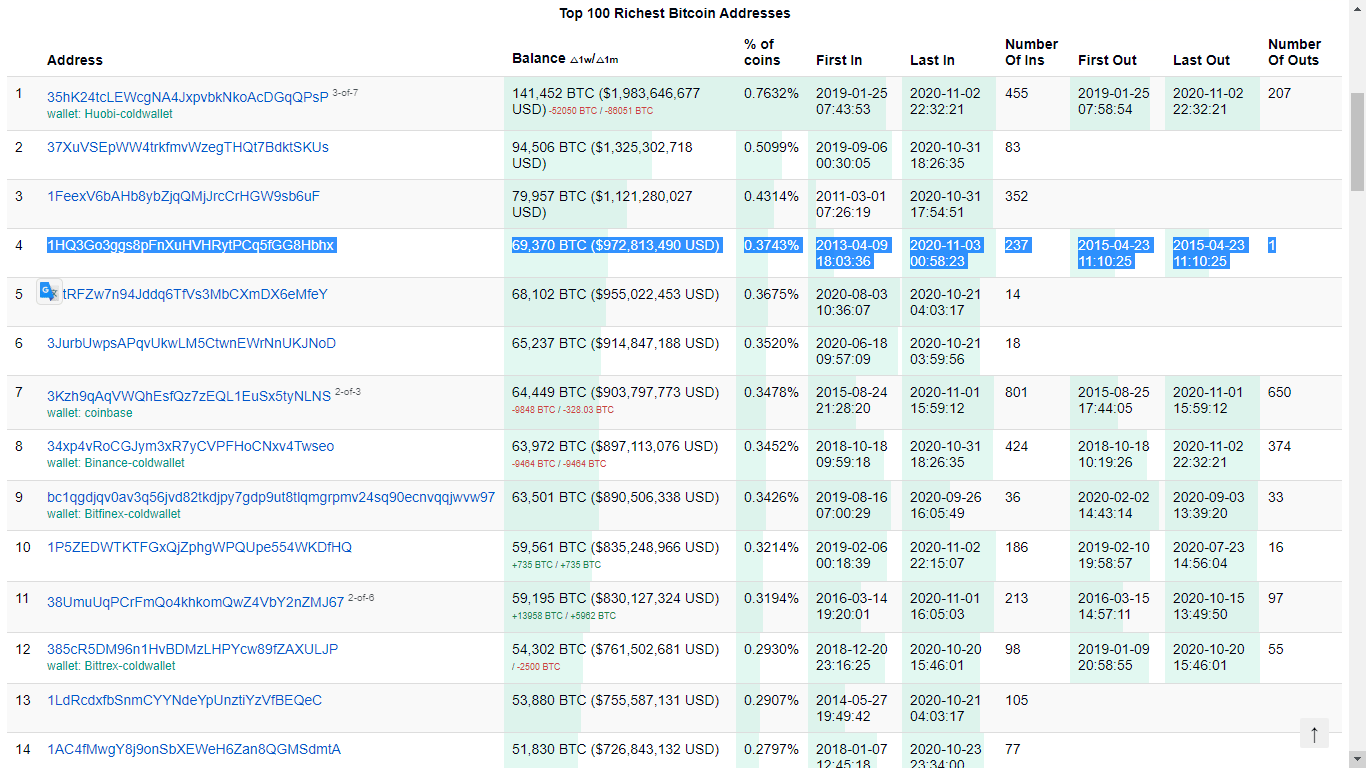

Huge $972 Million Bitcoin Transaction As The 4th Richest Wallet Emptied

One of the most famous Bitcoin wallets among hackers and treasure hunters in the crypto-verse is now empty. Someone moved over 69.369 BTC from a legacy wallet to a new native SegWit format address (a more modern format aimed at optimizing transactions by lowering their transaction fees).

Everything about the wallet is a mystery: Nobody knows who owns it, who moved the funds, or why. But the wallet was as mysterious as it was popular. It was the fourth richest Bitcoin wallet ever and it remained intact thanks to the magic of the cryptography that powers the Bitcoin blockchain.

