In Search of Stability: An Overview of the Budding Stablecoin Ecosystem

Stability.

The word seems to be at complete odds with the current nature of the crypto market. With its flagship coin having “died” on hundreds of occasions, volatility and meteoric price swings have come to define cryptocurrencies, as price stability, ever-elusive, is in short supply.

Bitcoin’s frenetic value has given critics plenty of fodder to argue that its underlying use case, a digital currency for a digital age, is kaput. The same argument has led proponents to rebrand bitcoin as a store of value, a kind of digital gold, instead of its ostensible utility as a payment method. It’s also one of the primary concerns for institutions when weighing the pros and cons of adopting cryptocurrencies into their business models or investing in the young asset class.

Enter stablecoins. A stablecoin, as its name suggests, is a cryptocurrency that is built to retain a stable value. Typically, each coin is pegged one-to-one to a national currency, most notably, the U.S. dollar or the euro. By mediating between the cryptographic controls of cryptocurrencies and the volatility that mars their monetary functionality, stablecoins are the answer to those critics who cry out against crypto’s mantra as digital cash.

The need for a stable cryptocurrency is obvious. Your local coffee shop isn’t going to sell you that latte for crypto if the price may decrease before they can liquidate it, and, on the flip side, you may not be willing to purchase it in crypto if there’s a chance that payment will appreciate in value after the fact.

Because of the above possibilities, proponents posit that stablecoins are a necessary analogue to adoption. With a stable payment mechanism in place, the belief goes, merchants, institutions and consumers should be more comfortable with using cryptocurrencies in their day-to-day.

But form and function aside, adoption still relies on integration, circulation and widespread use for a stablecoin to become a reliable payment method. What’s more, no two stablecoins are alike, and different models come with different degrees of decentralization and retain their pegs with collateral from different assets — or with none at all.

Stablecoins: A Brief History

Somewhat a product of the industry’s first altcoin boom, the stablecoin model dates back to 2014.

Bitshares, the brainchild of Dan Larimer, introduced the first fully functional stablecoin to the space. Described by many as a Decentralized Autonomous Organization (DAO) that offers a suite of services ranging from a a decentralized exchange to smart contract-managed payments, the platform debuted its stablecoin, BitUSD, on July 21, 2014.

Also referred to as a SmartCoin, BitUSD is backed by Bitshares’ native currency, BTS. To retain a 1:1 peg to the USD and to hedge against volatility, each BitUSD (typically) is insured with at least $2 in BTS. These BTS are locked up in a smart contract, and BTS holders can use Bitshares’ network to exchange their coins for BitUSD.

This model, known as crypto-collateralized, was the first first fully operable iteration of a price stable cryptocurrency. Keeping with bitcoin’s ethos, this model’s backing roots it in the cryptographic economy, and its only ties to fiat currency come from the dollar peg it represents.

Though it may seem odd to solve an asset’s volatility with the asset itself (more on this later on when we breakdown each stablecoin type), BitUSD is still around. But it’s been outpaced by its competitors, the strongest of which upholds what some say spits in the face of decentralization: stability with a direct peg to the USD.

Tether (USDT) launched shortly after BitUSD on October 3, 2014, as Realcoin. The most popular stablecoin hardly needs an introduction (though we’ll cover it more comprehensively later on). Currently ranked 8th on CoinMarketCap at the time of publication, the $2.8 billion asset purportedly backs each of its USDT tokens with a dollar in one of its multiple bank accounts. This fiat-collateralized, custodial model has become a market favorite, as Tether has become the go-to arbitrage and trading hedge on some of the space’s top exchanges.

As the first fully functional, fiat-backed stablecoin, Tether broke with the crypto-collateralized model that Bitshares pioneered, and its own model would set a precedent for a host of successors in the years to come.

