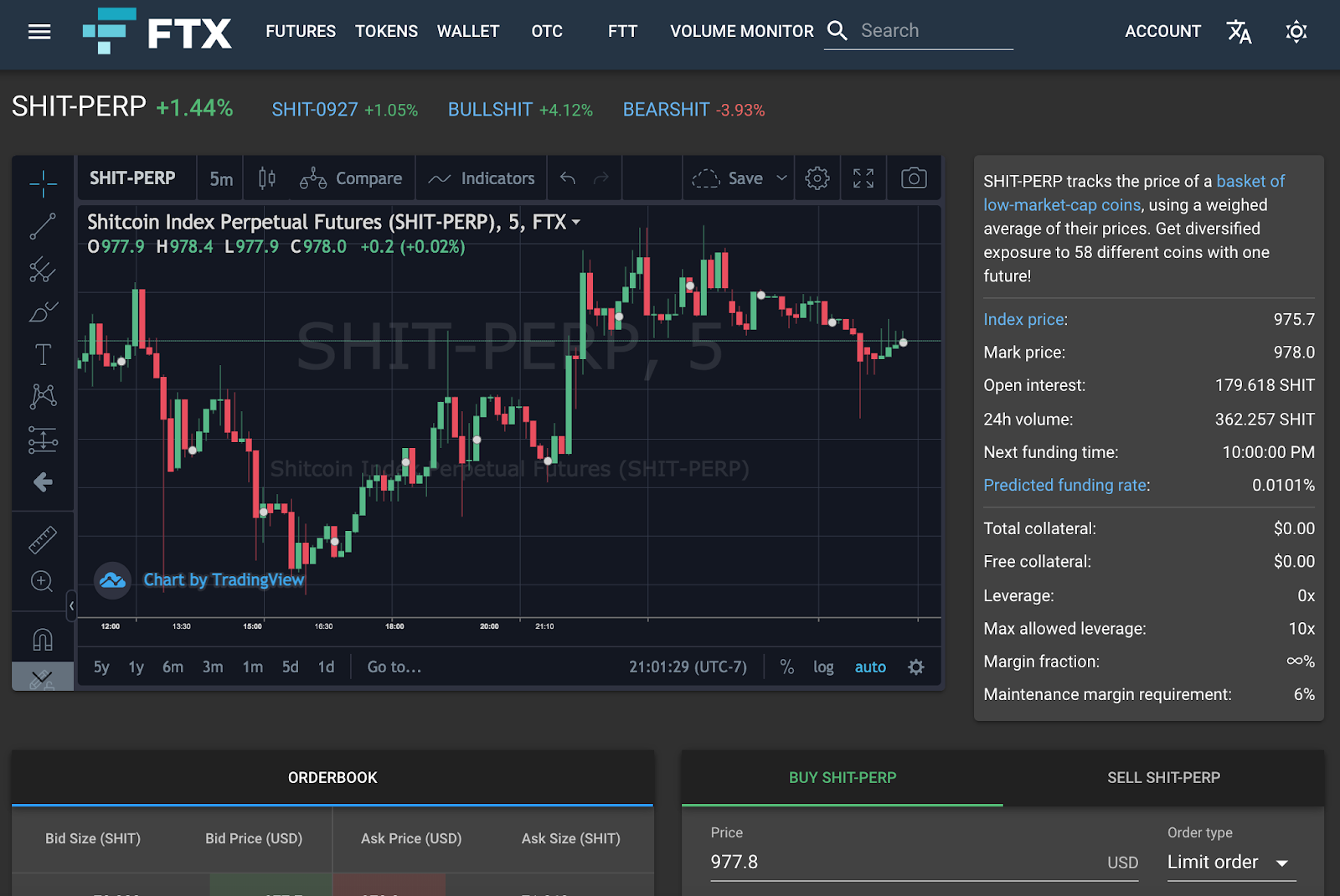

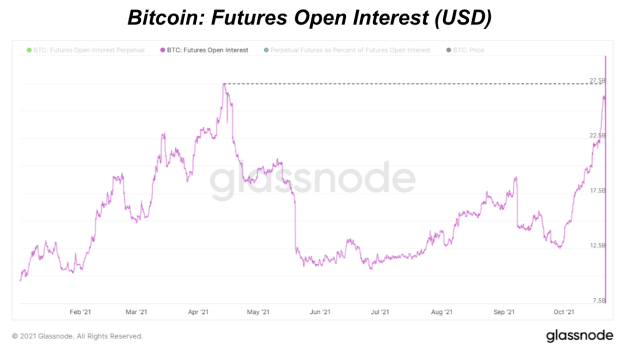

Is Rising Bitcoin Futures Open Interest Cause For Concern?

The aggregate bitcoin futures open interest rise is slightly below all-time levels.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Aggregate bitcoin futures open interest rise is slightly below all-time levels made at the local bitcoin market top in April. Is this cause for concern?

While futures open-interest and leveraged bets favoring the long side have certainly increased over the recent weeks with bitcoin’s feverish rally past previous all-time highs, there are a few key distinctions between the market structure in April versus what we are seeing now.

The biggest and maybe the most important difference between the derivatives market in April compared to today is the percentage of futures-open interest that is using BTC as collateral to enter a position. With bitcoin derivative markets, you can either use BTC or stablecoins as collateral.

If you are long (directionally betting on prices to increase) using bitcoin, then if the price decreases your position P&L (profit and loss) and your collateral decrease in value in tandem, this raises the liquidation price of your position. This can result in mass-market liquidation events, similar to what happened in May following the April highs.

Thus, it holds great significance that the percentage of open interest using BTC as collateral has declined significantly since April, from a high of 70.17% to 45.04%. This is a trend we have been covering in detail since July, when we broke down some of these dynamics in The Daily Dive #028 – Structural Changes To BTC Derivatives Market.