In Remote Northeast Ireland, This Bitcoin Miner Is Turning Biogas Into Sats

A proof of concept on a farm in Ireland demonstrates how bitcoin mining can create value from methane and carbon dioxide waste.

This is an opinion editorial by John Quigley, a Bitcoin mining researcher and digital nomad from Ireland. A version of this article was originally published on Adaptive Analysis.

For years, a growing divide has been forming between Bitcoin miners and BTC-concerned communities worldwide. A line has been drawn not only in the hash-rate-humming mining facilities around the globe but also in the social media arenas where anyone with two cents to share on Bitcoin advocates for one side or the other.

On the one hand, there has been a loud push toward renewables that extends far beyond the Bitcoin mining industry and is a pertinent issue in energy-intensive industries worldwide. However, Bitcoin miners have been firmly placed in the crosshairs of this push given the large amounts of energy that are consumed to power the globally-distributed mining network that is responsible for ensuring that blocks are steadily added on the growing Bitcoin ledger at a rate of roughly 10 minutes per block. Many Bitcoin miners have gotten onboard with this transition and have explored making use of hydroelectric, wind and solar power.

On the other hand, a small share of miners have adhered to and even advocated for fossil fuels, pointing out the intermittency issues that most renewable power sources pose to mining operations and the carbon-intensive manufacturing process and questionable longevity associated with these renewable power sources.

Mining In Armagh County, Ireland

In the upper righthand corner of Ireland lies a small mining operation that may satisfy the values of both communities. On a picturesque farm in the County of Armagh, 35 latest-gen mining machines are being powered off grid by a largely unknown power source. These machines are being powered from the excess energy which this power source cannot sell to the grid, making the cost associated with the power virtually zero. On top of this, the power source is entirely self-sustaining and only requires a little on-site labor to keep it operating smoothly, meaning that the machines can benefit from 100% uptime, an important attribute that wind, solar and oftentimes hydroelectric fail to offer.

Importantly, this power source is entirely powered by organic waste, not only producing clean energy but turning waste products into fuel that can be sold to the grid or power onsite Bitcoin mines. This energy source may be the consistent and clean source of energy that Bitcoin miners have been searching for — anaerobic digesters — and to date, they remain largely untapped as a power source for bitcoin miners.

Mark Morton, a young, Cork-based professional whose enthusiasm for Bitcoin exudes in his every word, was one of the main drivers behind the anaerobic-digester-powered mining operation in Armagh. Morton is one of the key decision makers at Scilling Mining, one of Ireland’s pioneering Bitcoin- and mining-focused companies. His work to educate the Irish community on Bitcoin and mining has led him to operate a small, office-based mining operation, host regular in-person meetups, and manage one of Ireland’s biggest online community groups for Bitcoiners where matters such as political developments, market movements and general industry trends are discussed.

Morton’s work paid off when the owner of the farm in Armagh paid him a visit to learn more about Bitcoin mining, to potentially make use of the excess energy his anaerobic digester was producing at his plant. A couple of meetings later and Morton was sourcing the mining machines and infrastructure setup to turn this idea into a reality.

As it stands, the mining operation is powering 35 latest-gen mining machines with capacity for another 33. At the time of this writing, the difficulty conditions mean that such an operation generates roughly 0.42 BTC monthly, a $8,133 monthly income at current prices.

This anaerobic-digester-powered mining operation is not just likely to be the first-of-its-kind in Ireland, but it may be the only such operation in the world. Anaerobic digestion is the process of utilizing the internal energy in waste matter to produce biogas, a fuel source which is 40% to 50% methane and 30% to 40% CO2, on average. Through use of an engine, this process can create on-site energy which can also be connected and sold to the grid with the proper infrastructure.

In contrast to renewable power sources such as wind and solar, anaerobic digestion provides 100% uptime if it is fed a constant supply of waste. This makes it an attractive supply load for grids which are working toward meeting demands for a higher share of renewable energy sources. As a result, some governments have incentivized the deployment of these generators. For instance, the United Kingdom government established a £10 million fund to assist in the development of such infrastructure. Incentives in the U.K. led to a proliferation in anaerobic digesters in Northern Ireland, a small segment of the country which is under U.K. jurisdiction.

Morton noted that in many cases, however, grid connections have failed to materialize, leaving farmers who invested heavily in such schemes with excess energy and a lack of revenue streams to pay off the costly infrastructure. Investments in anaerobic digesters can range upwards from £200,000 to £1,000,000 depending on the energy capacity with expected ROI timeframes of four to seven years. However, such ROI figures depend on reliable grid connections and the costs can radically increase when it comes to larger-scale projects with estimates for costs going up to $5,000,000.

Morton has estimated the ROIs for an investment in an onsite mining facility for anaerobic digester owners under a wide variety of price and difficulty conditions. He noted that under most conditions, the payback period is roughly two years, after which, the owner of the facility would be generating pure profit which would be accelerating the ROI of their anaerobic digester. Under favorable conditions, Morton estimates that the payback period could be as short as ten months for the onsite mining facility.

