India’s Controversial Crypto Tax Should Be Cut After Failing to Achieve Aims, Think Tank Urges

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

India’s controversial 1% tax deducted at source (TDS) crypto tax policy needs to be lowered to 0.01%, a technology think tank has proposed based on a new study.

India’s most controversial crypto policy, a 1% transaction tax deducted at source, needs to be lowered to 0.01% to help the government achieve its aims of boosting revenue and improving transparency, a New Delhi-based technology policy think tank said in a new study.

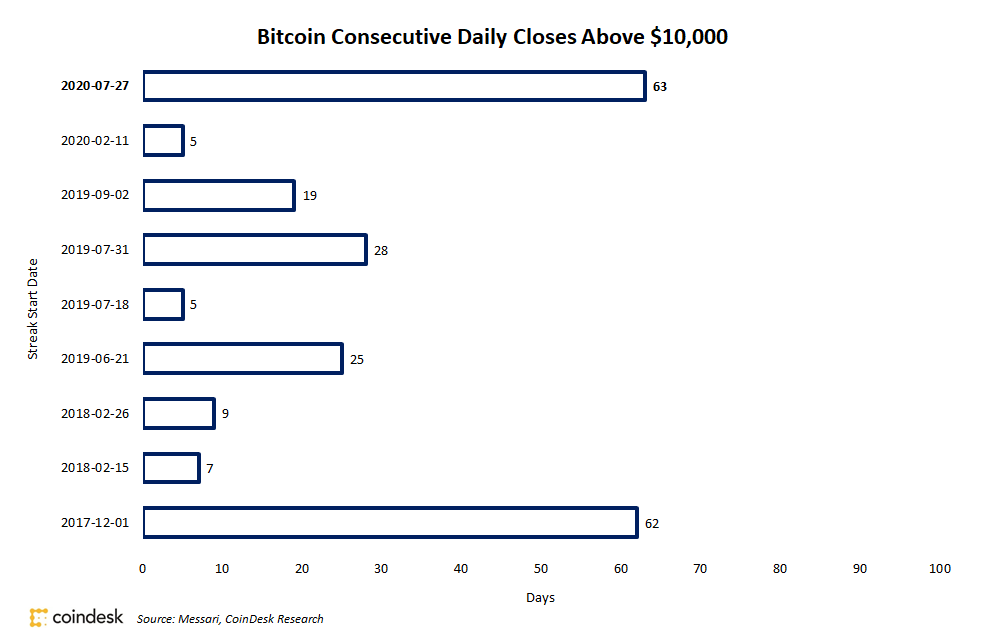

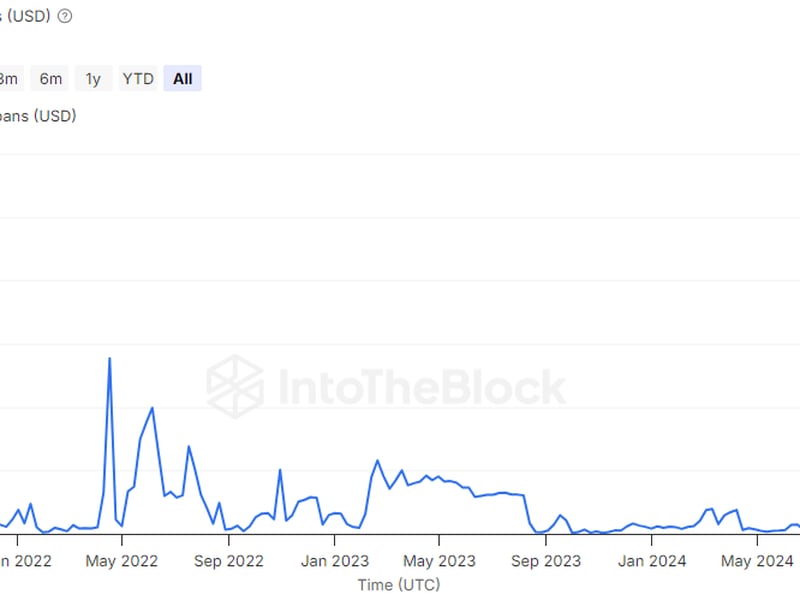

The tax, a form of income tax known as TDS, has prompted as many as 5 million crypto traders to move their transactions offshore, and has cost the government a potential $420 million in revenue since it was introduced in July, 2022, according to the study by the Esya Centre.

The findings in the “Impact Assessment of Tax Deducted at Source on the Indian Virtual Digital Asset Market” go one step further than the group’s previous report, which revealed Indians moved more than $3.8 billion in trading volume from local to international crypto exchanges after the controversial crypto rules were announced. They show that, at least in part, the tax failed to achieve one of its stated aims: taxing people who are earning profits.

“While the VDA market in India is burgeoning, the benefits of the same are being reaped by offshore exchanges,” said Vikash Gautam, the report’s author, referring to virtual digital assets. “Data shows that two likely policy objectives of the tax – to curb speculation and create transparency around transactions – have not been achieved.”

Prime Minister Narendra Modi’s government announced a 30% tax on crypto profits and the 1% TDS on all transactions in February, 2022. At the time, Finance Minister Nirmala Sitharaman said the intention behind the TDS, the more controversial of the levies, was to increase traceability in India’s crypto ecosystem. Domestic and international participants warned it could kill the industry, and Indian crypto traffic nosedived in the months following its implementation, forcing almost all major exchanges into survival mode.

Representatives of the domestic industry have pleaded with the authorities on numerous occasions to lower the taxes. In addition to tracing transactions, the intention behind TDS was to discourage “speculative activity,” according to the study, which analyzed transaction volumes from 13,000 peer-to-peer (P2P) traders and surveyed crypto exchange executives.

The Finance Ministry had not responded to a CoinDesk request for comment on the study by publication time.

The study also urged the government to clarify the applicability of TDS to offshore platforms.

“It just isn’t enforceable, as per stakeholders,” Gautam said in an interview. “It is possible to be done with international cooperation, but we do understand it is a long process. Some of the other countries have some arrangements with international exchanges to track that.”

Edited by Sheldon Reback.