Investors Track Pepecoin Whales to Cash In on Meme Coin Mania as Wider Market Stagnates

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.

After pepecoin (PEPE) took just weeks to go from zero to a nearly $2 billion valuation and produce almost-instant millionaires, envious crypto investors are prowling for the next get-rich-quick meme coin.

Anyone doing so is ignoring the fact that the shocking magnitude of PEPE’s controversial rise is rare. Digital assets that have very little – or no – fundamental value like dogecoin (DOGE) or Shiba Inu (SHIB) pop out of the ether every couple of years. But finding the next PEPE is next to impossible; every winner is surrounded by the ashes of many failures. (And, also, PEPE’s market cap has crashed to less than $650 million, according to CoinGecko.)

That doesn’t stop people from trying. For some, that means simply copying whatever early PEPE investors have put their money into next. On-chain data makes this easy. Wallets holding a large amount of tokens can be tracked on sites like DeBank.

Over the course of last weekend, several newly issued meme tokens surpassed PEPE in trading volume. This flurry of activity was down to whale watchers, people who buy assets based off what large wallets are doing.

One wallet that holds over $4 million worth of PEPE purchased a meme coin called HARAM – a token plagued with xenophobic imagery – at 22:22 UTC on Saturday. The market cap skyrocketed from $200,000 to $5 million in the next 4 hours, and 24-hour volume subsequently hit $20 million on Sunday.

This wasn’t the only example. Bizarrely named meme tokens like RIBBIT, BOB, JEFF and WEN all experienced massive spikes in volume over the weekend. Amid this rush into meme coins, overall volume on Uniswap’s decentralized exchange surged to $150 million an hour at numerous points on Saturday, way up from the typical $16 million to $30 million, according to Dune Analytics.

Pepe/USD chart (dextools)

As attention switches to meme coins, other sectors like decentralized finance (DeFi) are beginning to suffer. The total value locked (TVL) on DeFi protocols has slumped from $53 billion to $47 billion in the past 30-days, and while some of this can be attributed to a crypto market correction, outflows from platforms like Agility LSD, which has seen $500 million in outflows, could demonstrate a waning of interest.

(Dextools)

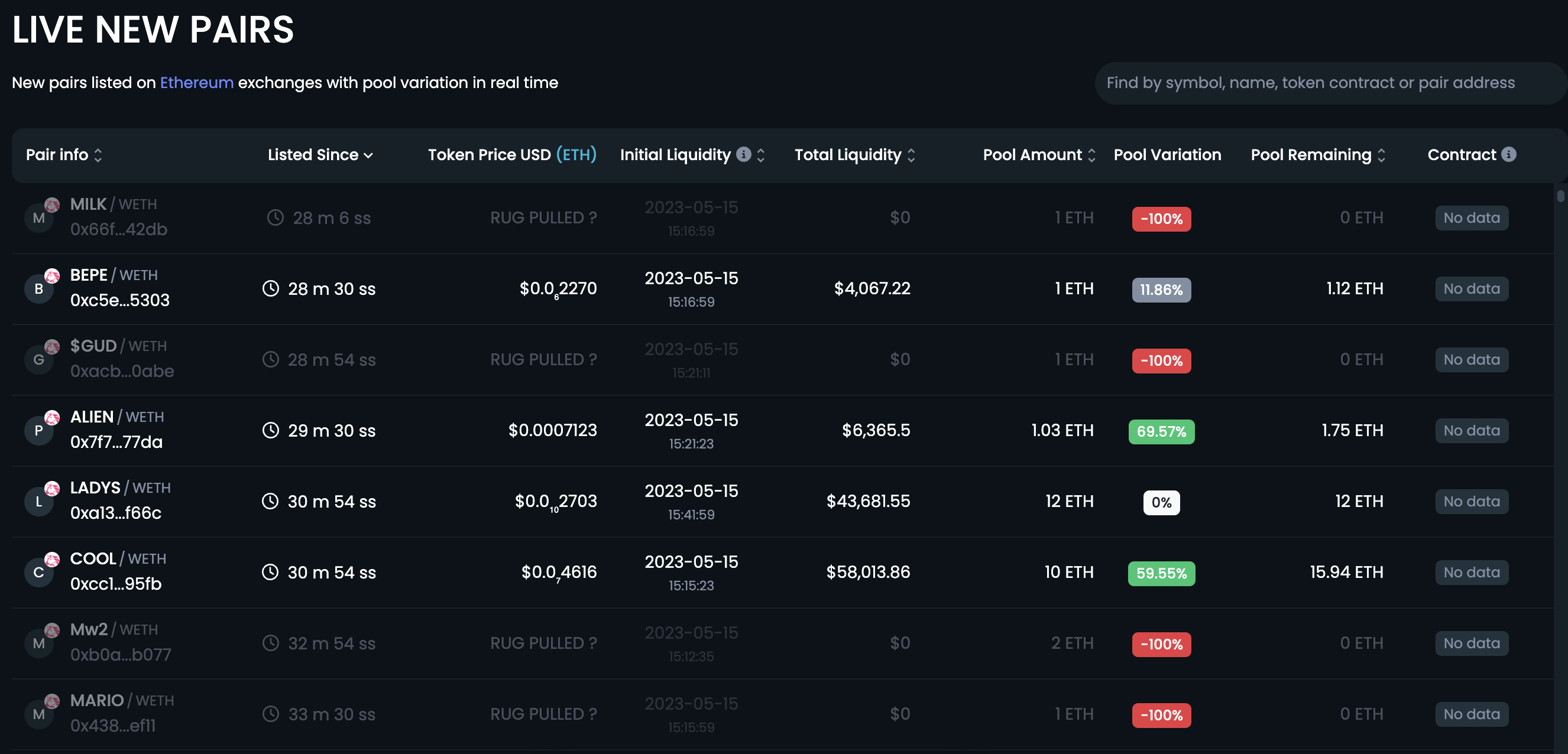

And then there’s the question of whether some meme coins have nefarious intentions. There are hundreds of new ones listed every day and a quick glance at DEXTool’s “live new pairs” section suggests an increasing trend of rug pulls, where token creators either dump their tokens on new investors or alter the code to make it so investors can’t sell.

While a select few investors might strike the jackpot and make substantial returns, the odds aren’t in their favor. Bigger picture, the meme coin trend has essentially created a black hole that sucks liquidity out of the market, creating a potential impediment for other cryptocurrencies like bitcoin (BTC) or ether (ETH).

Following an impressive start to the year, BTC and ETH have hit stubborn levels of resistance at $30,000 and $2,000, respectively, amid what’s been dubbed S**tcoin Spring.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Oliver Knight is a CoinDesk reporter based between London and Lisbon. He does not own any crypto.