How Will Today’s Huge $7.7B Crypto Options Expiry Impact Markets?

Around 89,000 Bitcoin options contracts are due for expiry on Friday, Sept. 27. These BTC derivatives have a notional value of around $5.8 billion.

Today’s options expiry is a whopper due to the end of the month and the end of the third quarter, so it could impact spot markets, which have been on the up this week.

Crypto Options Expiry

This week’s massive batch of Bitcoin options contracts has a put/call ratio of 0.64, which means that there are considerably more long (call) contracts expiring than shorts (puts). The max pain point, or the price at which most losses will be made, is $59,000, around $6,000 below current spot prices.

Open interest, or the value or number of open options contracts yet to expire, is still high at the $70,000 strike price with $872 million there. Moreover, there is an additional $910 million in OI at $90,000 and over a billion dollars on OI at the $100,000 strike price, according to Deribit.

Crypto options tooling provider Greeks Live commented that the asset class has rallied strongly in the last three weeks, fueled by the Fed’s 50 basis point rate cut, “which has boosted market confidence immensely.” It predicted a bullish fourth quarter, citing several tailwinds for crypto markets.

“The third quarter is coming to an end, and judging from data from previous years, the fourth quarter is usually good, and with the US election and two rate cuts, there should be plenty of trading opportunities.”

Greeks added that this quarterly delivery brings “a large number of shifting positions and margin release,” with all major term implied volatility at low levels.

“With the end of quarterly delivery, IV still has downward pressure, the last two weeks will be a good opportunity to lay out the fourth quarter.”

27 Sep Options Data

89,000 BTC options are about to expire with a Put Call Ratio of 0.64, a Maxpain point of $59,000 and a notional value of $5.8 billion.

718,000 ETH options are about to expire with a Put Call Ratio of 0.47, a Maxpain point of $2,500 and a notional value of $1.9… pic.twitter.com/JWD30gCE5w— Greeks.live (@GreeksLive) September 27, 2024

Ethereum Options Expiry

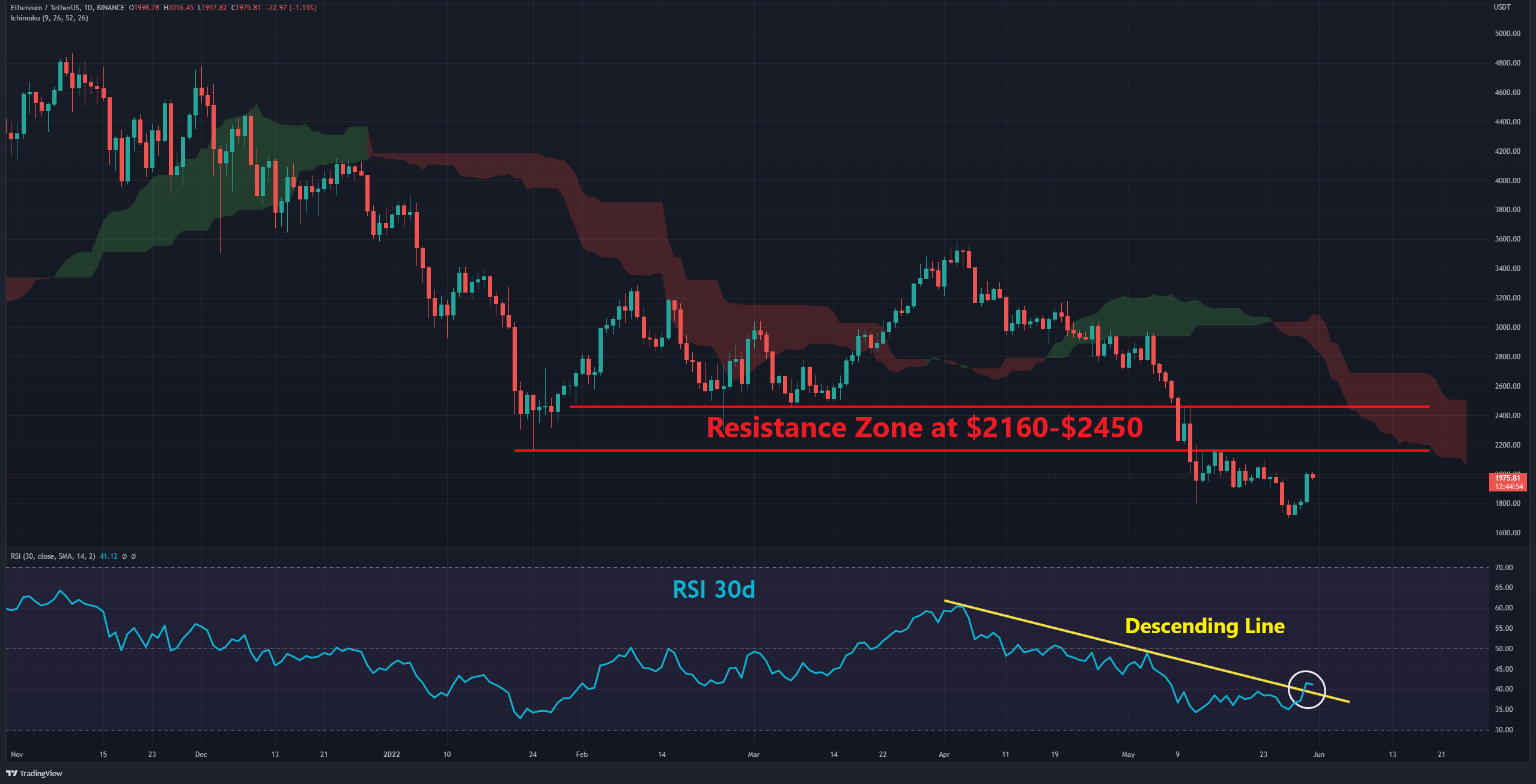

There are around 718,000 ETH options about to expire with a notional value of $1.9 billion. These derivatives have a put/call ratio of 0.47 and a max pain point of $2,500. This brings the total crypto options expiry event to $7.7 billion, the largest since the end of March.

Crypto markets have gained 1.4% on the day to reach $2.37 trillion in total capitalization, its highest level since early August.

Bitcoin topped $65,700 in a two-month high but retreated back to $65,300 during the Friday morning Asian trading session. Ethereum failed to break resistance above $2,650 and also fell back marginally at the time of writing.

The post How Will Today’s Huge $7.7B Crypto Options Expiry Impact Markets? appeared first on CryptoPotato.