Inside Information Leaked? Waves Surged Over 30% Before Announcing On $120M Funding Round

Waves, a public blockchain network that assists companies to develop their own tokens, recently raised a staggering $120 million in private funding, which was led by London-based financial services group Dolfin.

The funding is being used to “private version of its Vostok system for corporations and governments.” Raising a $120m incredible in any market conditions, but in a bear market, it seems to be something unprecedented in the crypto space.

Waves token initially launched through an ICO that raised $16 million on May 1, 2016. Since then, Waves market value had skyrocketed to $1.7 billion in December 2017 and crashed to $383 million recently.

Waves Founder, Russian Engineer Sasha Ivanov, has stated that Waves is much less focused on cryptocurrencies, and more focused on the application and use cases of blockchain technology:

“The cryptocurrency rush is over now, while the idea of using a decentralized network to store data and cut costs is still relevant,”

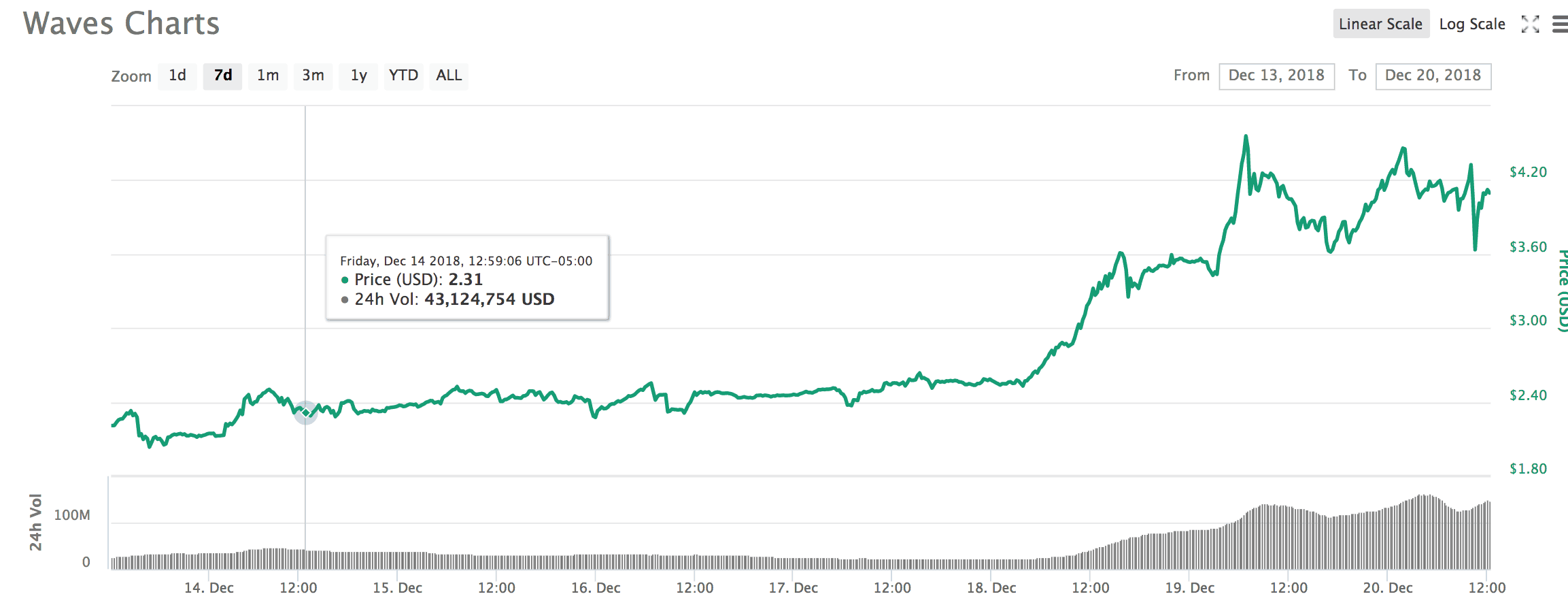

Waves token price reacted very positively to the news, skyrocketing by over 70% over the past three days.

Some Suggests Information Was Leaked

Though not everyone is convinced the price surge is purely legitimate, some see that the price hike may have been a result of inside information. A discussion on Twitter about how much evidence one could find for a price rally ahead of the actual announcement. With no argue, Waves gained already over 30% before releasing the news.

A short story of insider trading. ?♂️ $WAVES pic.twitter.com/EA2DKK8yT7

— Collin Crypto (@CollinCrypto) December 20, 2018

Regardless of the reason, Waves has just positioned itself as a promising token for 2019. If they’re able to validate their model well enough to raise $120m at the peak of the crypto bear market, we should all be excited to see what the can pull off in a bull market.

The post Inside Information Leaked? Waves Surged Over 30% Before Announcing On $120M Funding Round appeared first on CryptoPotato.