International Securities Regulator IOSCO Proposes Norms for Crypto Regulation, Invites Feedback

The International Organization of Securities Commissions (IOSCO) opened up its policy recommendations for crypto and digital asset markets for public comment on Tuesday.

The 18 policy recommendations cover a range of issues such as market abuse, conflict of interest, client asset protection, disclosures and risks associated with crypto.

Last year, the international policy forum that groups securities regulators in around 130 countries established a Fintech Task Force (FTF) to develop IOSCO’s regulatory agenda for both fintech and crypto. The FTF, chaired by the Monetary Authority of Singapore, is made up of 27 of 33 board member jurisdictions.

One of two working groups attached to the FTF, run by the U.K.’s Financial Conduct Authority, was set to publish recommendations for crypto assets this year, while another run by the U.S. Securities and Exchange Commission worked on decentralized finance (DeFi).

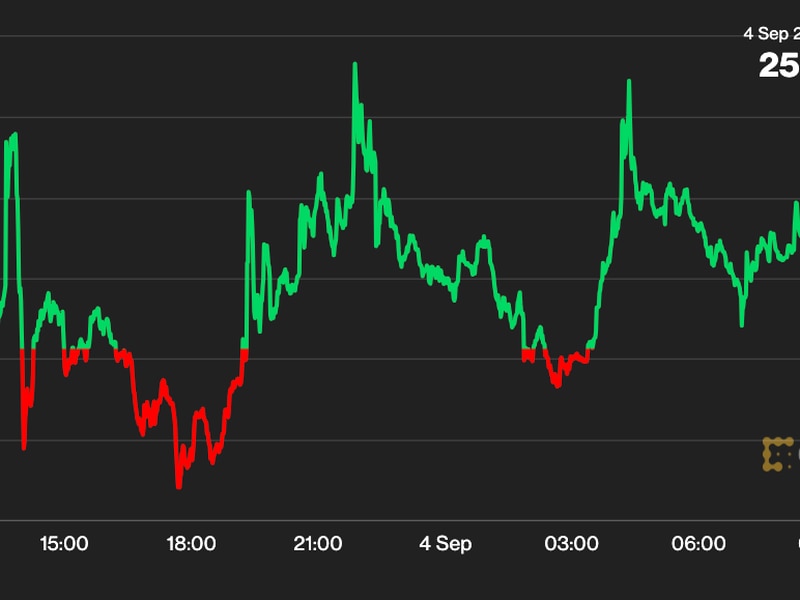

Global standard-setters’ call for tougher crypto regulations have renewed following the collapse of stablecoin issuer Terra and crypto exchange FTX last year. International financial crimes watchdog FATF last week called on the Group of Seven (G-7) advanced economies to lead in implementing its recommended norms for preventing money laundering.

“As the G-7 Finance Ministers and Central Bank communiqué of 13 May has once again reminded us, the time has come to put an end to the regulatory uncertainty that characterizes crypto activities. Today’s consultation paper received unanimous support from the IOSCO Board and is the outcome of an intense period of regulatory risk analysis, information sharing and capacity building,” said Jean-Paul Servais, chairperson of IOSCO in a statement to the press.

The Financial Stability Board is meanwhile set to publish recommendations for stablecoins later this year and coming global crypto rules will be based on a joint FSB and International Monetary Fund synthesis paper.

The consultation period on the recommendations closes on July 31.

Edited by Sandali Handagama.