Fast forward to 2018 and stablecoins have become the flavor of the year. The year following bitcoin and friends’ stratospheric boom and bust has seen the industry’s stablecoin niche roughly double its numbers. This expansion has been accompanied by an infusion of capital, as well, as the asset class has attracted some $350 million in funding, the majority of which comes from crypto-specific venture capital funds.

In the footsteps of Tether, the majority of these newcomers are fiat-backed, though Bitshares’ crypto-collateralized model still has its own adherents, and algorithmic-backed coins, hitherto confined to theoretical models and white papers, are making their working debut.

*Note: The following section examines fiat-collateralized stablecoins. While these coins fall under the larger category of asset-backed coins, we’ve decided to forego examining coins that are backed with hard commodities like gold or other assets like property and stocks, as coins that use these backings for stability either a) haven’t yet achieved a significant enough market cap or rate of adoption or b) are still in the ideation phase.

Fiat-Collateralized: The Second Coming of Old Money

As the previous history lesson explains and contrary to common misconceptions, Tether was not the first fully-functional stablecoin — though it did drum up enthusiasm for the fiat-collateralized model.

Tether’s cornerstone lies in a 2012 white paper authored by J.R. Willett. Entitled “The Second Bitcoin Whitepaper,” the ambitious document proposes a secondary layer on Bitcoin’s network, one that would allow developers to build additional coins on its blockchain (similar in concept though completely different in execution to building tokens on Ethereum).

This platform would eventually become Bitcoin’s Omni layer, the same technical springboard used to launch Tether. Tether co-founders Brock Pierce and Craig Sellars left Willet’s project in 2014 to work on Realcoin, what would later become Tether after a rebranding in November of 2014. By January of 2015, it began trading on the Bitfinex exchange, and the rest is history.

And that history has been complicated.

Information gleaned from the Paradise Papers leak in 2017, revealed that Bitfinex’s CEO Jan Ludovicus van der Velde is also the CEO of Tether Holdings Limited. This overlap has led skeptics to scrutinize the two organizations’ working relationship.

Augmenting this scrutiny, a report published by John Griffin and Amin Shams, two professors at the University of Texas at Austin, traces Tether’s issuance to a handful of Bitfinex wallets. The same report also corroborates a long-held suspicion that Tether prints more USDT than it has the dollars to back and suggests that Tether was used to artificially inflate bitcoin’s 2017 price, as a result.

Even so, Tether has its defenders. Dr. Wang Chun Wei of the University of Queensland, Australia, actually published research a month prior to Griffin’s and Shams’ own and, as though anticipating their scrutiny, found that Tether does not have enough market share to manipulate bitcoin’s price. Still, Wei’s report did not erase the questions surrounding Tether’s finances.

Tether could absolve itself from suspicion with a formal audit, though it claims this is impossible. Instead, in May of 2018, Tether conducted an internal review through the Freeh Sporkin and Sullivan law firm, which confirmed that Tether’s unencumbered assets match the tokens in circulation, while also cautioning that its report “… should not be construed as the result of an audit and were not conducted in accordance with Generally Accepted Auditing Standards.”

Without a proper audit on the books, Tether’s operations have been decried as opaque, and related concerns are exacerbated when we take a look at Tether’s liquidity. Making promises in its white paper that users can redeem Tether for USD at any time, the only real way to purchase Tether with fiat is indirect at best: You’d have to buy bitcoin or ether from a fiat-crypto ramp, transfer your coins to an exchange that supports tether and then trade for it there.

Tether itself, as Jon Evans has pointed out, does not actually allow users to redeem USDT for USD. The login function on Tether’s website is supposedly for this purpose, but recently, new users have been greeted with a registration error that says the site is rebuilding its system.

Fiat-Collateralized: Beyond Tether

Still, a growing force of fiat-backed competitors have taken to Tether’s model — with some modifications. These projects, in their own ways, have looked to avoid the controversies surrounding Tether by offering reliable liquidity and business models that place transparency at the fore of operations.

