Is it Time To Short Bitcoin? Answers OKEx CEO As Global Stock Markets Continue Their Uptrend

Despite world economies still feeling the adverse effects of the COVID-19 pandemic, most stock markets have recovered from the March losses, and some are even charting new highs.

This has raised speculations that Bitcoin’s price may head south, and OKEx CEO Jay Hao recently offered his answer on the matter.

Jay Hao Examines The Stock Markets And Bitcoin

As CryptoPotato reported, the popular index Nasdaq reached a new all-time high yesterday and continued its upward movement today. Other prominent US indexes such as the S&P 500 and Dow Jones are also in the green and have almost fully recovered since the Black Thursday in March.

The situation outside of the US is quite similar. The Shanghai Shenzhen CSI 300 is at its highest level in nearly a year, and the Hong Kong Hang Seng Index is close to the pre-COVID-19 level.

Jay Hao, the CEO of the popular cryptocurrency exchange OKEx, published an article after supposedly receiving numerous questions – “stocks have skyrocketed, can we short Bitcoin?” His attempt to answer this complex issue pushed him towards several factors regarding BTC’s recent developments.

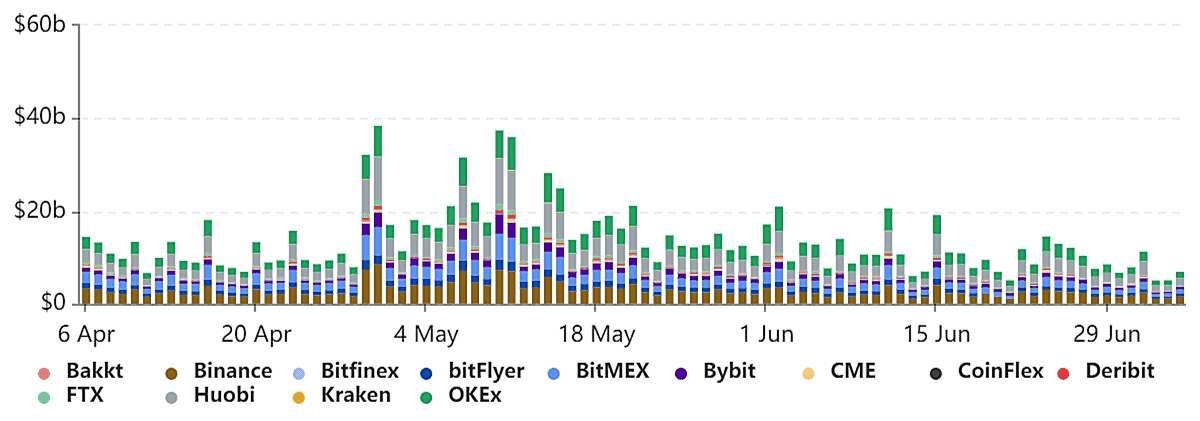

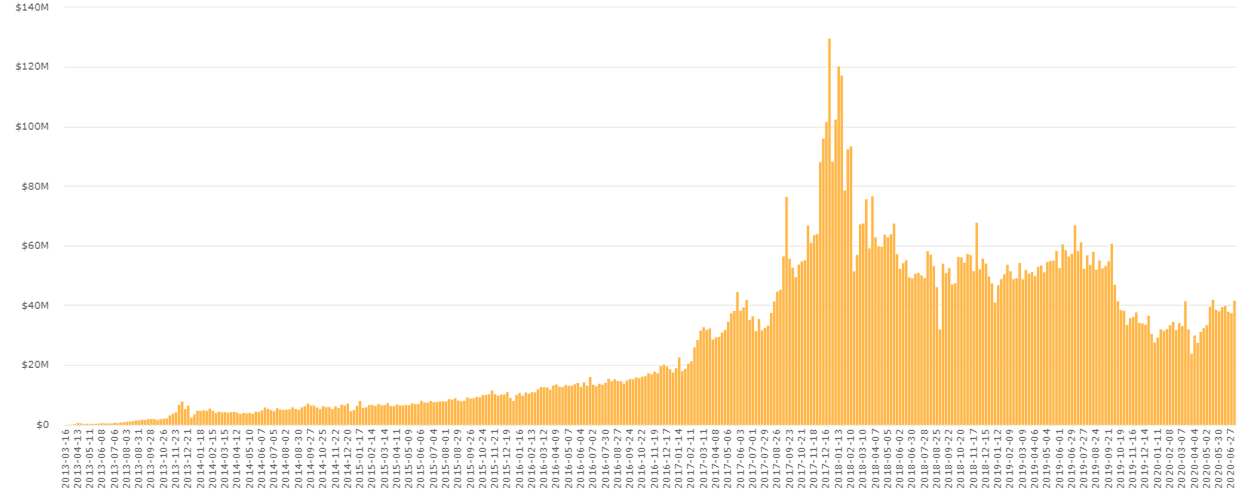

