Infrastructure Bill Will Hasten USD Devaluation and Bitcoin Hedging (Opinion)

The $1 trillion bipartisan infrastructure bill in the U.S. Congress is currently on pause until Sept 27th or later. Meanwhile, House Democrats want to spend $3.5 trillion. After $6 trillion in Covid appropriations in 2020. Here’s why that’s a favorable macro environment for crypto.

The fate of the relationship between the U.S. and cryptocurrency is wrapped up in the $1 trillion bipartisan infrastructure appropriations bill. The resolution of a contentious tax rule inserted as an amendment to the gigantic infrastructure package will determine both the government’s stance toward the industry and the nature of the sector’s tax obligation to the IRS.

But setting that aside, the sheer force of fiscal magnitude exercised by the U.S. Congress in moving to pass this bill, with the unprecedented emergency stimulus appropriations last year, and all on top of record-setting regular annual appropriations will have another, different kind of effect on the future of digital assets.

It will spur wider interest in cryptocurrencies as savings and investment vehicles, and bolster the value of their real and nominal market capitalization. With such forceful US dollar devaluation, digital assets will likely see more capital inflows from investors seeking them for inflation hedging as well as the potential for crazy stupid high-tech sector ROI.

US Dollar Inflation Outlook

To many authoritative economists, like Nobel Prize laureate Friedrich Hayek, the predictable end result of this radical monetary expansion is price inflation.

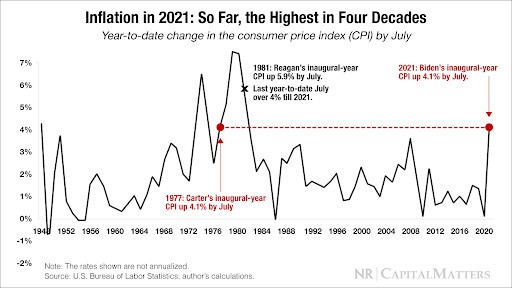

That inflation has even extended to U.S. consumer prices already in 2021. The arguably inflation under-stating CPI (consumer price index) rose the equivalent of 5.4 percent a year in July. In addition, plenty of other inflation metrics are reading out 5%+ annual equivalent monthly inflation rates for the past twelve months.

A writer for CNBC summarizes why it matters:

“For the past few months, the price of everything from groceries to cars to clothing has increased, straining budgets for households across the country. At the same time, savings have become less valuable, hitting Americans with a double blow to their bank accounts.”

E*TRADE Financial Holdings’ quarterly tracking study of experienced investors on its platform, as well as a user survey, found that investors regard inflation as the top portfolio risk.

Ballooning record sovereign debt obligations and record deficit spending and debt monetization threaten to make this year’s inflation look more permanent.

Cryptocurrency As An Inflation Hedge

Bitcoin price recently climbed above the $50,000 USD mark. Investopedia says in an Aug 23rd Bitcoin price update:

“Another possible cause for the rebound in the price of Bitcoin is that it may be seen as a hedge against rising inflation. If so, this would be an indication that digital currencies are being utilized by a growing segment of the investing public as a substitute for gold and other precious metals, which are more traditional inflation hedges.”

Though he’s “not a big owner,” Ray Dalio, who founded Bridgewater, the world’s largest hedge fund, says:

“There are certain assets that you want to own to diversify the portfolio, and bitcoin is something like a digital gold.”

While gold has served as a traditional inflation hedge, Steve Ehrlich, CEO of Voyager Digital (VYGVF), a cryptocurrency brokerage firm says, “There is a finite number of coins. That is why bitcoin can replace gold.” Cryptocurrencies like Bitcoin with a hard limit on the maximum supply are computer-simulated artifacts even more fiercely deflationary than gold.

An Aug 24th article on Yahoo Finance entitled “Should You Invest in Bitcoin for Retirement?” explains why:

“Bitcoin has a fixed supply of 21 million coins, which means that unlike with fiat currencies like the U.S. dollar, no more can be created once the circulating supply reaches that figure. That is one of the major upsides for bitcoin’s projected value over time, which is expected to increase as the purchasing power of fiat currencies decreases because of inflation.”

While this intense inflationary macro environment incentivizes investors to protect their wealth against dollar devaluation with inflation-proof assets, this fiat flood also pushes down interest rates and makes it cheaper to invest in crypto.