In the realm of fiat-collateralized coins, Tether’s biggest competitor is TrustToken. Like the monolith that came before it, TrustToken issues tokens tied to underlying dollars. Unlike Tether, however, which plays custodian, issuer and representative for its tokens, TrustToken is more hands-off.

In fact, it doesn’t have any degree of control over TrueUSD (TUSD), its flagship stablecoin. The company leaves this up to its smart contracts, escrow accounts and fiduciary partners.

To mint TrueUSD, users must send a wire transfer with funds to one of TrustToken’s fiduciary partners (currently either Alliance Trust Company or Prime Trust), and after depositing the money into their bank accounts, these institutions use the platform’s Ethereum-driven smart contract to issue tokens to the user’s Ethereum wallet. To redeem tokens, the user burns them through the smart contract, which then signals the trusts to wire the user the corresponding funds.

In an interview with Bitcoin Magazine, TrustToken’s vice president of Corporate Development, Tory Reiss, indicated that the platform provides its fiduciary partners with a dashboard to manage the token issuance and redemption processes.

“We act on behalf of the token holder but, as a business, we can’t access those funds,” he emphasized.

TrustToken’s laissez-faire approach sets it apart from Tether, and its banking partners open up clear liquidation pathways for users. But this isn’t the only difference in the company’s business model. It also publishes weekly and monthly attestations of its financial records.

“We have one top-50 accounting partner (Cohen & Company) that is performing attestation. When they look at your books, they look at all of your transactions. And if your account isn’t in line from day zero, they won’t maintain an audit account,” Reiss stated in our conversation.

“We have nothing to hide,” he continued, in a not-so-subtle jab at TrustToken’s competitor.

Reiss’s comments and TrustToken’s professional relationship with Cohen & Company throws a wrench in Tether’s claims that it can’t receive a proper audit. While Tether has claimed that an audit from one of the big four accounting firms is out of reach for a stablecoin, Reiss stated in our correspondence that TrustToken is currently in talks with two of these firms to give their audits additional legitimacy.

With a $100 million market cap, TrueUSD is Tether’s biggest competitor, even if it has significant ground to make up. But the month of September brought along with it three new institutional tier projects that could cut in to both front runners’ market shares.

Two of these — GeminiUSD (GUSD) and USD Coin (USDC) — were launched as in-house stablecoins for the Gemini and Circle/Poloniex exchanges, respectively. Both are seen as being potentially attractive to institutional investors for their regulatory compliance (Gemini is fully regulated per New York’s BitLicense laws, and Circle, regulated by FinCEN, is seeking money transmitter licenses from all 50 states).

USD Coin runs on Centre’s stablecoin framework, a blockchain developed by Circle. Like many other newcomers, GUSD runs on Ethereum, as does the Paxos Standard (PAX), the Paxos Foundation’s stablecoin that, like GUSD, is regulated by the New York Department of Financial Services. All three coins allow for quick and seamless fiat-to-crypto swaps and crypto-to-fiat redemptions using their own liquidity portals.

Gemini’s and Paxos’s coins have come under fire in the weeks following their same-day launches for backdoors in their coins’ code that allow either association to freeze funds and reverse transactions. These control mechanisms were likely necessitated by virtue of being regulated entities, and there’s no indication that either organization would abuse them under the regulatory spotlight.

As the CEO of Kowala (a stablecoin we’ll get to later), Eiland Glover put it, it’s either organization’s way of “being ahead of regulation, being over compliant” to give them the control “to go back and block or reverse something,” a control traditional financial institutions enjoy.

In the European sphere, Malta-based STASIS launched its STASIS EURS (EURS) in July of 2018. The coin’s finances are secured and managed by an undisclosed “AAA-rated European institution,” and it was the first exclusively euro-pegged stablecoin to hit the market.

Attesting to its reserves with daily, weekly and quarterly audits, CEO Gregory Klumov told Bitcoin Magazine that “STASIS created EURS token following the demand from institutional clients, high net-worth individuals, and funds that trade digital assets. Also, we think that there is a lack of price-stable cryptocurrency with the visible transparency of reserved assets.”