The first one is the trading volume, which has been declining for both derivatives and spot trading, as illustrated in the two graphs below from the cryptocurrency monitoring companies – Skew and CryptoCompare.

Hao argued that the overall decreasing volatility in Bitcoin’s performance is the reason why derivatives trading volume has plunged. “The value of Bitcoin derivatives is mainly reflected in hedging market risks. Whether it is Bitcoin futures or Bitcoin options, there is a strong trading demand during periods of high volatility,” and vice-versa, he added.

He concluded that this decreasing data “seems to suggest that we could short Bitcoin.”

But, Not So Fast

Bitcoin’s price is determined by significantly more factors than just its trading volumes on cryptocurrency exchanges. For instance, Hao brought up over-the-counter (OTC) trading, which could sometimes be “more trustworthy” as “trading volume on exchanges can be fraudulent.”

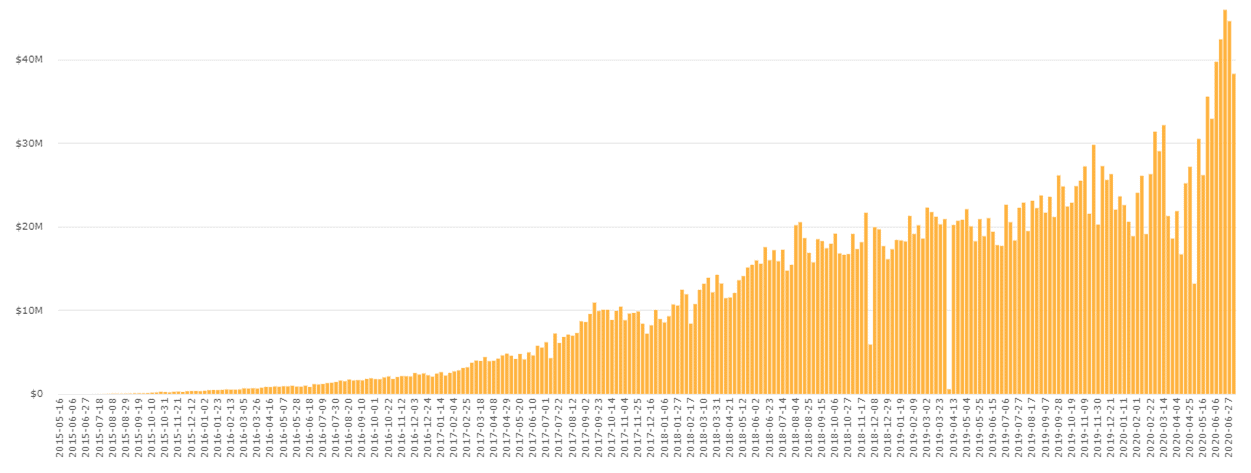

Data from Coin.dance reveals how the volume has altered lately on two of the largest peer-to-peer Bitcoin trading platforms, namely Paxful and Localbitcoins. While Localbitcoins has indeed experienced a slight decrease, Paxful stands on the opposite shore with a continuous increase and a recently registered all-time high.

