Institutions Flock to Ether After Shapella Upgrade

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Ethereum implemented the highly-anticipated Shapella hard fork, also known as the Shanghai upgrade, on April 12, reducing the risk of staking the blockchain’s native token, ether (ETH), by allowing withdrawals of locked coins at will. The pivotal event has galvanized institutional interest in the second-largest cryptocurrency by market value.

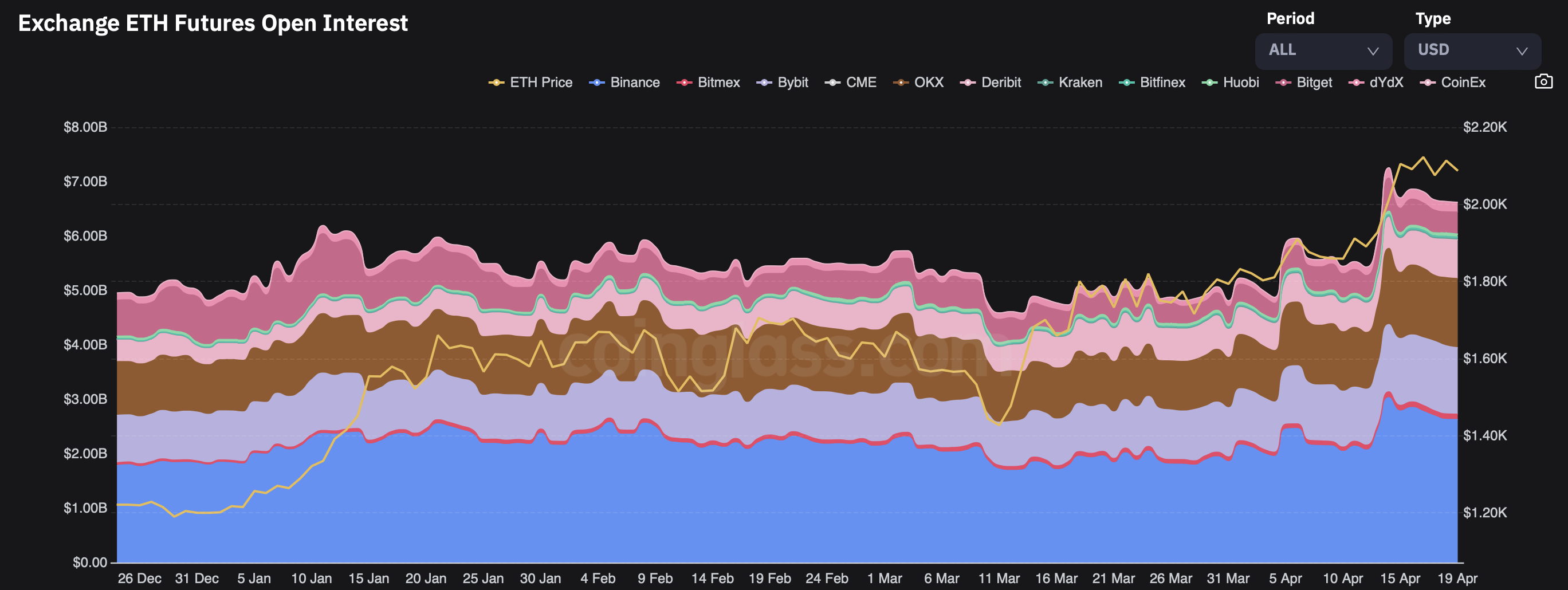

Since April 10, the number of active, or open, ether futures contracts trading on the Chicago Mercantile Exchange (CME) has risen 39% to 6,248, according to official data. In U.S. dollar terms, open interest has increased by over 70% to $633 million. The tally reached a 12-month high of $675 million on Friday, Coinglass data show. Each contract has a value of 50 ETH and is quoted in US dollars per 1 ether.

Institutions typically prefer regulated products like CME futures that allow them to take exposure to digital assets without owning them. As such, CME futures tied to ether and bitcoin are widely considered a proxy for institutional activity.

“The CME’s market share has grown as institutions have been forced to evaluate the credit exposure underlying their collateral on crypto native exchanges,” said Jeff Anderson, a crypto trader and the former CIO at Folkvang Trading. “The activity surrounding Shapella has laid this bare with open interest at 12-month highs.”

Noelle Acheson, the author of the popular Crypto is Macro Now newsletter, voiced a similar opinion.

“The past few days have seen a strong inflow of institutional interest into ETH futures,” Acheson said. “USD open interest is now at its highest since March 2022, and just before the weekend, ETH futures open interest on the CME jumped over 80% in USD terms,” Acheson said.

An increase in open interest alongside a price rise represents an influx of new money into the market and confirms the uptrend. Ether’s price has risen 8% since the Shapella hard fork, CoinDesk data show.

“ETH is definitely experiencing idiosyncratic flows at the moment,” Vetle Lunde, a senior analyst at K33 Research said. “BTC OI is down 1.5% since April 10, whereas ETH OI is up 38.7% in the same period,” referring to open interest.

“We have been seeing similar flows in exchange-traded products (ETPs). BTC ETPs saw net outflows of 1.52% from April 10 to April 18 while ETH has seen net inflows of 0.77% in the same period,” Lunde added.

The futures basis, or the spread between prices in futures and spot markets, has widened, with the annualized rolling three-month premium doubling to over 4%. The combination of rising open interest and widening basis suggests the leverage has been allocated to the bullish side.

A rising premium often draws carry traders to the market. Carry trading involves setting up a market-neutral strategy by selling futures and simultaneously buying the underlying asset in the spot market to pocket the price differential between the two markets.

“The attractive basis has brought more traders to market,” Anderson said.

Activity on other exchanges has also picked up pace post-Shapella, suggesting institutions are not the only ones flocking to the market right now.

“Open interest has also been hitting record highs on Deribit, so it may not be conclusive evidence of institutional buying,” Dick Lo, the founder and CEO of quant-driven trading firm TDX Strategies, said.

The global ETH futures open interest, excluding CME, has increased by almost 22% to $6.62 billion, Coinglass data show. Open interest in Deribit-listed ETH futures has jumped 30% to $750 million, reaching the highest since the May 2021 record high of $778.6 million.

Open interest has increased on all exchanges, including Deribit and Binance. (Coinglass) (Coinglass)

“Post the Shapella upgrade, unstaking withdrawals have been orderly and well-absorbed by the market and we are also seeing an uptick in staking from ETH holders. As ETH continues to be deflationary post-Merge and with the added attraction of staking yields which can be freely unstaked, we are seeing more bullish interest on ETH,” Lo said.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.