How Would Fed Tapering Affect The Bitcoin Market?

With the S&P 500 continuing to reach all-time highs almost daily, the talk of tapering by the Federal Reserve is rampant.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

With the S&P 500 continuing to reach all-time highs seemingly almost daily, with the last 5% correction occurring 10 months ago, talk has begun to reemerge from Federal Reserve officials to start tapering asset purchases programs. Robert Kaplan, president of the Dallas Fed, is proving to be among the loudest voices. The following are all tweets yesterday from Walter Bloomberg:

- KAPLAN SAYS FED HAS COMMUNICATED A TAPER IS COMING

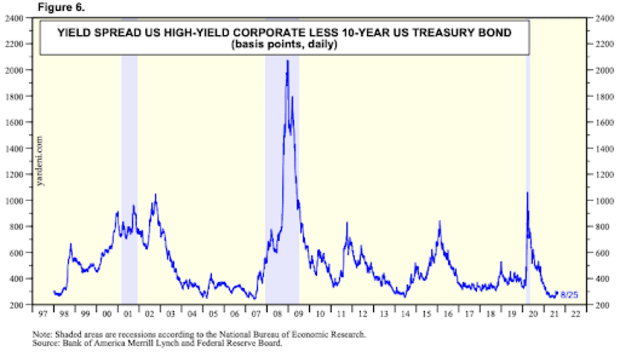

- KAPLAN SAYS CREDIT SPREADS ARE HISTORICALLY TIGHT

- FED’S KAPLAN SAYS THERE ARE SOME DISTORTIONS IN THE ECONOMY PARTICULARLY IN CREDIT MARKETS

In the spirit of the recent taper talk, we wanted to republish our thoughts on a Fed taper that we originally published back on May 29 of this year.

The Daily Dive #013 – The Fallacy Of Taper Talk

“The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment.”

In the Federal Reserve’s mandate, there are two stated goals for its monetary policy:

- Stable prices

- Maximum employment

With these two stated goals, the Fed is implicitly telling the market that any taper talk is complete nonsense, and here is why:

The entire economic system is built upon credit, and to maintain full employment and stable prices (i.e., “2% inflation targeting”), credit cannot be allowed to contract.

Let’s dig into some recent trends in the real estate market for context:

Median prices for single family homes have increased 14.6% year over year, fueled by record low mortgage rates over the last 18 months.