Is ADA Primed for a Crash This Week? Three Things to Watch (Cardano Price Analysis)

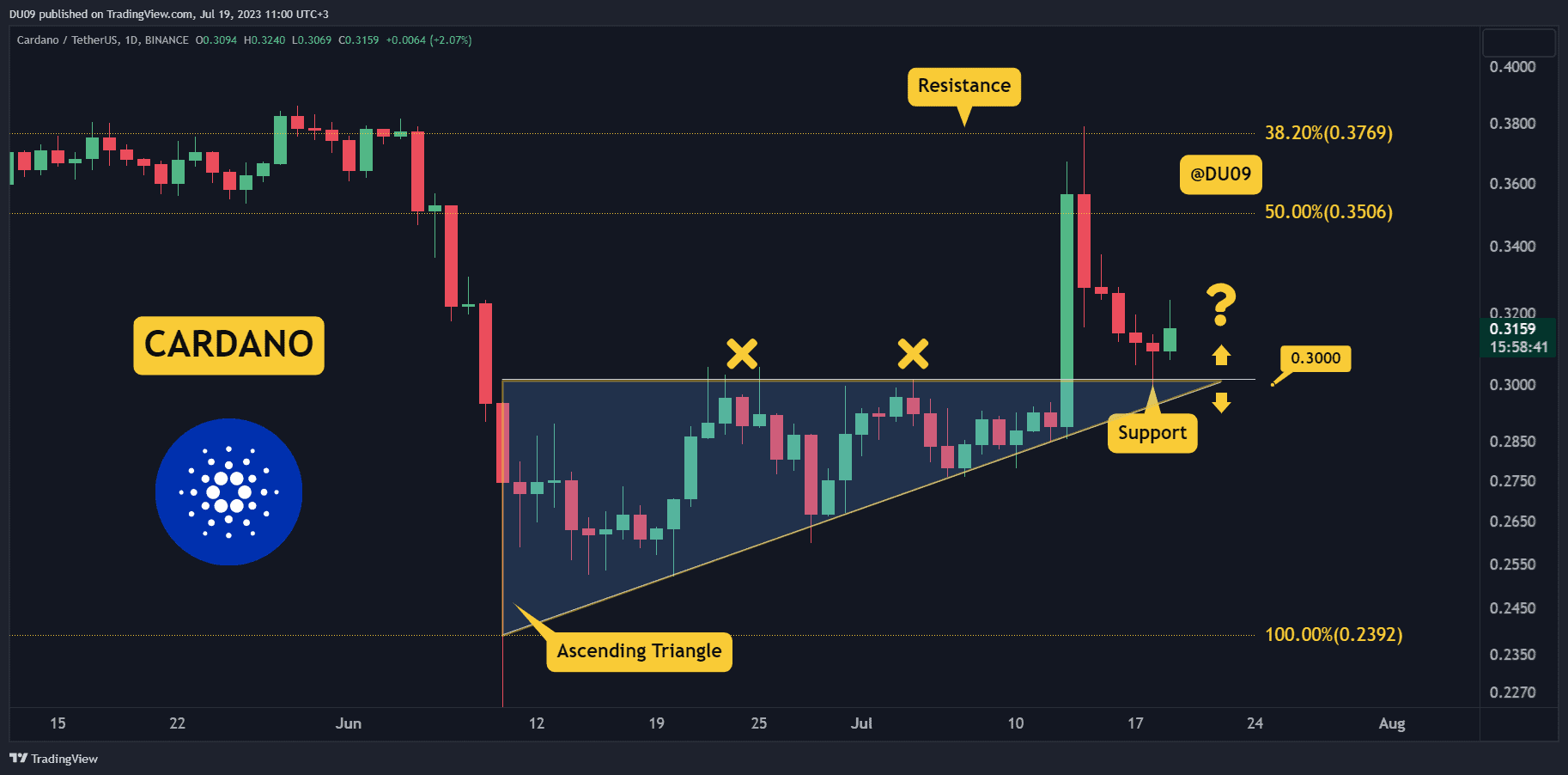

After a significant rally, ADA retraced almost completely, erasing most of the gains.

Key Support levels: $0.30

Key Resistance levels: $0.35

1. ADA at Critical Support

The price has reached critical support at $0.30, which has been tested successfully. Buyers remain interested at this key level. As long as it holds, then ADA has a good chance to resume its uptrend.

