In Bullish Report, Bloomberg Predicts $400,000 Bitcoin Price In 2021

In its latest monthly “Crypto Outlook” report, Bloomberg outlined the “rising bitcoin adoption tide” with some bullish sentiment.

On April 6, Bloomberg released the April edition of its monthly “Crypto Outlook,” in which it outlined the bullish narratives around bitcoin and the burgeoning industry surrounding it. The report was notably bullish, particularly as it came from a reputable legacy firm in the financial and media industry. Here are some of the highlights:

“Bitcoin Fills The Digital Reserve-Asset Need In Low-Yield World”

“Adoption iterations for Bitcoin have entered a unique state of human nature that supports the crypto’s ascent, in our view. Money managers reluctant to cross the Rubicon and allocate at least a small portion of funds may be at risk as Bitcoin simply does more of the same, advancing in price amid unprecedented low interest rates and elevated equities.”

The record-low yields across the global economic environment have played a major role in Bitcoin adoption over the past year, and more investors are starting to take note. Bloomberg also highlighted the dichotomy between the recent performance of bitcoin against the performance of gold.

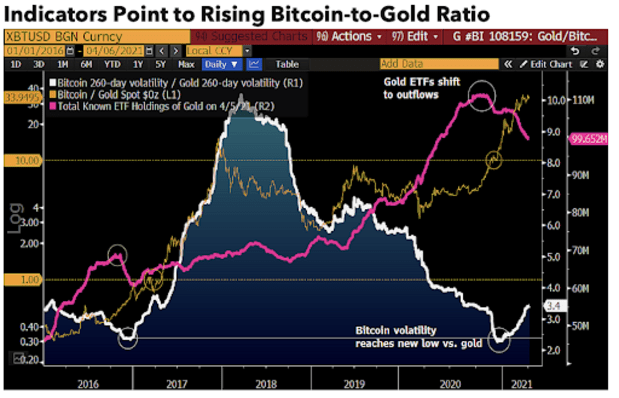

“Indicators Point To Rising Bitcoin-To-Gold Ratio”

“In addition to plenty of maturation potential for nascent Bitcoin, the crypto has a clear edge that should further pressure its volatility vs. gold’s — Bitcoin supply is fixed. Mainstream adoption and higher prices are increasing depth, which suppresses volatility and risk measures.”

The report repeatedly emphasized the superior properties of bitcoin and its fit as a monetary asset in the digital economy in contrast to gold. While the outlook on gold wasn’t bearish for the metal itself, the data and price action has led Bloomberg to conclude that bitcoin is replacing its monetary predecessor as the preferred non-sovereign reserve asset in investor portfolios.

“Bitcoin Replacing Old-Guard Gold Is More Sudden Than Gradual”

“The adage that money flows to where it’s treated best describes what we see as firming underpinnings for the price of Bitcoin. It’s not necessarily bearish for gold, which is backing into layers of support below $1,700 an ounce, but most indicators show a shifting global tide that favors the nascent digital currency as a reserve asset.”

“Digital Vs. Analog: Bitcoin’s Upper Hand”

“Bitcoin’s relationship to gold is similar to 2016, when the metal peaked just below $1,400 an ounce and the crypto launched toward its 2017 peak. A key difference this time is that Bitcoin is rising in value and less speculative, underpinned by greater adoption. It was the world’s largest automaker by market cap (Tesla) announcing the diversification of some of its equity wealth into the crypto that allowed Bitcoin to breach $40,000 resistance.”

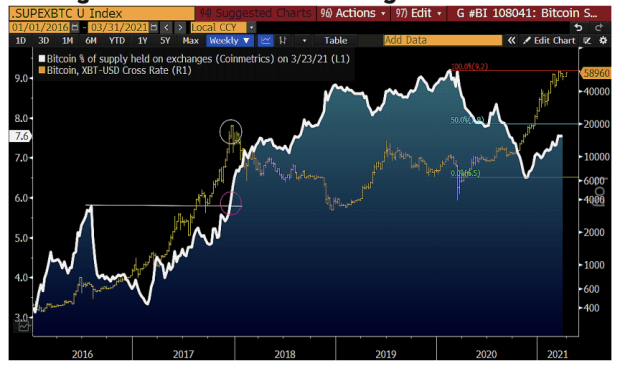

The report also highlighted on-chain analytics that shows that the supply of bitcoin on exchanges is continuing to decrease, despite bullish price action, which is the opposite of the trend observed during the 2017 bull cycle.

“Few Signs Of Bitcoin Holders Looking To Sell”

“Markets are about buyers vs. sellers, and Bitcoin risks lean toward further price appreciation, if the amount of the crypto readily available to trade is a guide. Our graphic depicts the percentage of Bitcoin held on exchanges well below the peak from 2020, which marked a selling extreme. The patterns in this dataset from Coinmetrics suggest the Bitcoin price will gain elevated risk of sellers dominating buyers when the amount of the crypto held on exchanges exceeds the previous high. That’s what happened around the price high in 2017.”

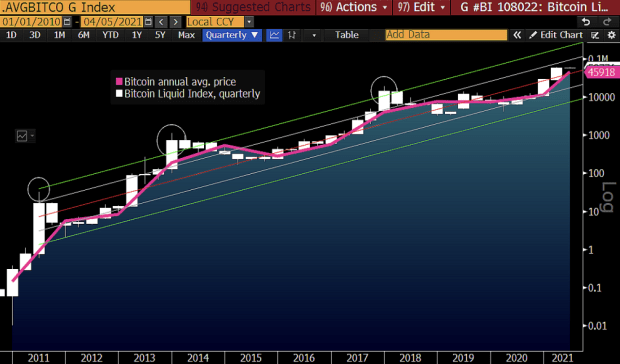

Another noteworthy highlight from the report was the expectation from Bloomberg that bitcoin was on a similar path as the 2013 and 2017 mining subsidy halving bull cycles, pointing to a price of $400,000 for the asset. The logarithmic, seemingly programmatic, price action of bitcoin over the years has investors salivating in the current no yield economic environment.

“Bitcoin Rhyme With 2013, ’17 Peaks About $400,000”

“The technical outlook for Bitcoin in 2021 remains strongly upward, if past patterns repeat. Common companions for strong annual rallies in the first-born crypto — low volatility and halvings — are aligned favorably. Our graphic depicts Bitcoin on similar ground as the roughly 55x gain in 2013 and 15x in 2017. To reach price extremes akin to those years in 2021, the crypto would approach $400,000, based on the regression since the 2011 high. In September, 180-day volatility on the crypto about matched the all-time low from October 2015. From that month’s average price, Bitcoin increased a little over 50x to the peak in 2017.”