Is ETH About to Plunge Deeper Below $2K? (Ethereum Price Analysis)

Technical Analysis

By TradingRage

Ethereum’s price has been on the rise for the past few months, breaking above several resistance levels. Yet, the market is currently consolidating around the $2,000 mark, failing to continue its bullish momentum.

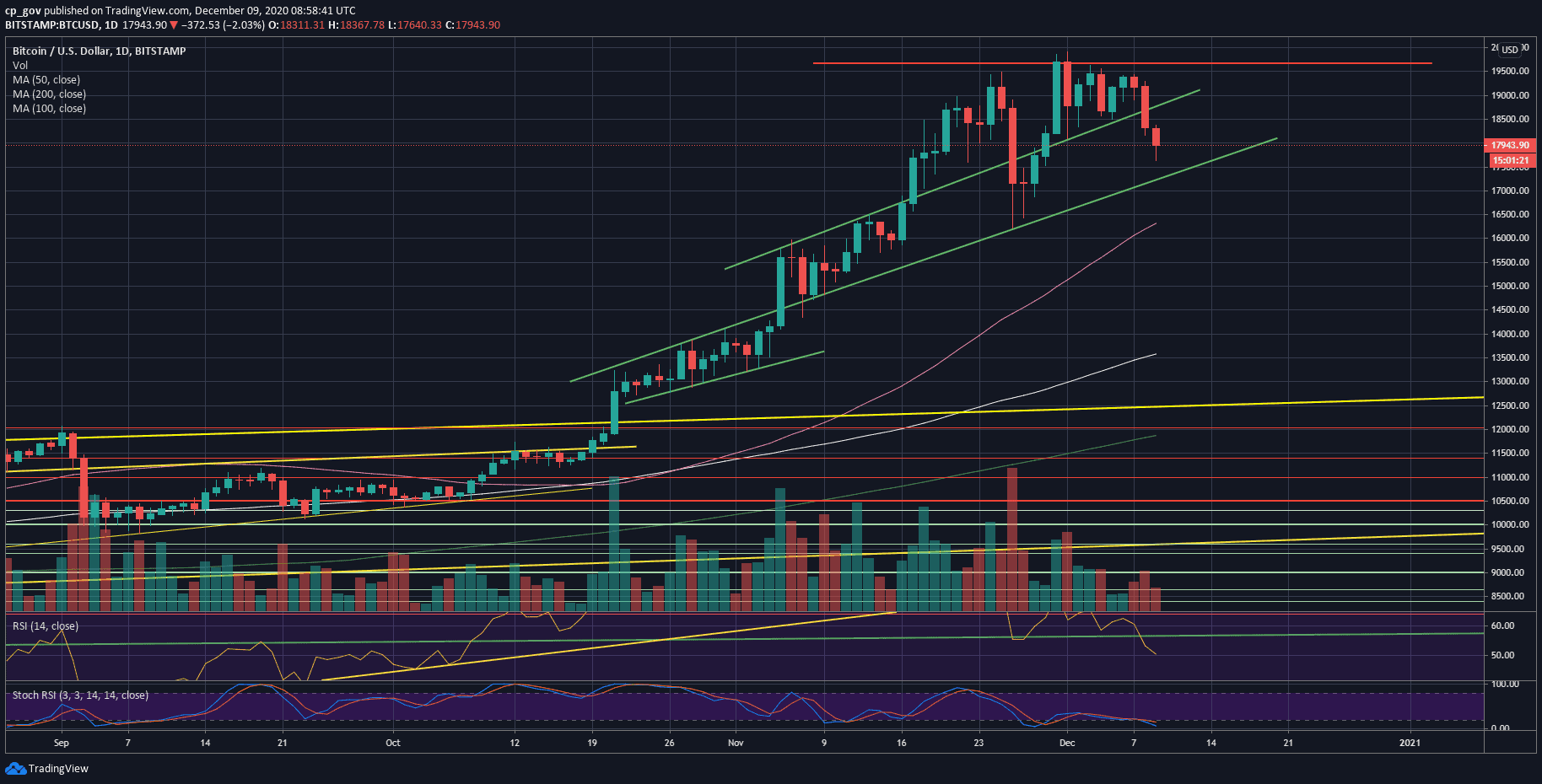

The Daily Chart

On the daily timeframe, the price has been consolidating around the $2,000 level after getting rejected from the $2,150 area once earlier.

Yet, the $2,150 level has rejected the price once again, and the market is currently testing the $2,000 level, which has turned into a support now. If it is broken down, it would be likely that a double-top pattern forms and a deeper decline occurs.

Considering the fact that the relative strength index is still showing values above 50%, which means that the momentum is in favor of the buyers, a bearish reversal seems improbable.

The 4-Hour Chart

Looking at the 4-hour chart, the recent price range becomes more clear. The price has been forming a triangle which is a classical continuation pattern.