Takeaways and Tradeoffs

Acting as glorified IOUs for their underlying currencies, fiat-collateralized stablecoins are the least complex of the asset class’ three main categories.

By consequence, they’re also the easiest to understand. For this reason, institutional investors are likely to favor them over their more abstruse, technically complex counterparts. The regulatory protections and transparency that coins like GUSD, PAX, TUSD and USDC offer are also likely to make institutional investors and retail investors with little cryptocurrency knowledge feel at ease when entering the market.

They also offer the most surefire on and off ramps for liquidity. Now, if the end game of a stablecoin is to replace cash and fiat, then this won’t matter in the long term. But considering that stablecoins function primarily as a hedge for trading in their current form, ease of liquidity is a must for most investors.

Ironically, the same features that make stablecoins so attractive are the same things that might make them a turn-off for some users.

They require a baseline of trust that the institution in control of redeeming tokens will honor this commitment. The anxieties surrounding this counterparty risk are probably felt most with Tether, given its lack of transparency. Ultimately, this model reintroduces the same financial intermediaries bitcoin had intended to cut out. As is the case with PAX and GUSD, these same custodians have the power to access funds directly and reverse transactions — financial controls most crypto evangelists have rejected.

Crypto-Collateralized: Taming Volatility From Within

It seems odd to use an inherently volatile asset to create stability. But for those who place decentralization as a priority above all else, on-chain collateralized assets provide more peace of mind than their off-chain collateralized counterparts like Tether.

As we covered earlier, BitUSD broke ground by introducing the market to the stablecoin model, collateralizing the trailblazing asset with cryptocurrency in the form of BitShares (BTS).

BitUSD has since substantially fallen behind projects that came after it, and this may be in part due to the fact that its underlying asset, BTS, offers less liquidity and is used by fewer people than the more widely recognized Ethereum.

Because of this, we’ll be focusing on the Ethereum-based Maker, a decentralized autonomous organization (DAO) and its stablecoin, Dai (DAI). Founded in 2015, Dai has become the most popular crypto-collateral stablecoin available with a market cap of $56 million at the time of publication, and it functions similarly to BitUSD with a few key differences.

In fact, Maker’s CEO, Rune Christensen, told Bitcoin Magazine that BitUSD was the inspiration for DAI’s creation.

“I got into stablecoins initially with Bitshares’ [BitUSD], which was the first stablecoin project. And from there me and some of the other Bitshares community decided to take this fundamental stablecoin model and tweak it. At the time, you know, Tether’s model wasn’t around. The original stablecoin model was this crypto-collateralized, and it shows you how much the fundamental thought of the space — to decentralize finance — has changed.”

Dai maintains its $1 peg with what the platform calls Collateralized Debt Positions (CDP), and the same CDPs are responsible for minting new Dai. In order to mint Dai, network users must lock up collateral in a CDP, and in order to hedge against volatility, the CDP must be over-collateralized by at least 1.5x the value of Dai generated (e.g., if the current market value of ether is $225, then to generate 150 DAI, a user would have to front 1 ETH).

To free up collateral, the CDP’s owner must pay back the position’s debt (the amount of Dai originally generated) as well as any interest that the position accrued. This will always be paid in Dai, while the user must also pay a stability fee to the network in MKR, Maker’s base currency, the sum of which is burned by the network.

In the event that Dai’s price goes above or below its target price ($1), the networks Target Rate Feedback Mechanism (TRFM) kicks in to alter user incentives for generating or holding Dai. Falling below will increase the target rate of each CDP, making it more costly to generate Dai so as to reduce the number of coins pumped into circulation. This would then incentivize users to hold Dai as it moves back toward its target price, as their capital gains will increase. With more users holding and fewer Dai being minted, the price will stabilize.

