Is Greece Cracking Down on Tax Evasion or Taxing Anonymity?

Is Greece Cracking Down on Tax Evasion or Taxing Anonymity?

Greece’s plan to curb tax evasion by mandating digital receipts shows a fundamental dilemma of modernization: Economic policies rarely address corruption without sacrificing civil liberties.

The Greek prime minister’s chief economic adviser, Alex Patelis, told The Telegraph on Sunday that in 2020 Greek citizens will need to produce digital receipts for spending 30 percent of their annual income. Citizens that fall short of this documentation requirement – for example, only having credit card purchases and bank transfers for 20 percent of their income – will be fined 22 percent tax on the remaining amount (the remaining 10 percent, in this example).

When it comes to Greece, this drastic policy shows nation-states can mandate that citizens rely on banks. Credit cards and bank transfers – and their incumbent surveillance features – are no longer payment options for Greek citizens, they are obligations. And while bitcoin experts say cryptocurrency likely won’t be much help in this situation, they have been quick to pick up on the policy’s broad implications.

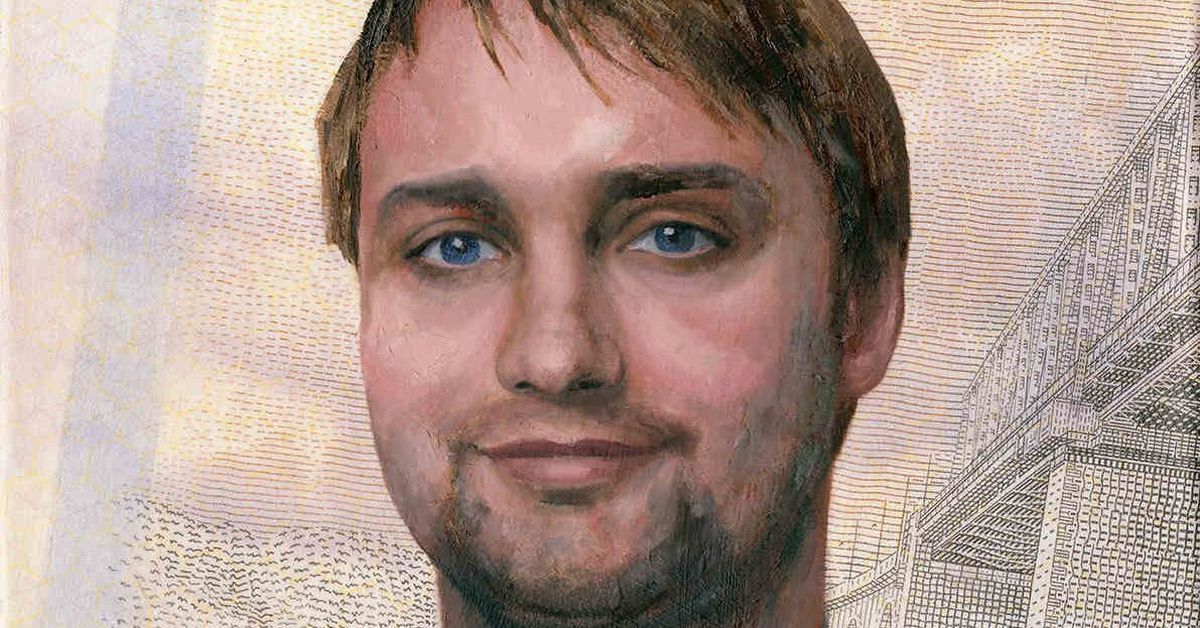

“I’ve never heard of anything like this before. It’s the most aggressive move to eradicate cash that I’ve seen in any country,” said British-Greek bitcoin advocate Andreas Antonopoulos, who grew up in Greece and still has family there.

However, economist Nicholas Economides, whose previous advisory clients include the Bank of Greece in 1993, disagreed that this policy represents a dramatic shift. To the contrary, Economides said the Greek government has required digital receipts for tax deductibles for more than five years. If citizens are unable to show bank records or credit card statements for deductible bills, paper receipts no longer suffice. As such, he argued this is merely another modernization push.

“When you have widespread cheating, there has to be a way to make people stop cheating, to pay [taxes]. One way might be this extensive banking surveillance,” Economides said.

This policy aims to curb tax evasion. But, ironically, the middle class appears to be the most frequent taxpayers. Local media reports indicate that 5 percent of Greek taxpayers earning between €24,000 and €100,000 are paying half of all income-tax revenue. Basically, the remaining 95 percent pay as much as the above-mentioned 5 percent, implying the vast majority of citizens don’t pay their full income taxes.

“The violence of this law will impact all people, mainly our parents who are not familiar with… e-banking services,” Athens resident and bitcoin enthusiast Argy Xafis said. “My privacy is also invaded.”

