Iranian Crypto Outflows Spiked Following Geopolitical Tensions in 2024

Sanctioned regions and entities collectively received $15.8 billion in cryptocurrency during 2024, representing around 39% of illicit crypto transactions. While OFAC issued 13 crypto-related designations – fewer than in 2023 – it was still the second-highest number recorded in the past seven years.

Unlike previous years, sanctioned jurisdictions accounted for a larger portion of overall sanctions-related crypto activity, making up nearly 60% of the total value by the end of the year. According to Chainalysis’ report shared with CryptoPotato, Iran has played a significant role in this trend.

Iran’s Crypto Surge

Following the 1979 US Embassy hostage crisis in Tehran, the US imposed sweeping financial sanctions on Iran. Despite these restrictions, Iran continues to rely on the global financial system for its stability and liquidity. The country’s volatile and depreciating currency, combined with limited access to international banks, has led many individuals and businesses to seek alternative financial methods to maintain economic mobility.

Iranian services saw a notable rise in their share of sanctions-related crypto transactions in 2024. This was driven by mounting distrust in the government and continued geopolitical turmoil. Chainalysis found that these financial movements are not predominantly tied to illicit activities or government-led initiatives but rather reflect Iranian citizens’ growing concerns about their government and their urgent desire to move assets out of the country.

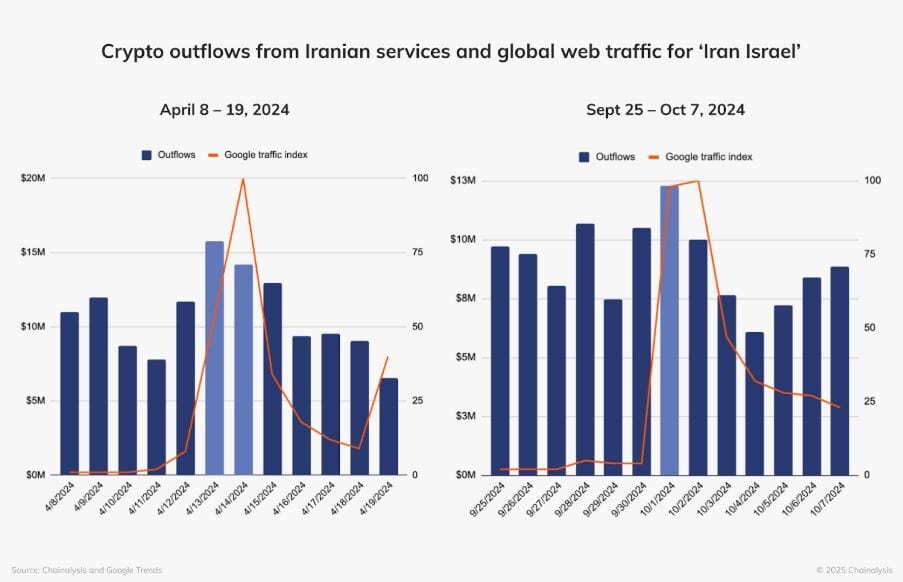

During times of increased geopolitical tension involving Iran, cryptocurrency outflows from Iranian exchanges surged, especially on the day of or shortly after conflict-related events. Google Trends data supports this correlation, revealing global spikes in searches for “Iran Israel” on April 14th and October 1st – dates that closely coincide with escalations in conflict. This trend comes as the Iranian Rial experiences sharp fluctuations in response to political and military events.

Interestingly, although outflows rose across all asset types, including stablecoins, Chainalysis observed a disproportionately high volume of Bitcoin transactions. Significant spikes in Bitcoin outflows coincided with periods when reports suggested Iran was preparing missile strikes, with notable peaks occurring on April 9th and 14th, 2024, as well as in late September and early October of that year.

No-KYC Exchanges Are Back

As Iran’s use of cryptocurrency has expanded in response to financial restrictions and geopolitical instability, a similar trend has emerged in Russia, where no-KYC exchanges continue to facilitate transactions despite enforcement efforts.

As Iran’s use of cryptocurrency has expanded in response to financial restrictions and geopolitical instability, a similar trend has emerged in Russia, where no-KYC exchanges continue to facilitate transactions despite enforcement efforts.

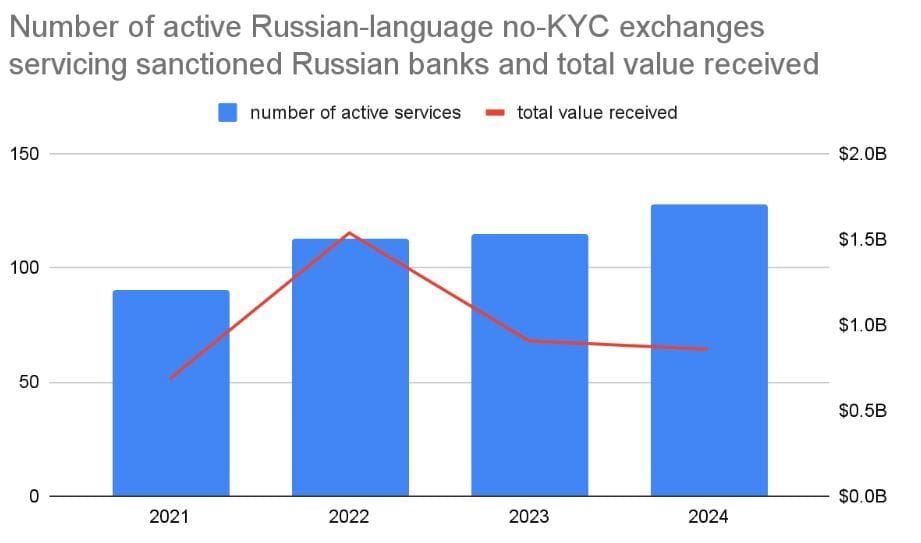

Chainalysis observed that the total number of active no-KYC exchanges has grown, as smaller startups step in to replace those that were dismantled. However, the overall inflows have dropped, which was indicative of the impact of US and international sanctions.

Many of these platforms cater to Russian-speaking users and process transactions with sanctioned Russian banks, yet their lack of clear incorporation details makes it difficult to determine where they are based.

The post Iranian Crypto Outflows Spiked Following Geopolitical Tensions in 2024 appeared first on CryptoPotato.