If Dai’s price exceeds $1, the target rate decreases, and Dai is easier to mint in order to dilute supply. Community members are then disincentivized to hold Dai as the price decreases and approaches its equilibrium.

Currently, ether serves as Dai’s only collateral. Denominated as Pooled-Ether (PETH), users must first submit the ether they want to use as collateral into one of Maker’s smart contracts, and this user’s deposit is redeemed as PETH to use in the CDP.

Christensen told us that Maker’s uni-collateral model is something for the platform’s early days. The team hopes to scale the platform to accommodate “basically everything as the backing assets,” he said, collateralizing anything from gold to property and even other stablecoins.

“What we’re looking at is to create a stablecoin that represents a global basket of currencies, so it’s kind of like a measure of global stability for a global economy.”

This ambitious expansion will begin with Dai creating a peg for the euro, with an end goal of becoming blockchain agnostic to bundle the other assets in Maker’s scope.

Maker’s closest competitor outside of BitUSD is Havven, a bi-platform stablecoin ecosystem that runs on the Ethereum and EOS networks. Much like Maker, Havven’s stablecoin, nomins (nUSD), is created through collateralized debt backed by Havven coins (HVN). Unlike Dai, however, nUSD has struggled to catch fire with the wider crypto community and has a current market cap just under $1 million.

Takeaways and Tradeoffs

Demand, issuance and circulation are all driven by community members for both Havven and Maker. There are no overarching or centralized bodies in charge of the platform’s operations and, in Maker’s case, governance and risk management are the onus of MKR holders.

With communities left to their own devices — and with their responsibility to mint coins — the crypto-collateralized model is more decentralized than its more popular fiat-collateralized counterpart. For this reason, crypto-collateralized stablecoins are often championed by crypto evangelists, as they come without the centralized controls of coins like Tether and are more detached from the traditional financial system that bitcoin was built to disrupt.

For the same reason that decentralization diehards may be willing to endorse these coins, though, more mainstream investors and users may shy away from them. Out of the millions of investment dollars poured into stablecoins, only 9 percent of this ($33 million) has gone to crypto-collateralized assets, and $27 million of this figure has been allocated to Dai.

That few dollars are behind these projects isn’t all that surprising. While these coins may not feature the same counterparty risks that come with custodial, fiat-collateralized models, most investors (especially institutional or accredited ones) like the financial guarantees and protections that come from working with a formal banking institution.

It also speaks to the difference in complexity and perceived reliability of the crypto-collateralized model compared to those coins backed by fiat. A coin that is tied to the dollar because it literally represents an existing dollar is much easier for the general public to understand than the hoops they must jump through with a coin like Dai. Plus, the thought of using a volatile asset in cryptocurrencies to generate stability makes less sense to most investors than using a dollar-based IOU model, which most closely resembles how they currently bank using debit and credit.

Algorithmic Backed: Assets Backed by Math

Raising 50 percent ($174 million) of all venture capital funding committed to stablecoin projects to-date, algorithmic-backed stablecoins (coins that have no assets backing them) are the ecosystem’s dark horse. And though they have plenty of bills betting on them, there’s no guarantee that they’ll win out in the end — just plenty of promises and expectations to succeed.

Out of New Jersey, Basis coin has attracted the vast majority of this funding, a jaw-dropping $133 million from the likes of Andreessen Horowitz, Polychain Capital, Pantera Capital and the Digital Currency Group. The coin takes a cue for its stability mechanism from the Seigniorage Shares model developed by Robert Sams.

Its launch forthcoming in 2018, Basis relies on a combination of smart contracts and bonds to achieve stability, and its model, while complex, is predicated on traditional economic theories and incentives to maintain its peg.

In short, in the event of market expansion (when the coin exceeds $1), the network’s smart contracts mint more coins to inflate the circulation and drive prices down. If the price dips below $1, the network will create bonds (debt certificates) and sell them for Basis coins, thereby taking excess currency out of the ecosystem to drive the price back up.

