Institutional Investors Continue to Buy Bitcoin as Price Tops $50K: Report

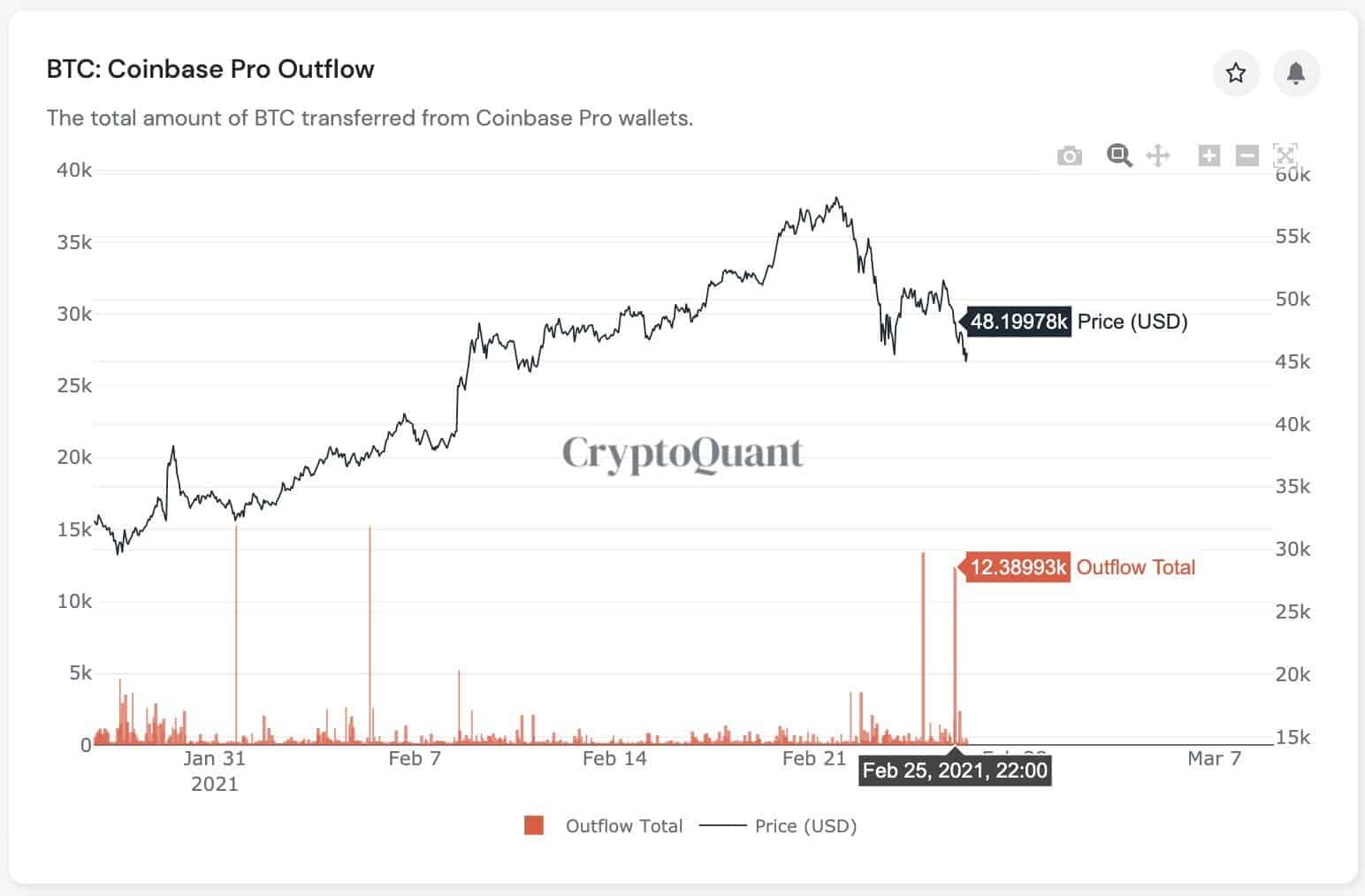

The recent price developments have not deterred institutional investors from allocating funds in bitcoin. Just the opposite, the latest major withdrawal from Coinbase to custody wallets worth $630 million became a fact earlier today, suggesting that institutions keep accumulating.

Institutions Double-Down on BTC

CryptoQuant’s CEO Ki Young Ju has repeatedly outlined the connection between bitcoin’s price and institutions using the largest US-based crypto exchange, Coinbase, to purchase more of the asset.

Past examples provided by the analytics company have indeed been followed by an increase in BTC’s value when such investors transferred sizeable quantities to custody addresses.

Ju predicted last week when BTC struggled beneath $45,000 that the asset will soon rather than later return above $48,000, which he classified as the “institutional buying level.”

His projection materialized, and the cryptocurrency has even increased above $50,000. Furthermore, Ju outlined that institutional investors have withdrawn another significant portion from Coinbase to custody wallets.

CryptoQuant’s data suggests that the withdrawal this time was about 12,400 bitcoins. From a USD perspective, this considerable about accounts for roughly $632 million with today’s prices.

It’s Not Just Coinbase Though

During last week’s market crash, when BTC lost about 25% of its value in a matter of days, reports emerged that miners have transferred substantial portions to exchanges and had cashed out some profits just before the drops.

The community feared that institutional and retail investors might follow as it could be the beginning of further sales that could harm the asset’s price even more. However, it seems that this is not the case.

Data from another monitoring company, Glassnode, shows that bitcoin holders had indeed increased the transfers to exchanges in the last week or so in February. Nevertheless, the trend has quickly reversed, and BTC investors have withdrawn some of their portions outside of trading venues.

Looking at the bigger picture, it becomes clear that investors seem determined to decrease the bitcoin holdings stored on exchanges. In the past six months alone, the percentage of BTC on trading platforms has declined from over 14.5% to 12.5%, suggesting HODLing mentality.