Cryptocurrency exchange Huobi appears to be inching towards a reverse initial public offering (IPO), according to a document posted with Hong Kong Stock Exchange (HKEX).

In the filing, dated Sept. 10, Hong Kong-listed electronics manufacturer Pantronics Holdings Limited, acquired by Huobi last August, disclosed it will change its name to Huobi Technology Holdings Limited.

The company transferred more than 221 million ordinary shares to Huobi Group at its acquisition, according to shareholding disclosures. The $77 million deal made the cryptocurrency exchange the majority shareholder in Pantronics, with an over 73 percent stake in the company.

The deal was reported at the time as potentially providing Huobi the opportunity to go public in Hong Kong via a process known as a reverse takeover.

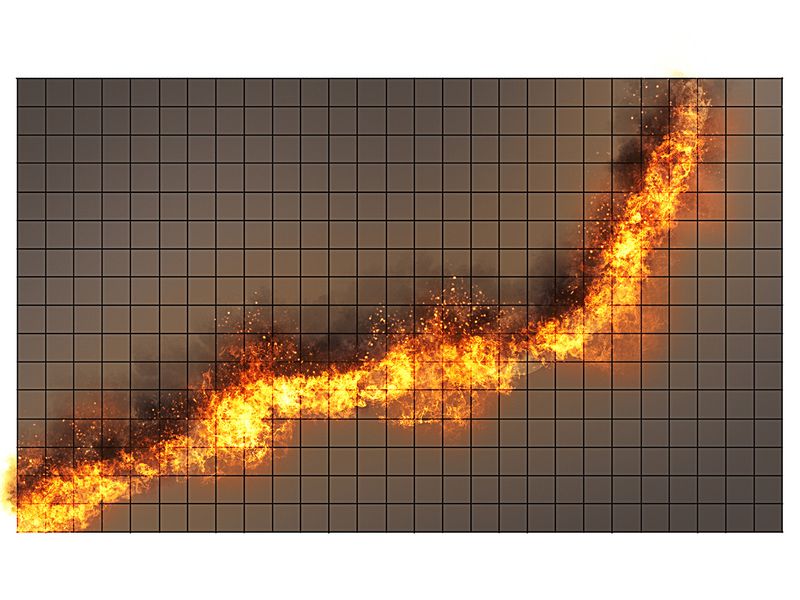

However, the move could be affected by the stricter regulations (pdf) on backdoor IPOs from HKEX planned for Oct. 1. The stock exchange said it would make changes to its current regulations, making such transactions more difficult for those that acquire another publicly listed company in different industries based in Hong Kong.

Other major companies in the cryptocurrency space are also seeking to go public in different jurisdictions, after stalled attempts in Hong Kong.

After mining giant Bitmain’s IPO attempt in Hong Kong was allowed to expire, apparently due to reluctance from HKEX, it’s reportedly now planning to list in the U.S. Another miner manufacturer, Canaan Creative, is also reported to have already confidentially filed in the U.S. after a failed HKEX attempt.

HKEX image via Shutterstock; Pantronics document via HKEX