These bonds are then bought back in times of expansion with newly minted coins, and they can even be sold for less than they’re worth, in the case of demand being seriously scant.

Carbon (CUSD), a hybrid fiat and algo-backed stablecoin with $2 million in VC funding, will operate using a like model. Instead of bonds, though, it will issue what is called a Carbon Credit token (Carbon Credit) using a reverse Dutch-style auction when CUSD prices fall below the peg threshold. Like Basis, these credits will be redeemed proportionally per user during events when the network must mint new coins to bring the price down from an unwanted rise. To kick start its network, Carbon is launching on a fully fiat-backed model.

Basis is supposed to launch this year, and Carbon, which went live recently with limited access to hedge funds, accredited players, exchanges and professional traders, is supposedly waiting to have some $1 billion in fiat reserves before transitioning to a partly-algorithmic model. When they do come to market, they’ll be the first non-asset backed stablecoins to test out Sams’ Seigniorage Shares model.

But they won’t be the first algorithmic stablecoin to circulate. Kowala’s kUSD, which launched the alpha for its mainnet in September 2018, has them beat. The first stablecoin to see integration by Ledger, kUSD applies the economic rationale of the Seigniorage Shares model with a spin.

Instead of managing a price peg through debt buybacks and smart contract mandated inflation, the coin uses transactions fees, dead-end addresses and mining rewards. Its model relies on two coins to this end: mUSD, a staking token for mining rights, and kUSD, the stablecoin.

Miners mint kUSD as their mining reward and are, in turn, tasked with circulating the currency. In the event that the price of kUSD climbs above $1, mining rewards are increased to correct the discrepancy. If the price dips too low, then transaction fees are slightly increased, and a portion of these is sent to a dead-end address to be burned by one of the network’s smart contracts.

The largely under-the-radar project has been working closely with regulators and accredited individuals, said CEO Eiland Glover in an interview with Bitcoin Magazine. Its coffers have been filled with rounds of funding from private investors and, per SEC regulations, only accredited investors were allowed to purchase initial sums of its mining token, mUSD.

Operating these private rounds as a securities sale, Glover intends to open the sale of this token to the public when the project’s mining rights are more widely distributed. He’s also reportedly in talks with entities outside of the U.S. to create Kowala coins for other national currencies and economies.

Glover also stressed that kUSD went through “test after test” and code audits before it launched, and he showed the author of this article an AI-driven testnet scenario of kUSD’s minting, circulation and trading to demonstrate its stability mechanism in action.

Kowala is also the only algorithmic stablecoin with open-source code on an active GitHub, which can be viewed here.

Takeaways and Tradeoffs

Our section on algorithmic stablecoins was shorter than the rest for the simple reason that this model is still untried and untested. Even Kowala, the closest to a beta mainnet, is still in alpha and hasn’t stood trial on the crypto market.

Theoretically, algorithmic stablecoins could offer the greatest degree of decentralization. Completely detached from any underlying asset, subsisting only on the math behind their designs, they present themselves as the futurist’s economic instrument, as the next evolution of stablecoins and cryptocurrencies writ large.

But of course, this is assuming they function as intended, and no one can say for certain that they will. Even in Basis’ case, all the backing in the world is no guarantee for success, and there are plenty of variables that could make the model untenable.

One of these is the chance that an algo-backed stablecoin could experience a “death spiral.” Basically, if the price drops low enough, investor confidence could be shaken to the point of inciting a massive sell-off — something akin to a bank run for the network — and this could send the coin into a freefall from which it couldn’t recover.

Basis’s and Carbon’s bonds/debt contracts are meant to mitigate this risk, but these safety nets operate under the assumption that the community has enough confidence in the coin’s economic model to a) buy the contracts in the first place and b) hold them long enough to redeem them. Essentially, they’re predicated on a belief that the network itself holds value; if this belief is shattered, then there won’t be enough buyers left to pick up the pieces.