Therefore, in case a breakout occurs to the upside, the market will likely begin another bullish wave. Yet, the relative strength index is demonstrating a bearish momentum at the moment, showing values below 50%. Therefore, a drop to the lower boundary of the pattern is expected first.

Sentiment Analysis

By TradingRage

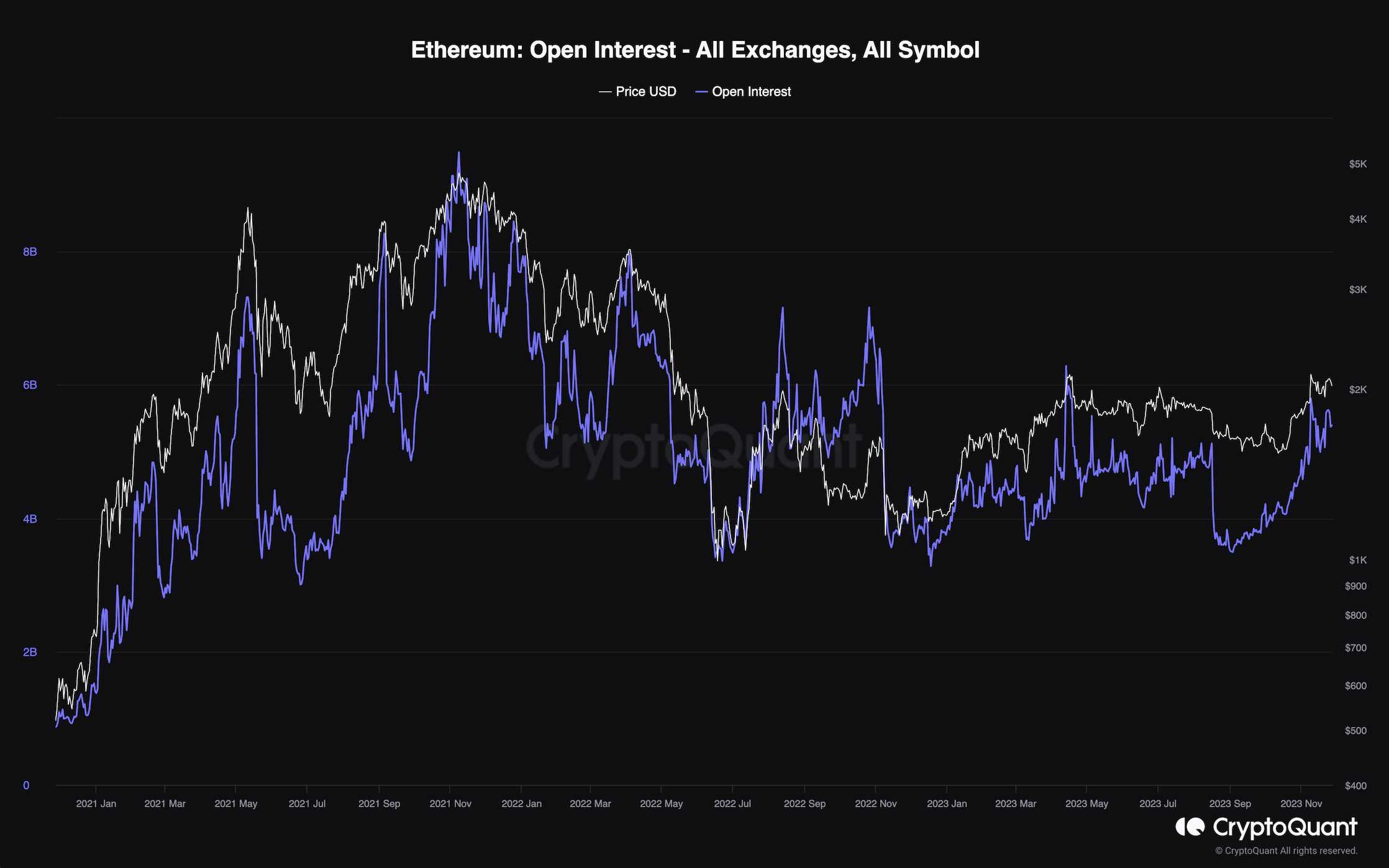

Open Interest

Analyzing the futures market sentiment could provide beneficial insight for the short term.

This chart represents the Ethereum open interest, which measures the number of open perpetual futures contracts on a daily basis. Higher values typically result in high volatility and probable bearish reversals, while lower values indicate a more sustainable trend.

Currently, it is evident that the open interest has been on the rise. But, it has yet to reach the values last seen during the all-time highs range. As a result, while corrections are always possible, the futures market is still far from overheating, and the current bullish trend is likely to continue in the coming weeks.

The post Is ETH About to Plunge Deeper Below $2K? (Ethereum Price Analysis) appeared first on CryptoPotato.