Is a Bitcoin (BTC) Crash Imminent? Two Factors to Keep in Mind (Analyst)

TL;DR

- Bitcoin’s High and Potential Correction: Bitcoin reached over $44,000, a 19-month high, with some analysts warning of a possible correction despite the current bullish trend.

- Market Sentiment: The Bitcoin Fear and Greed Index suggests extreme greed, which could be a precursor to a market correction due to overly optimistic or uninformed investing.

- Optimistic Long-Term Forecasts: Prominent figures like Max Keiser and Adam Back predict substantial future growth for Bitcoin, with potential targets ranging from $100,000 to $700,000.

Is BTC Price Correction in the Making?

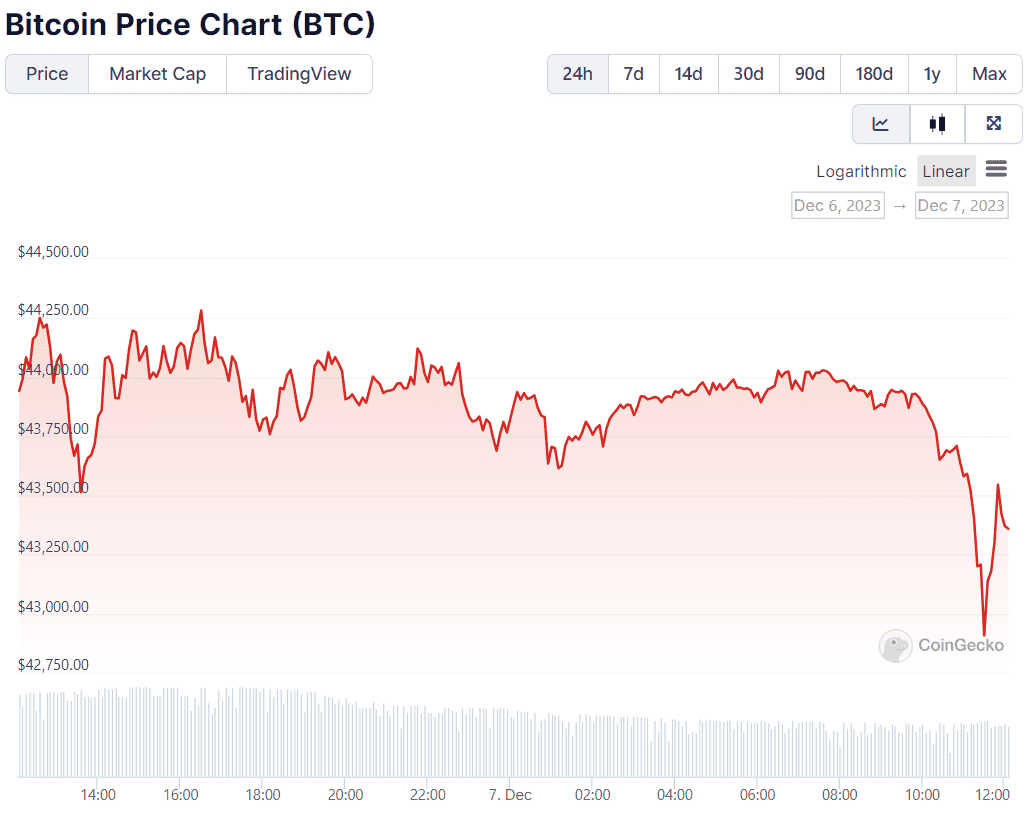

The price of the primary cryptocurrency has been going through the roof lately, reaching a 19-month high of over $44,000. And while some believe this is the beginning of a bull run that could take the asset to a new ATH, there are potential setbacks investors should watch out for.

The popular analyst Ali noted Bitcoin’s progress, outlining that optimism for BTC has surged to its highest level since June. However, the expert also warned that the leading digital asset is “a contrarian and doesn’t always follow the crowd.” Having that said, future traders should beware of a possible price correction.

Another indicator worth observing is the Bitcoin Fear and Greed Index. The metric has been in “Greed” or “Extreme Greed” territory for the past two months, indicating bullish sentiment among investors and traders. The result is based on multiple elements such as social media interaction, surveys, market momentum, volatility, and others.

The rising greed among people, though, could hint that some individuals hop on the bandwagon due to a FOMO (“Fear of Missing Out”) effect and without conducting proper due diligence. In other words, when investors are getting too greedy, the market might be due for a correction.

It is worth mentioning that BTC’s price has dropped significantly in the past few hours, reaching a bottom of around $42,900. A subsequent rebound took the valuation to its current level of approximately $43,300.

What if BTC’s Rally Continues?

On the other hand, some analysts and experts think investors should not expect a serious Bitcoin pullback anytime soon. The American filmmaker and outspoken proponent of the primary cryptocurrency – Max Keiser – recently argued that BTC might experience a so-called “God candle” that could boost its price to as high as $100,000. He also predicted the asset would catch up to “the implied, hash-adjusted price of $375,000.”

“This will literally shock the world. And the Bitcoin Singularity will be upon us,” he added.

Robert Kiyosaki (known as the author of the best-seller “Rich Dad, Poor Dad”) and Adam Back are other prominent figures who outlined a bright future for Bitcoin. The latter forecasted that BTC could reach an astonishing $700,000 by potentially surpassing the market capitalization of gold.

It is worth noting that the cryptocurrency has a long way to go to flip the yellow metal. The former’s market cap is currently around $850 billion, whereas the latter’s is almost $14 trillion.

There are also multiple important events that will take place later in December. They could impact Bitcoin’s price considerably. For more information, check out our latest video here:

The post Is a Bitcoin (BTC) Crash Imminent? Two Factors to Keep in Mind (Analyst) appeared first on CryptoPotato.