Economides said he hopes the government will make exceptions for the elderly, but added this mandate may not impact the unbanked poor, as citizens below the poverty line don’t pay income taxes.

“People who don’t have debt or credit cards may have a hard time,” he said. “The government should create exceptions for people who don’t have such financial instruments.”

From Economides’ perspective, tax evasion is a widespread cultural norm in Greece, across income levels.

Yet Georgios Konstantopoulos, an independent cryptocurrency consultant from Greece, said tax evasion isn’t the primary reason so many Greeks rely on cash for their daily transactions.

Konstantopoulos said it’s common for local businesses to offer a different price in cash compared to a transaction with an official receipt, even among hospitals, courts and other heavily regulated entities. Antonopoulos agreed cash bribery is the standard local practice.

“Every single medical procedure that is supposedly covered by the national healthcare in Greece involves a cash envelope,” Antonopoulos said. “You go into any hospital in Greece and they give you a blank envelope at the reception.”

As such, Konstantopoulos said this new policy will be difficult to enforce for waiters, construction workers and other laborers who generally rely on day-to-day cash payments – unless these low-income workers pay their rent with a bank card.

“The people who earn €500 a month, of course, will tax-evade because otherwise they cannot survive,” Konstantopoulos said. “Literally every young person who wants to do things in their life is looking for ways to work abroad. …Generally, salaries suck; there are high taxes and fixed fees, pension or insurance, so a lot of shops and restaurants tend to have employees who work ‘undeclared,’ paid daily in cash.”

Antonopoulos said this policy will make it more difficult for middle-class households and business owners to pay such workers in cash, since the culture of bribery won’t “disappear” overnight. Instead of jeopardizing healthcare and legal services, Antonopoulos said, the policy may push low-income workers into poverty and food insecurity because their services will be seen as comparably expendable.

“Pretty much every Greek I know who has even the slightest means to travel has a bank account in Germany,” Antonopoulos said, referring to how many Greeks skew their income reports and banking limitations. “It’s all for show. [This policy] is not a meaningful effort to curb tax evasion.”

Stepping back, the cash-centric Greek “shadow economy” reportedly accounts for more than 21 percent of the nation’s total GDP, according to a 2017 study by the Institute for Applied Economic Research.

The government previously curbed the cash economy by limited bank ATM withdrawals, a policy that started with a €60 ($70) daily limit in 2015 and finally lifted for domestic withdrawals in 2018. According to CNN, Greek bitcoin trades shot up when the banking restrictions first when into effect in 2015. Yet Konstantopoulos said the domestic bitcoin scene hasn’t surged since then to facilitate significant volumes. Antonopoulos agreed, describing the Greek bitcoin community as “small,” “isolated” and “risk-averse,” because people with the resources to buy bitcoin generally prefer foreign bank accounts.

“This isn’t about surveillance, this is about pushing people into poverty,” Antonopoulos said, explaining his criticism of the new tax policy.

According to an academic working group paper last revised in 2016, Greek professionals from industries such as law, medicine and media were most likely to be involved in tax evasion. As such, Antonopoulos said banking limitations primarily impact the middle class, because households with expendable income simply use foreign bank accounts instead.

It’s hard to say definitively how many Greeks are misrepresenting their taxable income because statistics are further skewed by the high percentage of self-employed and unemployed Greeks, each respectively estimated to represent over a third of the nation’s prospective workers. There is a popular perception that government corruption contributes to such economic woes, even without studies to quantify that impact. The nonprofit Transparency International gave Greece a failing integrity grade of 45 percent for “perceived levels of public sector corruption” in 2018.

Despite bitcoiners’ distrust of the government, Greek policies aren’t uniquely draconian. Reuters reported in August 2019, the central bank removed the €4,000 daily withdrawal limit for Greek citizens abroad as well. Furthermore, the Mediterranean nation is hardly the first to use banking surveillance to try to curb tax evasion. India conducted a comparable measure in 2016 through demonetization, forcing citizens to swap old bills for fresh ones in order to curb black-market dealings.

Whether these measures work is a different question altogether. Two years after demonetization, The Hindu reported tax revenue increases were on-par with previous years of economic growth, indicating the measure may not have been worth the hassle.

In support of Antonopoulos’ concern, economist Kaushik Basu wrote that Indian demonetization hurt low-income workers and small business owners while hardly inconveniencing the bulk of tax evaders, who hold assets in “gold and silver, real estate and overseas bank accounts.”

Generally speaking, tax evasion appears to be a social issue that economic policies alone fail to impact at scale.

“The people who are conducting the egregious tax evasion are in the government,” Antonopoulos said. “The hypocrisy of pushing measures through like this … by people who know they’ll just switch to using their German bank accounts, is just disgusting.”

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.