Filling The Gap

The genius of Scilling Mining is in utilizing Bitcoin mining infrastructure to fill the gap between the energy produced by these anaerobic digesters and the lack of a demand-side outlet such as an onsite demand load or grid connection. Bitcoin mining fills that role of an onsite demand load and monetizes the excess energy by powering the fundamental role of validating, bundling and appending transactions to the Bitcoin blockchain.

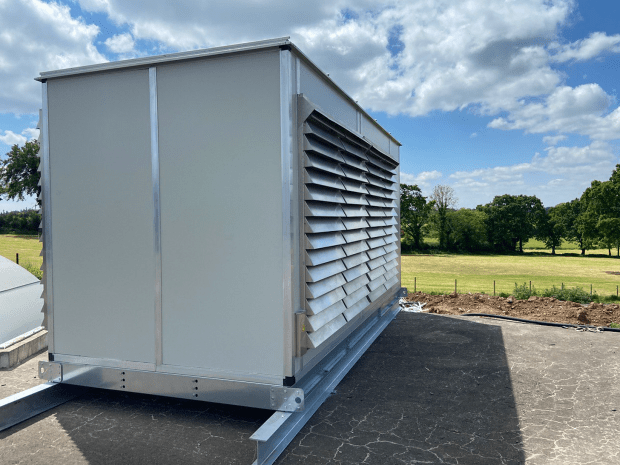

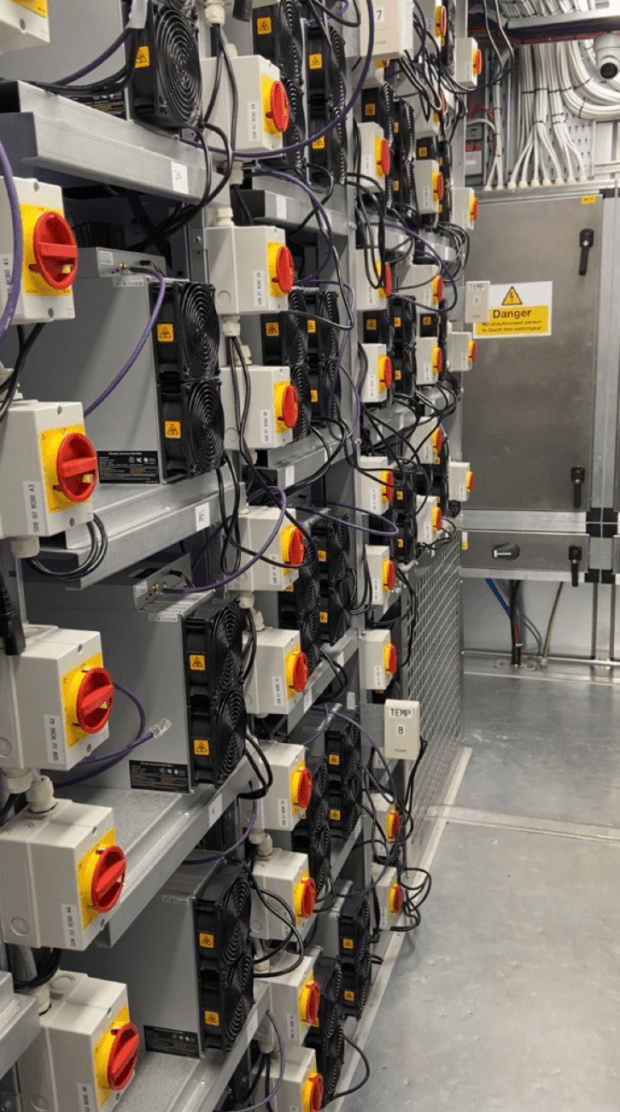

Morton and Scilling Mining initially researched container options to both house and connect the rigs to the power source but determined that the best solution would be to work with the right professionals to build their own custom solution. The result was the Power Vault 68, a container solution that houses up to 68 mining machines and is carefully designed for airflow, electricity infrastructure and to meet fire hazard standards.

With over 20,000 anaerobic digesters operating worldwide and roughly 1,000 new plants being deployed each year, the natural question that emerges is how much scope there is for partnerships between the owners of such infrastructure and those with expertise on the Bitcoin end. The efforts of Morton and Scilling Mining have certainly alleviated the pain points of one owner of this costly infrastructure. But Morton doesn’t see it stopping there. Scilling Mining has ambitions for more sites operating by the end of the year and aims to educate anaerobic digester owners across the continent on the potential for monetizing their excess energy with onsite Bitcoin mining facilities.

This model is not new. For years, North American Bitcoin professionals have been partnering with and assisting oil and gas producers to help them tap into their excess energy production which is oftentimes flared directly into the atmosphere. But now it looks like a relatively new, Bitcoin-focused company has discovered Europe’s equivalent. Throughout Europe, there may be vast amounts of untapped, clean energy with 100% uptime that are ideally positioned to be monetized through on-site Bitcoin mining machines.

Thanks to Scilling Mining and a forward-thinking farm owner in the Northeast of Ireland, there is now a successful proof of concept operating in a remote farmland in Ireland which highlights the potential for further partnerships between the owners of anaerobic digesters and Bitcoin professionals in the years to come.

This is a guest post by John Lee Quigley. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.