Is Ether a Security?

The NYAG sued KuCoin last week under state law, alleging that ether, post-Merge, is a security under the Ethereum blockchain’s proof-of-stake consensus mechanism. The NYAG also alleged that terraUSD (UST) and luna (LUNA) are securities, as well as KuCoin’s Earn platform. I’m not going to get into the last two – regulators have alleged for a while now that “earn” products are securities, and have settlements with various lenders to support that contention, and there are other cases looking at the terraUSD/luna ecosystem.

Related Posts

Market Wrap: Bitcoin Falls to $12.7K as Global Equities Falter; Ethereum Fees Continue to Drop

Oct 26, 2020 at 20:26 UTCCoinDesk 20 Bitcoin Price IndexMarket Wrap: Bitcoin Falls to $12.7K as Global Equities Falter; Ethereum Fees Continue to DropBitcoin’s price fell Monday on larger macroeconomic concerns while lower Ethereum fees benefit hardcore DeFi users.Bitcoin (BTC) trading around $13,011 as of 20:00 UTC (4 p.m. ET). Slipping 0.33% over the previous…

Brazilian Civil Police Dismantles Crypto Laundering Scheme Employed by Drug Gang

The Civil Police of São Paulo, Brazil, dismantled a money laundering scheme managed by the drug gang First Capital Command (PCC) that operated a company operating as a crypto exchange, the police said on X (formerly Twitter) on Tuesday. The company conducted transactions worth approximately 500 million reais ($89 million), according to a CNN report.

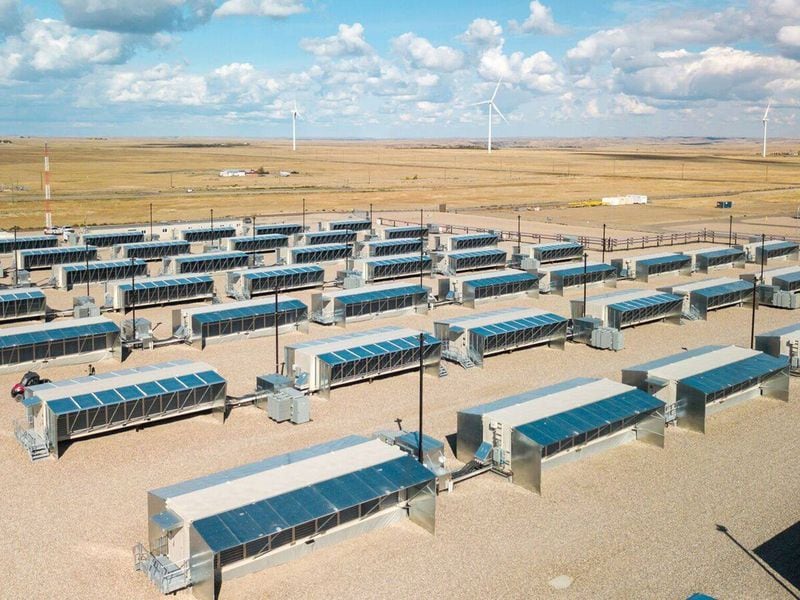

Miner Hut 8’s Bitcoin Stack Gives it Capital to Pursue Upcoming Projects, Upgrade to Buy: Craig-Hallum

Hut 8 owns more than 9,100 bitcoin giving it a large amount of capital for future projects, the report said.Craig-Hallum upgraded the stock to buy from hold with an unchanged $12 price target.The broker said the company’s pipeline includes bitcoin mining as well as HPC and AI opportunities.Bitcoin miner Hut 8’s (HUT) stack of more

Free Money? Traders In Asia Are Buying Bitcoin Cash Ahead of Hard Fork

NEWS With bitcoin cash (BCH) now looking certain to split into two competing cryptocurrencies, some traders in Asia are betting that the sum of the parts will be worth more than the whole. Specifically, these investors have been buying BCH in anticipation that Thursday’s contentious network software upgrade, or hard fork, will leave them owning…

Bitcoin Starts the New Year Rising Past $45K, Highest Level Since April 2022

The price of bitcoin (BTC) soared more than 6% on the first day of the new year, as the leading cryptocurrency blew past $45,000 for the first time since early April 2022.As has been the case for the past several weeks, anticipation that the U.S. Securities and Exchange Commission (SEC) will green light the launch

How a Bitcoin Exchange Is Surviving a Central Bank Crackdown in India

Indian regulators' clampdown on cryptocurrency businesses is forcing the exchange startup Unocoin to experiment with stablecoins and ATMs to continue receiving fiat deposits from customers. Unocoin co-founder Sunny Ray told CoinDesk his company hasn't been able to transact through regular banking channels with its 1.3 million customers for several months, after the Reserve Bank of…

Bitcoin Holdings in One Coinbase Custody Wallet Jumped by 2.5K After BlackRock ETF Filing

The bitcoin (BTC) held in one Coinbase Custody wallet jumped 2,500 BTC soon after BlackRock filed for a spot bitcoin ETF last week, data from analytics tool CryptoQuant shows.Coinbase Custody is a service offered by the crypto exchange that allows institutional investors to store large amounts of tokens, such as bitcoin, in a secure wallet.…

U.S. House Passes Crypto Illicit Finance Bill That’s Likely to be Rebuffed in Senate

A narrow bill to create a U.S. working group to dig into crypto use in terrorism and money laundering passed the U.S. House of Representatives in a routine vote. The legislation isn't likely to get any further without a Senate counterpart, but it marks another congressional approval of a crypto measure. While Congress considered this