With So Many Coins, Where Do We Go From Here?

It’s worth pointing out that the stablecoins examined in this article are not exhaustive. For now, we covered only the most notable stablecoins in each class, focusing mainly on those that have already launched.

There are still others, some of which have attracted significant attention and capital. Saga, for example, has raised $30 million dollars in venture funding, and its team and advisors boast a former J.P. Morgan executive, a former central banker and even a Nobel prize-winning economist. Its peg will tap into the International Monetary Fund’s special drawing right, a foreign exchange reserve asset that represents an index of national currencies to serve as a unit of account.

If we can glean anything from the institutional track record of its team and its economics, Saga’s design is aimed at big league investors. Over time, its price stability mechanism will allow it to maintain its peg without full funds to back every token in circulation, a feature that may too closely resemble fractional reserve lending for crypto’s more fundamental believers.

With funding to the tune of $32 million, the South Korean Terra offers a basket of assets for collateral like Saga. A bit of Frankenstein’s monster conglomeration of the stability mechanisms we’ve looked at, the coin will initially be backed by fiat, later backed by Luna — a currency for network stakeholders who deposit Luna in a Stability Reserve — and later will be ballasted thanks to transaction fees (these fees are paid out to Luna holders, and they increase in the event of a price fall). It is projected to launch in Q4 of 2018.

At any rate, the myriad stability mechanisms and the divergence of these even within each sub-category of stablecoins illustrates that the asset class is rich in variety and, as evidenced by the number of projects announced and launched in 2018, is undergoing a tremendous growth spurt.

Even still, the model, in all of its forms, has a long road ahead before it becomes completely viable as a payment method or store of value. Merchant integration and community adoption is needed, along with a track record of sustainable value (even the oldest stablecoins are less than half a decade old) and consumer confidence.

This confidence may be tenuous in the short term, as a handful of stablecoins have seen their pegs broken at some point in their lifespans (e.g., TrueUSD rose to $1.30 upon being listed on Binance, rising again to over $1.20 five days later; Dai dipped to as low as $0.86 on February 28, 2018; and Tether even dropped to $0.57 in 2015, albeit upon its launch).

Despite its initial plummet upon going live, Tether has remained incredibly stable, and this may explain, in part, why it still accounts for roughly 98 percent of all stablecoins’ market volume.

Of course, this could also be indicative of a lack of competition, something that has been ramped up as of late. With a slew of new coins joining the market race, it’s possible that each coin could serve its own distinct function in the ecosystem as it matures, something both Christensen and Glover expressed in our conversations.

“People have different demands for what they want from the stablecoins they use,” Christensen put it simply in our conversation.

“We definitely think that for the vast majority of people, they just want to use the currency they use,” he continued, stressing that, for adoption to stick, “user interfaces and DApps [must be] really easy to use.”

Glover echoed Christensen’s thoughts, believing coins like the GUSD, PAX and USDC aren’t “really transaction coins” as they were “built for trading” more specifically.

When we consider the above coins’ painstaking emphasis on regulations and the traditional financial controls they have in place, Glover believes these coins will be more appealing to institutional investors looking for a safer in to the market. He also believes legacy companies and institutions are starting to see the benefit of blockchain and cryptocurrencies, something the influx of investment capital and stablecoin projects in 2018 stands testament to.

But for these institutions to buy in, they’ll need that previously elusive — or eluded — guarantee: regulation.

“I see this as institutions now starting to plug in blockchain and crypto into an existing world. To do that, you have to make it fit,” Glover said.

Christensen believes that regulation is both inevitable and necessary, both to embolden the ecosystem and demonstrate to government officials that it isn’t some boogeyman it should simply fend off.

