Huobi Drives Exchange Bitcoin Balances Even Lower

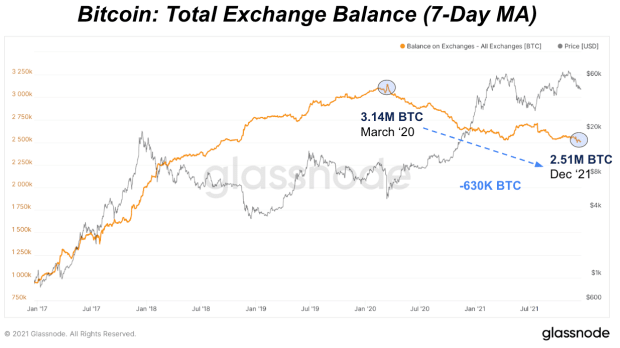

Since March 2020, the total balances of bitcoin being kept on exchanges have fallen by nearly 630,000 BTC, roughly a 20% decline.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

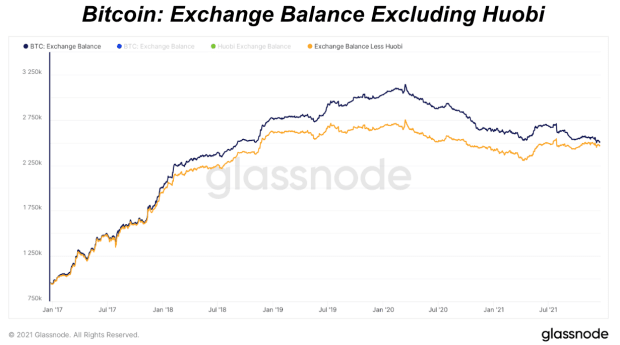

As we’ve noted in previous Daily Dives, one of the most interesting on-chain trends over the last two years is the secular shift in the trend of exchange balances. Since March 2020, total balances on exchanges have fallen by nearly 630,000 BTC, roughly a 20% decline. Typically bitcoin leaving exchanges is a bullish macro indicator for price and adoption, as now that bitcoin can’t be sold or exchanged on the market.

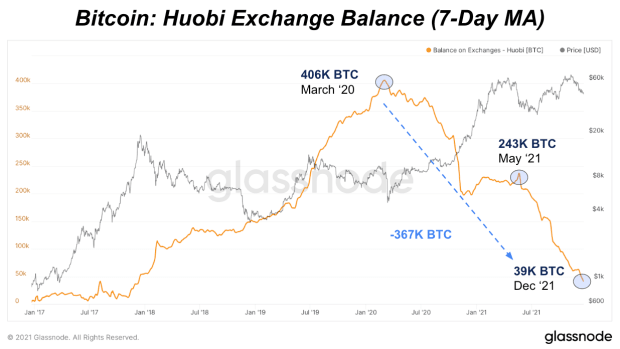

However, this is just a high-level view of all estimated exchange balances with trends differing by exchange and regions. With China’s latest crackdown on cryptocurrency exchanges, exchanges operating in mainland China had to stop offering services to users and remove all accounts.

As a result, a key driver of the falling exchange balance this year has come from Huobi, China’s top exchange. Since March 2020, Huobi’s exchange balance has fallen by 84% with exchange balances in a freefall over the last few months as Huobi shuts down China operations. This forces users to either sell their positions or withdraw their bitcoin and move it elsewhere.

As for quantifying the amount of selling pressure over the last month, there’s been an unprecedented amount when looking at Asia working hours.

As Huobi users move their bitcoin, especially the bitcoin used for derivatives, futures and short-term trading, we can expect some of that bitcoin to likely make its way to other exchanges.

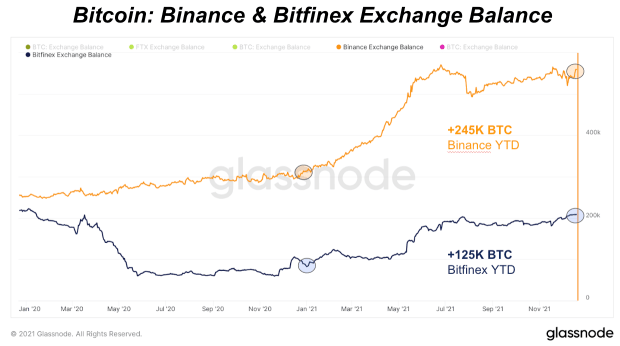

This year, exchanges across Binance, Bitfinex and FTX have seen their exchange balances significantly increase, with Binance and Bitfinex adding nearly 370,000 BTC to their platforms. These exchanges could be new homes for similar speculative short-term trading that has left Huobi.

In response to Chinese regulations, Binance announced in September that it would run checks to ensure mainland China users can only make withdrawals and announced it will discontinue any trading against the Chinese yuan on December 31.

All that said, the key macro narrative of bitcoin leaving exchanges and likely ending up in cold storage has still been consistent since March 2020. Without Huobi, exchange balances are still in a declining trend.