Iceland’s Currency Will Be First in Europe to Be Traded as E-Money

The Financial Supervisory Authority of Iceland (FME) has approved Reykjavik-based Monerium as its first electronic money institution.

The designation, announced Friday, means that Monerium has regulatory approval to provide fiat payment services on a blockchain and use it throughout the European Economic Area. Electronic money is a well-established regulatory framework in Europe that’s been in use for years, Sveinn Valfells, CEO and co-founder of Monerium, explained to CoinDesk in a phone call.

It’s the first time, however, electronic money has been approved for use over a blockchain.

Monerium sees the fact that it’s working under an established framework as a competitive advantage, Valfells said, adding:

“For practical purposes, fiat will be the currency most people and institutions will want to use in the near- and medium-term. And if you are touching fiat in any way, you just have to comply with the relevant regulations.”

Monerium cofounder Jon H. Egilsson will discuss the news at a digital currency conference in Stockholm on Saturday. Egilsson was formerly chairman of the Supervisory Board of the Icelandic Central Bank.

Electronic money is fiat held and transferred digitally. The ConsenSys-backed Monerium will initially operate using the ethereum blockchain – though it is prepared to operate across public and private distributed ledgers, allowing expenditures and transfers to be made without an intermediary.

In a copy of his prepared remarks shared with CoinDesk in advance, Egilsson wrote:

“Monerium e-money encompasses the benefits of programmable money on blockchain, in addition to being the closest form of central bank money there is – based on a proven EU regulatory framework.”

The legal concept of an electronic money institution (EMI) dates back to the financial crisis, established in a 2009 act by the European Union. The rule is primarily used now for prepaid debit cards, Valfells explained.

Valfells argues that many companies making similar products, such as fiat-backed stablecoins, designed technology first and looked for regulators to approve it. Monerium instead decided to base its technology on an existing set of rules. Valfells said:

“We believe law is also protocol.”

How it works

Banks make money by turning deposits from customers into loans to borrowers. EMIs are more conservative with deposits.

From Egilsson’s remarks:

“Unlike bank deposits, an electronic institution (EMI) must safeguard clients funds separately from any other financial activities, such as lending. Instead, customer funds are invested in a segregated portfolio of high-quality liquid instruments along with regulatory minimum reserves. The structure is similar to a high-grade money market fund.”

The idea is that the EMI-model provides consumers with more protection. Fiat put into an EMI must always be redeemable without conditions.

By putting e-money on the blockchain, it also enables cross-border payments without a financial intermediary. The company plans to start with Icelandic krona (ISK). Once live, Monerium’s version of ISK will be usable throughout the EU and should shortly be usable in many other parts of the world with similar regulatory regimes. More currencies will follow.

As a regulated form of payment, it follows the typical know-your-customer, anti-money-laundering procedures familiar throughout the developed world.

The world of fiat-backed global currencies is getting somewhat crowded. The CENTRE Consortium created by Circle and Coinbase is designed to allow member institutions to issue their own fiat-backed stablecoins. Earlier this week, the initiative opened itself to new members. Facebook’s “GlobalCoin” is also reported to be backed by a basket of fiat currencies.

Monerium is still in closed beta. For its earliest partners, an e-money ISK will be available in a matter of days, Valfells said. Valfells estimated that as early as Q4 2019, the e-money ISK should become available to a wider audience.

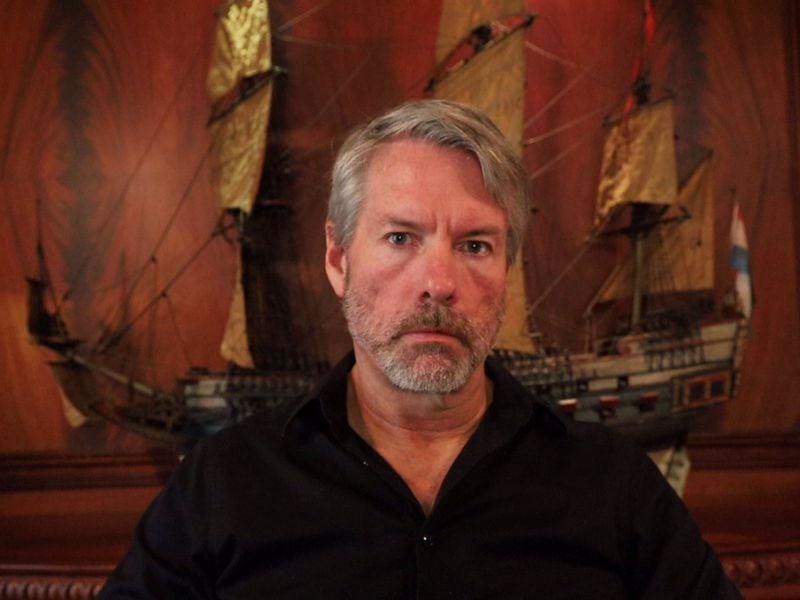

Team photo courtesy of Monerium. Pictured, left to right: Arni Gudjonsson (engineer), Gisli Kristjansson (co-founder and CTO), Sveinn Valfells (co-founder and CEO), Hjortur Hjartarson (co-founder and COO), Jon Gunnar Olafsson (counsel) and Jon Helgi Egilsson (co-founder and chairman)