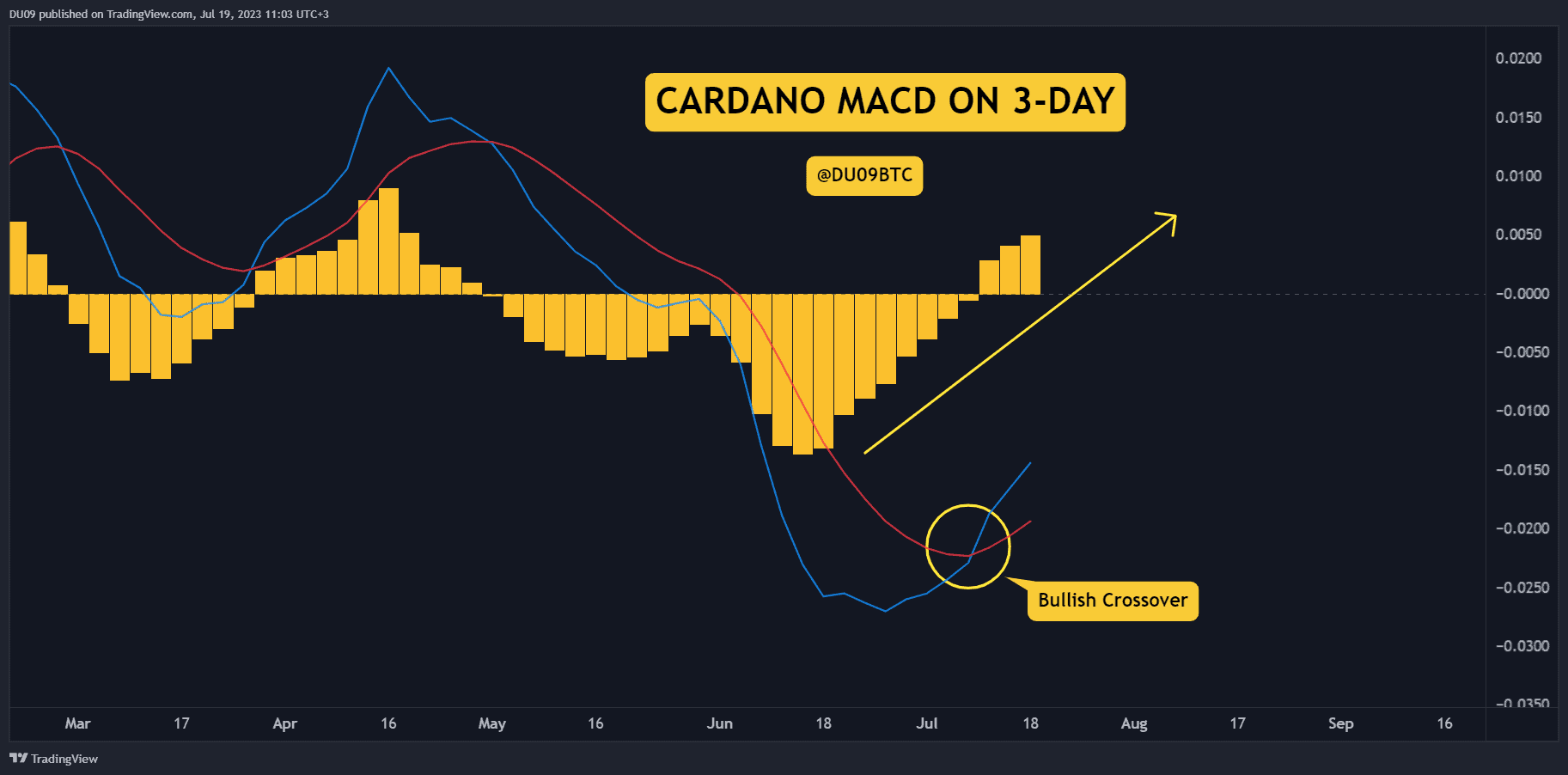

2. Momentum Remains Bullish

Despite some disappointment from buyers after Cardano’s price fell from the resistance at $0.37 to $0.30, the momentum indicators remain bullish. This gives hope that as long as the key support holds, buyers may return and, in the process, take ADA back to $0.35, which is the current target.

3. Buyers Return

ADA closed five days with the volume in red after last Thursday’s pump, and today is the first time we see the volume in green. This shows buyers are returning to Cardano, and their biggest challenge is to maintain this momentum.

Bias

The bias for ADA is bullish so long the key support holds.

Short-Term Prediction for ADA Price

Buyers showed good interest at $0.30 and so far have managed to defend this level. With the sellers losing strength, the opportunity has arrived for ADA to go back on the offensive and challenge the resistance at $0.35 again.

The post Is ADA Primed for a Crash This Week? Three Things to Watch (Cardano Price Analysis) appeared first on CryptoPotato.