Invictus Capital Introduces Bitcoin Alpha Fund With Downside Protection For Investors

This is a promoted article provided by Invictus Capital.

Invictus Capital, a leading blockchain asset management platform, has announced the latest upcoming fund in its offerings set which gives investors exposure to BTC while offering additional yield as well as downside risk protection.

The Invictus Bitcoin Alpha Fund (IBA) is designed to outperform BTC by leveraging options and lending strategies that seek to give long-term BTC investors enhanced returns. The fund will maintain full BTC exposure at all times, while utilizing proprietary lending software to generate additional returns. Global investors are able to subscribe into the tokenized fund with a section of crypto assets, including USDT.

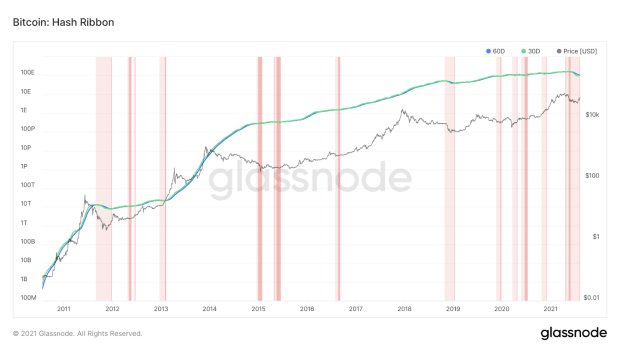

“IBA Fund drawdown in any calendar month will be capped at -10 percent — this is achieved through the purchase of an out-of-the-money put option — giving the fund the right to sell bitcoin holdings above market value in the case of a price collapse,” Daniel Schwartzkopff, Invictus CEO, explained. “The price of this put option is covered by the sale of a far out-of-the-money call option and returns generated from lending of the fund’s assets through the Invictus Margin Lending Fund — with the former enabled by portfolio margin agreements with the platforms we operate on.”

With its exposure to the world’s original cryptocurrency and a drawdown floor, IBA is ideal for investors who are looking to diversify their portfolios with an investment that provides value over a significant time threshold.

“Bitcoin’s returns exhibit low correlation to most traditional asset classes, making it a powerful addition to an investor’s holistic portfolio,” Schwartzkopff said. “The fund is suitable for investors with a medium- to long-term horizon. In particular, it may be appealing to long-term bitcoin holders who wish to maintain their long exposure but are concerned about large price downturns.”

IBA is offering investors a once-in-a-lifetime chance to invest in a truly revolutionary asset that has not yet realized its full potential, while providing peace of mind that their capital is protected from sudden exogenous shocks.

“Bitcoin’s market capitalization pales in comparison to more traditional financial assets such as stocks, bonds or even gold,” explained Schwartzkopff. “This means bitcoin has enormous upside potential if it can capture even a small fraction of traditional markets. This asymmetry makes Bitcoin appealing to investors who are willing to risk a small amount of investment capital for the opportunity of an outsized return.”

The fund charges no management fee, but rather a 20 percent performance fee charged on spot outperformance — with backtests of the strategy showing significant outperformance as a result of the downside protection. The fund is already operational, having raised over $450,000 since its launch mid-August.

Bringing Proven Success To Bitcoin

To successfully manage IBA, Invictus Capital will be drawing on the success of its past offerings, which include Crypto 20, the first tokenized crypto asset fund; Hyperion, the world’s first tokenized venture capital fund; and the EMS Fund, an innovative solar energy infrastructure fund.

Invictus creates value for its investors through a scientific and data-driven approach that simplifies investment decisions, transparency around investor interest that protects privacy and wide-ranging collaborations that leverage a diverse range of knowledge and skillsets.

IBA’s unique offering, combined with the proven expertise of Invictus Capital, has created an investment opportunity that is truly novel in the Bitcoin space and something that should receive significant attention from investors.

You can learn more about IBA through Invictus Capital’s Litepaper and slide deck.

The post Invictus Capital Introduces Bitcoin Alpha Fund With Downside Protection For Investors appeared first on Bitcoin Magazine.