Bitcoin’s on-chain trading data provides optimistic outtakes as well. According to a recent report, three vital on-chain market metrics have been performing rather impressively lately. The daily new addresses reached a 2-year high of 560,000 – a number not seen since the parabolic price increase of 2017. As a result, the number of total addresses on the network is more than 670 million.

The daily transaction count is at its highest level in ten months after reaching 382,000 earlier this week. Bitcoin’s hash rate has also recovered from the post-halving decreases to near ATH levels, making the network more robust.

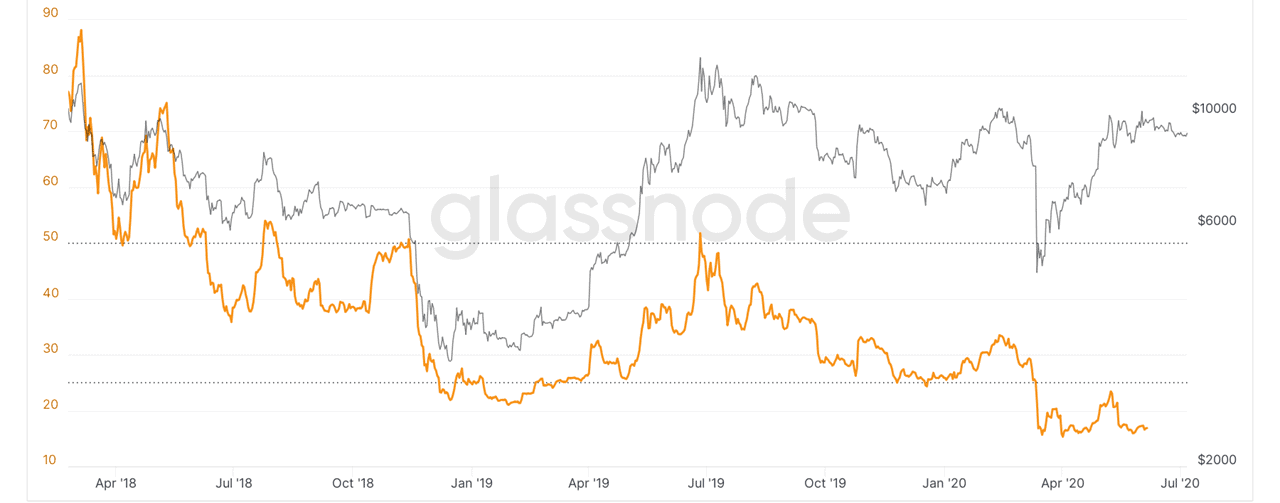

The Stablecoin Supply Ratio (SSR), measuring the ratio between the Bitcoin supply and the stablecoins supply (or BTC market cap/Stablecoin market cap), is another indicator that breaths confidence in the primary cryptocurrency’s performance. Hao outlined that when the SSR is low, it provides more “buying power” to purchase BTC. And, data from Glassnode confirms that the SSR is extremely low.

Hao Neglects The Correlation Between Stocks and Bitcoin

The primary cryptocurrency has demonstrated increased correlation levels with most indexes lately. However, Hao told CryptoPotato that despite the rising trend, the current levels are still not sufficient for major conclusions:

“The current correlation coefficient is about 0.23. But statistically, it is considered that the absolute value of the correlation coefficient should be generally above 0.8 to consider A and B to have a strong correlation; between 0.3 and 0.8 can be considered to have a weak correlation, but below 0.3 to consider that there is no correlation.

Therefore, although the current correlation between Bitcoin and stocks has become more pronounced, we still believe that there is no direct correlation between the two.”

Following the above information, Hao concluded that “the stock markets may indeed lead to the loss of funds in the crypto market and be behind the decline in trading activity.” However, BTC’s fundamentals are still strong, and its popularity has not decreased.

“The shift of attention caused by the rise of other investment products is only temporary, and, as an individual investor, I am still very optimistic about the return of Bitcoin as a healthy investment.”

The post Is it Time To Short Bitcoin? Answers OKEx CEO As Global Stock Markets Continue Their Uptrend appeared first on CryptoPotato.