InsurAce Protocol Aims to Protect Customers’ Funds While Providing Higher APY

[Featured Content]

Decentralized finance (DeFi), alongside non-fungible tokens, has been the most widely-discussed topic within the cryptocurrency community over the past year. The growth of the space is more than evident, with nearly $100 billion already locked in various projects.

The ability to operate without a central governing authority (typically a bank) and the possibility of earning income through lending or borrowing (among other ways) have attracted countless supporters and investors.

However, it comes with risks of its own. Whether they are rug-pulls, in which the (usually anonymous) team behind a DeFi protocol dupes the community and leaves with their funds, or blatant hacks, like the most recent one when $600 million were stolen from PolyNetwork, the option of losing money is more than real.

This is where startups like InsurAce.io come in. Aside from enabling DeFi protocols and their investors to insure their funds against potential losses, it also provides promising investment products of its own.

What Is InsurAce.io

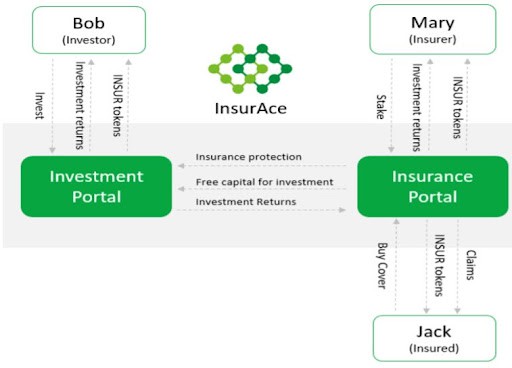

Launched in April, InsurAce.io has quickly grown in the field of decentralized insurance protocol, aiming to provide reliable, secure, and robust DeFi insurance services to investors. It works similarly to insurance companies from the more traditional financial industry, with two separate branches covering insurance and investments.

Users can protect their DeFi investments in 55 protocols across 8 different chains via the InsurAce.io dApp. Insurance premiums can cost up to 2.5% annually. Considering the fact that there is a high risk in the space, and defi projects sometimes offer double-digits APY, the insurance cost could be reasonable.

At the time of writing, InsurAce.io themselves offer “underwriting mining” as a staking option offering up to 80% APY by staking BNB on the protocol (disclaimer: we haven’t tested the service, as for any crypto investment, never risk funds you can’t afford to lose).

In the upcoming investment side of the app, users will be able to invest capital into an investment pool to receive high or lower yields, depending on the selected risk appetite. The yield from the investment side will complement the premium at the insurance side to a large extent, which should reduce the insurance coverage costs.

InsurAce generates revenues from the insurance premium and the investment returns. The project utilizes the funds in other areas, such as operation and development costs, community incentives, and ecosystem collaborations.

InsurAce Tokenomics

By spreading the risk between over 50 protocols, the premium purchases made from each protocol, and underwriting mining, the insurance coverage aims to be significant enough to protect against any hacks or smart contract vulnerabilities that may occur on the covered protocols.

Rewards for underwriting staking and investment are paid in the native INSUR token released by InsurAce, which forms part of their governance in managing claims when staked. Participants in the governance are also rewarded with tokens.

In the event of an attack that results in losses to insured assets, claims are submitted through the same app and are assessed by insurance experts before being put to a community vote.

Overall, InsurAce.io claims that it continues to enhance the platform’s user experience through regular product updates, partnerships, and marketing campaign drives. For example, they recently announced that the existing staking options would be improved by removing caps, and shortening the lock-up period.

The team has been working with their partners to reduce premiums across the protocol and claims that they are cheaper than their major competitors on most protocols listed before the user takes advantage of any referral rewards or the portfolio insurance option that InsurAce offers.

This portfolio-based insurance service can save users up to 60% on their insurance premiums and up to 50% on gas fees when compared with other insurance protocols. An upcoming API will allow for seamless integration into DeFi protocols on multiple chains to offer ‘1-click insurance’ in the same way that insurance can be added to flights for travel.

DeFi insurance, on the whole, is a relatively nascent section of the crypto ecosystem. But it is through the launch of protocols like InsurAce and continued improvements to the security of DeFi that will allow for larger institutions to enter the DeFi space safely.