Huge Bitcoin Price Move Upcoming? This Indicator Almost Never Misses

Bitcoin’s price is often predicated on major volatile moves, both up and down. Recently, however, the price has been trading sideways for almost a month in a rather tight range, which could be a sign that a big move is coming soon. Considering the tightening Bollinger Bands, we could actually be in for a significant move sooner rather than later.

Bitcoin’s Current Sideways Action

The largest cryptocurrency by market cap has been trading within a fairly close range between $8,600 and $7,800 since the end of September. However, over the last 10 days, it has held relatively steady with a short movement upwards yesterday. History teaches us that when Bitcoin’s price remains in a close range for a significant period of time, a notable movement is to be expected.

Back in mid-September, Bitcoin was on a similar trajectory when it was trading around $10,300 for a while. As CryptoPotato reported, the subsequently price plunged by more than $2,000 in just a few days. It’s worth pointing out that there is another similarity between now and then – the Bollinger Bands.

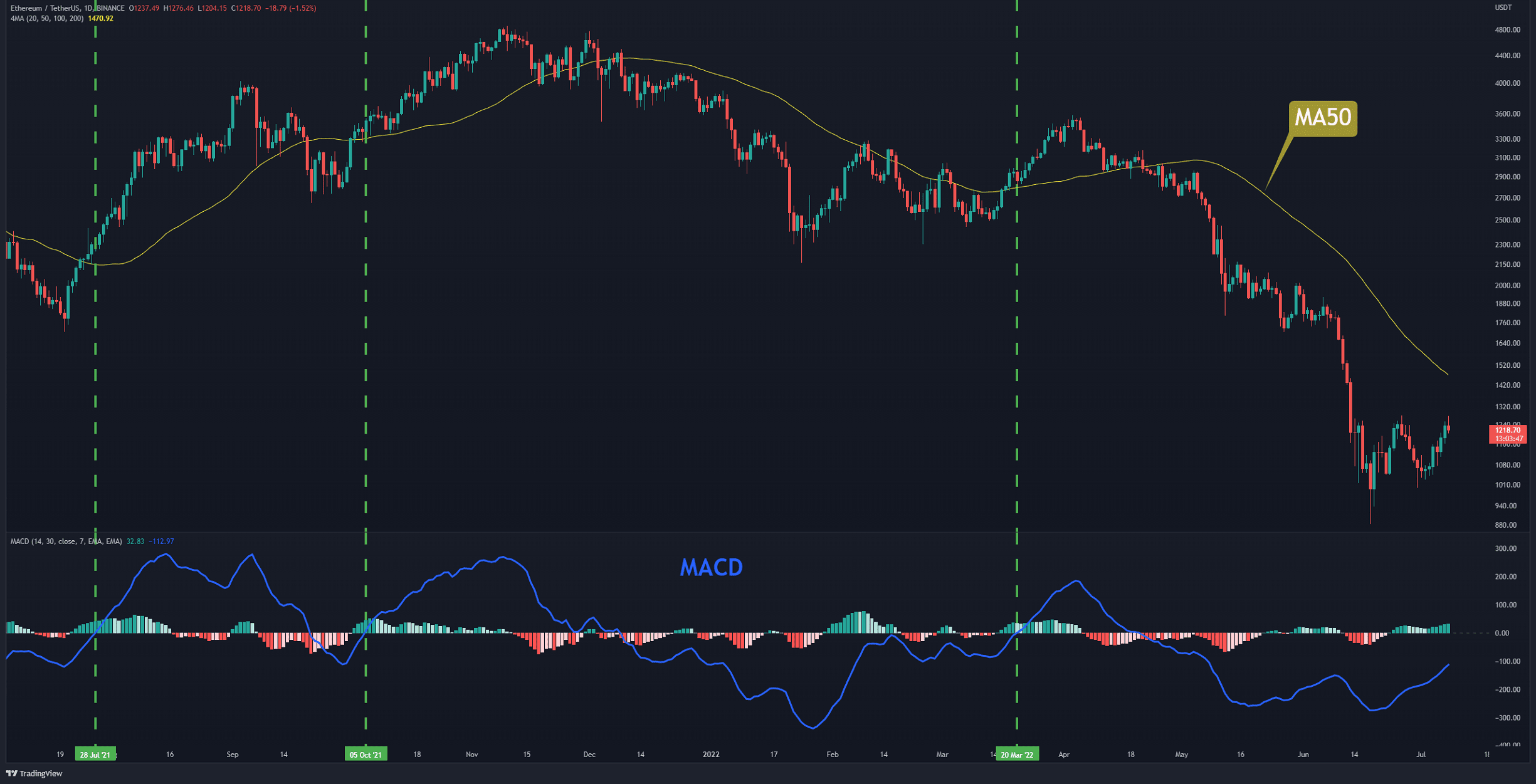

Bollinger Bands are an indicator based on a given asset’s standard deviation and moving average. While they don’t provide an exact prediction of where the price may be headed, the bands currently show that Bitcoin’s volatility has been decreasing and that we could be in for an expansion.

$BTC Bollinger Bands squeezing!

Note that narrowing bands do not provide any directional clues. They simply infer that volatility is contracting and should be prepared for a volatility expansion, which means a directional move.

Which way will it go?

Watch Out!! pic.twitter.com/xpbzpO0UFk

— Faisal Sohail ?️? (@oddgems) October 22, 2019

Bitcoin’s Current Situation

Bitcoin is worth $8,250 at the time of this writing with a total market capitalization of $148,513,000,000. The 24-hour trading volume has been declining after the monthly high of $21 billion was reached on the 10th of October, and it’s now at $16 billion. During September’s price plunge, the daily volume rose to $29 billion after holding steady under $15 billion for a few days.

Looking at the technical charts, Bitcoin’s nearest resistance lies at $8,300. The most interesting resistance level is located around $9,000, as it’s a psychological level and the location of the 200-day moving average line. If the bears come to town, additional resistance levels lie at $8,000 and $7,700, with the latter having been tested successfully a few times already this month.

Bitcoin’s total market dominance stands at 66.7% as of now, with a yearly low of 50% in March and a high of 71% in September.

It’s hard to say whether the price will go up or down from here, but if history and the Bollinger Bands are solid indicators, we can expect a serious move coming soon.

The post Huge Bitcoin Price Move Upcoming? This Indicator Almost Never Misses appeared first on CryptoPotato.