“I think it’s absolutely crucial. First of all, we need to turn around the image of cryptocurrency away from the early days of destroying the governments, destroying the banks and being used for shady stuff on the internet. And secondly, we need to engage with government and explain to them that this is not going to undermine their ability to control their national currency. For instance, all the stablecoins are pegged to national currencies already — they’re not being circumvented. It’s important that regulation comes to protect consumers, but that it doesn’t interfere with the fundamental advantages of blockchain technology.”

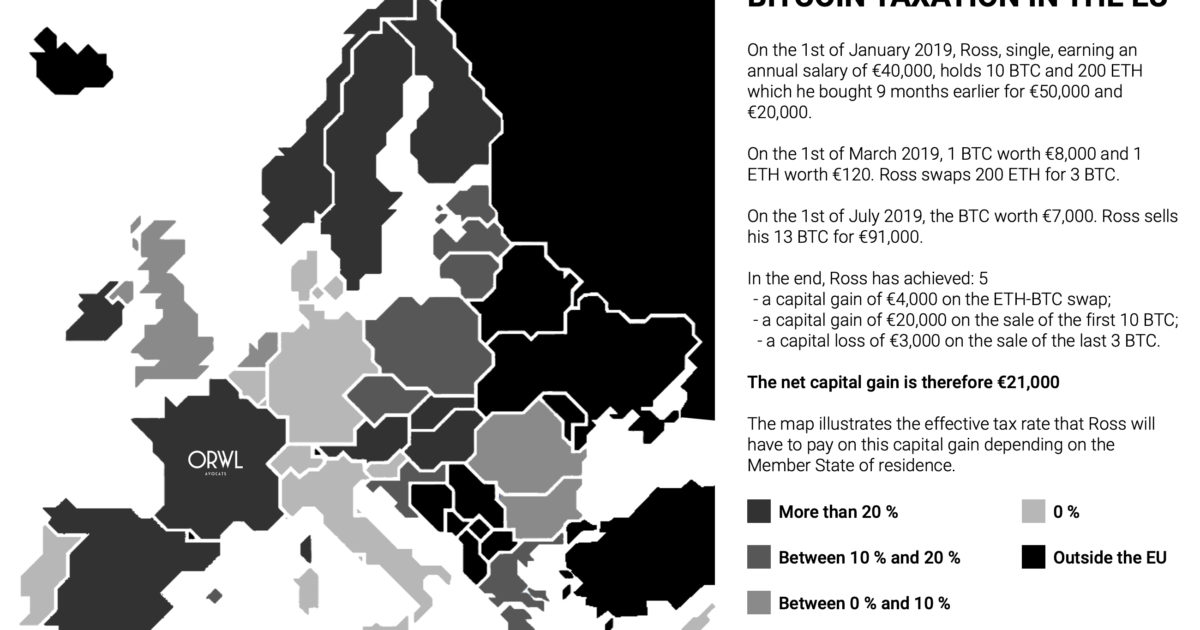

Where these regulations will take the industry and when they will be affected (if at all), is hard to say, especially when you consider the complexity of this newer asset class within a new and largely misunderstood asset class in cryptocurrencies. In the U.S. context, for instance, stablecoins like Basis and Kowala, which both offer profit potential for their users, could very well be seen by the SEC as securities, while asset-backed stablecoins may be seen as commodities by the CFTC for acting as economic instruments.

Capping off our discussion on regulation, Glover indicated that, to remain viable amidst the “moving goalpost of regulations,” projects are running to regulatory guidance instead of away from it. This act of self-preservation couold be interpreted as a show of legitimacy for what use to be a stigmatized industry, but it also means walking the line between what that space is about and what it is primed to become in the larger economy.

“I think a lot of people got subpoenaed and that was a ‘game over.’ You want to do things in a way that preserve the integrity of the stablecoin, but you don’t want to be shut down. I think there is a move toward compliance. Everybody’s seeking out a safe haven where they can feel comfortable that they’re operating under some regulation that protects them. Because now all of this stuff is turning into a real business.”

This article originally appeared on Bitcoin Magazine.