Institutional frenzy: CME becomes 2nd biggest Bitcoin futures market

The CME Bitcoin futures market overtook Binance Futures to become the second-biggest Bitcoin (BTC) futures exchange by open interest. The data shows that the institutional volume is rapidly gaining a larger share of the cryptocurrency market.

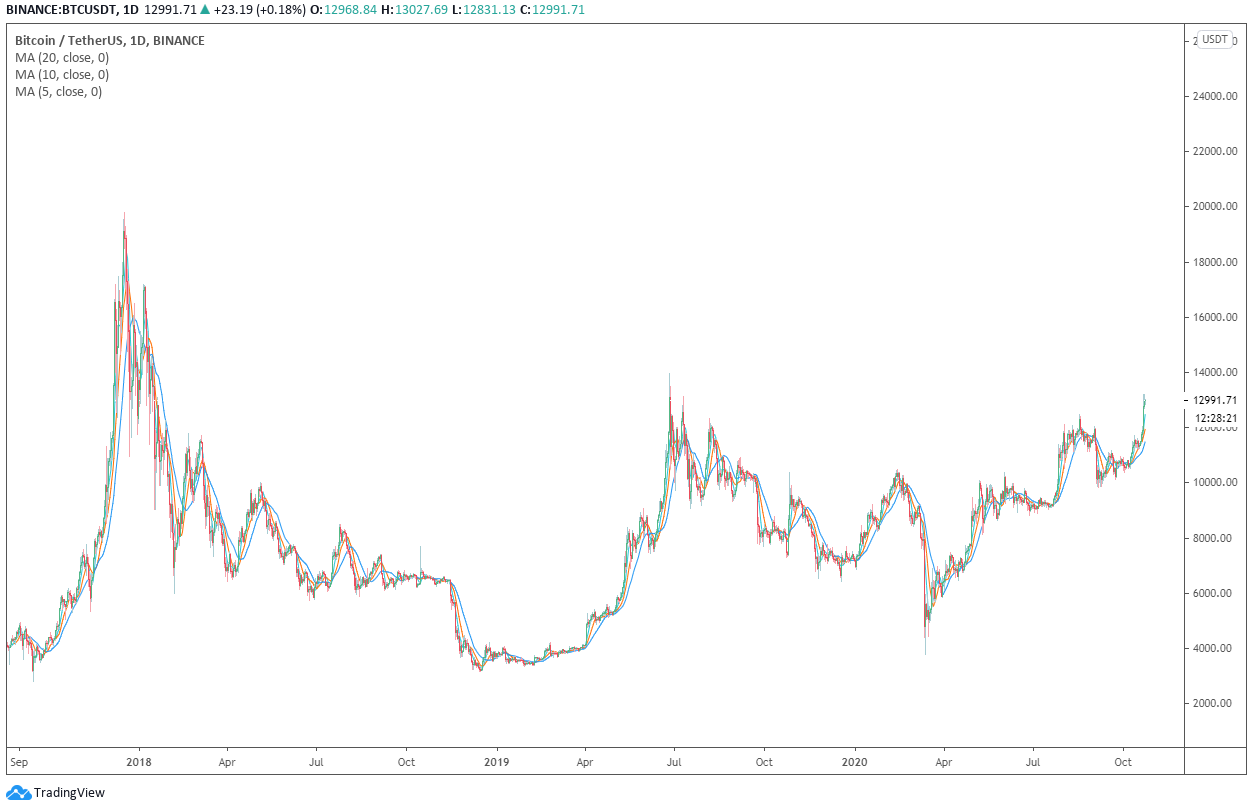

On Oct. 10, Skew reported that the CME Bitcoin futures market’s open interest rose sharply by 1,500 contracts. Since then, within three days, the price of BTC surged 9% to over $13,000.

The growing open interest of CME’s futures contracts on BTC is likely to have a positive effect on BTC price, particularly as a recent study found that “CME Bitcoin futures contribute more to price discovery than its related spot markets.”

A clear spike in institutional demand for Bitcoin in a short period

For many years, the Bitcoin futures market was dominated by two key players: BitMEX and OKEx. In the past year, new-generation futures exchanges began to swiftly expand, which led Binance Futures, Bybit, and Huobi to compete against the likes of BitMEX.

The CME launched its Bitcoin futures contracts on Dec. 17, 2017. Within a span of three years, it evolved into the second-largest BTC futures exchange by open interest, Skew reports.

The term open interest refers to the sum of the value of all long and short futures contracts that are actively open. It is used to gauge the activity of the market by measuring the amount of capital that is deployed onto the futures market.

Data from Skew shows CME now accounts for $790 million worth of BTC long and short contracts. It falls merely $19 million behind OKEx, which has been the dominant futures exchange throughout 2020.

The rapid increase in the open interest of the CME Bitcoin futures market reflects growing institutional demand for three key reasons.

First, throughout the past three days, the overall volume of the Bitcoin futures market rose substantially. Hence, CME’s open interest rose higher than other retail-focused platforms, which also saw a large spike in volume.

Second, major institution-focused markets, including the Grayscale Bitcoin Trust (GBTC), reported a massive upsurge in institutional inflows. Cointelegraph reported that Grayscale saw a $300 million upsurge in net assets under management (AUM) in one day, albeit the rising BTC price primarily caused the AUM to rise.

Third, the options market has also achieved a record-high daily volume, which is also preferred by full-time traders and high-net-worth investors.

Would the institutional frenzy continue?

High profile investors, like Chamath Palihapitiya, the CEO of Social Capital, believes more banks and institutions would soon support Bitcoin. He said:

“After PayPal‘a news, every major bank is having a meeting about how to support bitcoin. It’s no longer optional.”

Institutions are primarily exploring Bitcoin as an inflation trade and a long-term allocation, as the billionaire Wall Street investor Paul Tudor Jones said. But technical analysts state that the short to medium-term outlook remains bright for BTC/USD.

Bitcoin saw its highest daily candle close since Jan. 15, 2018, meaning the price of BTC is on the verge of breaking out across all time frames.

As Cointelegraph reported, traders have emphasized the bullishness of the weekly and monthly log charts of Bitcoin. If BTC remains above $13,000 at the weekly close and stays above $12,500 until the month’s end, it could signify a compelling technical breakout.

The confluence of macro as well as a favorable technical structure could further intensify the demand for Bitcoin as institutions are starting to increasingly embrace the world’s biggest cryptocurrency.