The World’s Fourth Richest BTC wallet is Empty

The wallet was emptied on November 3, 2020. 69,369 bitcoin were moved from the BTC address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx to the address bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6. The 0.00087980 BTC fee says a lot about the advantage of using cryptocurrencies to move large amounts of money. At the time of this writing, the transaction was equivalent to $972 million.

In a little less than an hour, the mysterious wallet owner sent almost $1 billion, paying 12 bucks for the operation without anyone asking for KYC, AML, or any other complicated policy.

In the world of crypto, it is normal for users to lose or forget the keys to their Bitcoin wallets. Anything from damaged disks, corrupted zips to simple human errors have caused losses ranging from a few cents to several million dollars. That’s what makes custodial services attractive for amateurs.

But after the Bitcoin boom, more and more people have been looking for ways to access this potential source of free wealth. Some users go to hypnosis sessions to remember the password to that old Bitcoin wallet from 2010. Others trade the .dat files of dormant wallets with people willing to take a shot at cracking their content.

The Beautiful Dream of Hacking a Bitcoin Wallet

Cracking a Bitcoin wallet is highly improbable using brute force. Still, statistics have never prevented people from dreaming about winning the lottery, and statistics won’t make an uncrackable wallet any less attractive.

Surprising Fact about Bitcoin:

Bitcoin private keys are integers between 1 and 10^77

If you were able to make a trillion guesses per second, you’d have to guess for about 3.3 decillion (10^33) years to find the private key to a particular Bitcoin address.1/3 pic.twitter.com/jNvvEaTGlx

— Panama Crypto (@Panama_TJ) January 28, 2019

The wallet in question was actively traded among hackers, so there are two possible explanations:

- The realistic scenario: The owner of the wallet, aware of the activity around his treasure, decided to move his stash to a “safe harbor” and change wallets. This has happened previously with several wallets from the “Satoshi era” moving tokens after years of inactivity.

- The Hollywood scenario: Some lucky guy got access to the wallet. Maybe by brute force, possibly by a seed phrase entered by mistake (or perhaps by some quantum computer used in secret to decipher a secret key, if you are into tinfoil hats).

Both possibilities are surprising, but they indeed say a lot about the Bitcoin era. Being able to resist attacks for decades is a sign of time-tested security, and being able to move millions of dollars in minutes for very little money is a feature that can help Bitcoin gain even more value in the future.

For Alon Gal, CTO at cybercrime intelligence company Hudson Rock, the “Hollywood scenario” is to be taken seriously. There is a market for everything, even dormant wallets. The possibility of cracking the password of a .dat file —not the private key — of a certain wallet seems attractive as it could be easier in theory:

“Stealing Bitcoin wallets from victims worldwide is a common goal among cybercriminals. Wallets tend to be protected by strong passwords and in the event that a cybercriminal manages to obtain a wallet and cannot crack the password he might sell it to opportunistic hash crackers who are individuals with a large amount of GPU power,”

So there is the possibility that a hacker with access to the .dat file of the wallet somehow managed to crack its password, regaining access to the wallet and its private keys. Sounds crazy, but could happen:

UNBELIEVABLE – Someone was able to crack the password of the Bitcoin wallet I reported on only a short time ago and spend the $1,000,000,000 that was inside it!https://t.co/cEcdGcYzfI pic.twitter.com/XfBbkj1mHJ

— Alon Gal (Under the Breach) (@UnderTheBreach) November 3, 2020

It was either the person who cracked the password or the original owner who may have noticed the recent articles about his wallet being circulated among hackers.

The wallet was considered “dormant” since 2013.

Either way this is pretty interesting.

— Alon Gal (Under the Breach) (@UnderTheBreach) November 3, 2020

In any case, Whether it was a hacker or a concerned owner, traders can only pray for the tokens to remain safe on their new home without being dumped into the markets. It would be bad for bulls if someone sold one of the largest Bitcoin stashes in the world.