Is Bitcoin Gearing for a Major Move to $65,000? (BTC Price Analysis)

Bitcoin’s price has recently experienced a decline following news of conflict in the Middle East. However, the market has seemingly found a footing.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

The daily chart shows that the price has recently broken below the $64K level and the 200-day moving average in the same area. However, the $60K support zone has seemingly held BTC, pushing it back higher toward the 200-day moving average.

If the market gets rejected from the 200 DMA, then a further drop toward the $56K level and even the $52K level would be probable.

The 4-Hour Chart

Looking at the 4-hour chart, it is evident that the market structure has gone through a bearish shift, with a breakout below the bullish trendline a few days ago.

However, the market has seemingly created a bottom at $60K, as the RSI was also showing an oversold state. Therefore, everything now depends on whether the price will be able to break above $64K or if it will be rejected and pushed further down.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

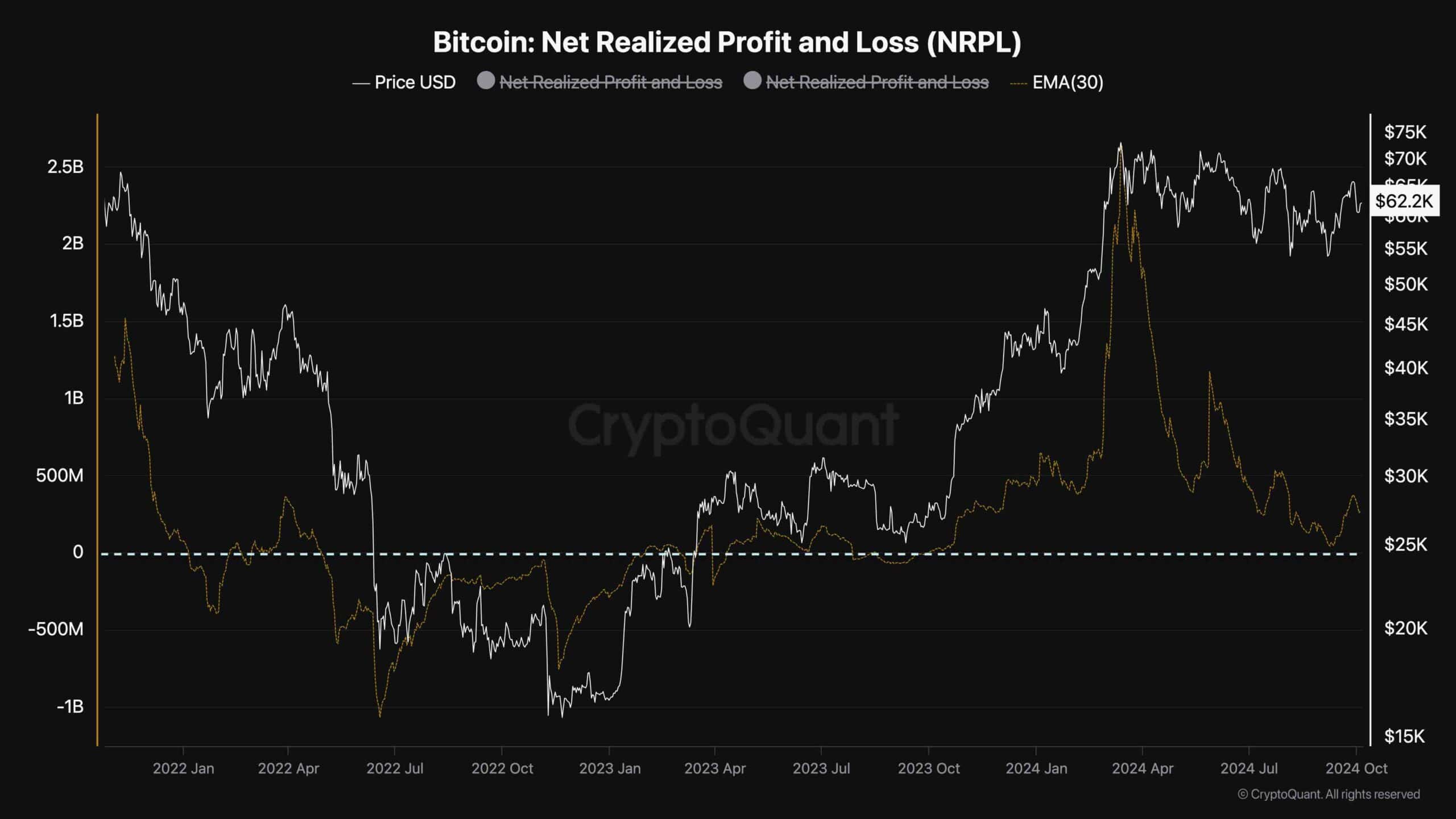

Bitcoin Net Realized Profit and Loss (NRPL)

Bitcoin’s price has been consolidating for more than six months now, and market participants are still speculating whether the cycle top has formed or whether higher prices will be seen shortly. Analyzing the Bitcoin Net Realized Profit and Loss (NPRL) metric would be beneficial in this situation.

The metric measures the net profits or losses investors realize. Positive values are associated with net profits, and negative values show net losses.

As evident, while the market has not demonstrated a significant crash yet and has only been moving rangebound, the NRPL has already decreased to levels that were last seen when the price was around $30K, and the bull market was only beginning.

Therefore, if other factors do not drastically change, it could be concluded that BTC might be preparing for a new bullish run in the coming months.

The post Is Bitcoin Gearing for a Major Move to $65,000? (BTC Price Analysis) appeared first on CryptoPotato.