IMF Poll: Digital Currencies Are Real Money

The debate as to Bitcoin and other cryptocurrencies are real money has been going on ever since the nascent assets came into existence. Both sides have their proponents.

Nevertheless, according to a recent poll, the overwhelming majority of respondents tend to think that digital currencies are, indeed, money.

Digital Currencies Are Real Money: Poll Results Conclusive

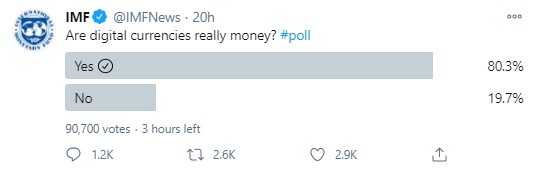

In a recent poll, the International Monetary Fund (IMF), an organization of 190 countries, took it to Twitter to ask whether or not digital currencies are really money.

Although there are three hours still left on the clock, the results are more than conclusive. Out of 90,700 voters, 80.3% believe that they are, indeed, money.

What is even more interesting, however, are some of the responses. In particular, Gabor Gurbacs, a digital asset strategist and director at VanEck, responded with another poll, asking whether fiat currencies are money. With two days left on the clock, 9,248 votes are already turned in, 78.81% of which said “no.”

Bitcoin: A Store of Value

More popular is becoming the narrative that Bitcoin is a store of value, just like gold is. Unlike the latter, however, the former does present some benefits. For example, and that’s just the tip of the iceberg, it’s a lot easier to “transport.” It doesn’t have the physical restrains that gold has.

This, among other things, is the reason for which many companies, institutions, and analysts, are referring to BTC as digital gold and a better version of it.

In terms of its capabilities as a store of value – the protocol’s mechanics make it a scarce digital asset. Just like there’s a fixed amount of gold on our planet, there will always be no more than 21 million bitcoins in circulation.

This is the reason for which it’s not an inflationary unit, as opposed to fiat currencies, where governments can print money away and inflate the amount to an infinity – something that we’re currently seeing amid the ongoing coronavirus crisis. This is the reason some investors have taken up the opportunity to invest in Bitcoin as an “inflation hedge.”

Bitcoin, again – unlike fiat currencies – is not governed by a central authority. Instead, it’s governed by a decentralized public ledger, the dynamics of which are based on math rather than a subjective decision-making process.