How We Ranked CoinDesk’s Crypto Hubs 2023: Our Methodology

Ranking crypto hubs worldwide with some level of accuracy and credibility is fraught with challenges. We had basic questions like: What is the right geographic boundary (cities, states, countries)? What criteria should be used? What happens when data sources are hard to come by or only available for some of the cities/regions being evaluated?

Even which cities/regions should be considered is not always obvious.

As the editor and consultant to CoinDesk’s Crypto Hubs 2023, we aim to provide insights into the methodology and data sources we used to resolve these questions. We admit our list is far from perfect but we hope it helps advance the conversation regarding which places around the world are crypto hot spots.

Jeanhee Kim is senior editor for lists, rankings and special projects. She is a veteran journalist who launched the inaugural Forbes Asia “100 to Watch” in 2021. Early in her career she was a reporter on Money Magazine’s Best Places to Live. Boyd Cohen is CEO and co-founder of Iomob, which is building the Internet of Mobility network and WheelCoin Move2Earn to gamify green mobility. He produced the “Smartest Cities in the World” for Fast Company.

Step 1: Selecting Cities & Regions

The team first debated what should constitute a hub. Could it be a city, could it be an entire state or even a small country? In the end, we said yes to all as the reality is that depending on population density, tolerance for commuting and embedded connectivity across a geography, any of the above could constitute a crypto hub.

The next challenge was to create the initial sample of hubs we should collect data for. Both of us have worked professionally in the past on rankings that began with a sample of hundreds of metro areas. But our time and resources are not unlimited; we sought to shortcut the process by reaching out to dozens of crypto experts representing media, blockchain clubs, venture funds, founders of layer 1s, 2s and decentralized applications, players in DeFi, ReFi and more. We sought diversity wherever we could: race, gender, sexual orientation and nationality, at least. We asked these experts to independently respond to a survey to indicate five to 10 or more crypto hubs around the globe they felt deserved being considered for the ranking. We also asked them to explain in a sentence or two what each hub had to offer and how they would prioritize criteria to be used in the ranking.

After communicating with more than three dozen experts around the world we received 18 responses. We also harvested from published lists of the prior year and a half, including Decrypt’s Most Influential Crypto Cities in the World, Recap.io’s The Rise of Crypto Hubs and Quantilus’ The 10 Most Crypto Friendly Cities in the World. From those, we gleaned 38 hubs for possible inclusion in our initial sample. Finally, we winnowed down to the 25 that were identified by two or more of the sources. These 25 hubs became our initial sample. All of our subsequent data research would be focused on these hubs only.

Step 2: Identifying Criteria and Data Sources

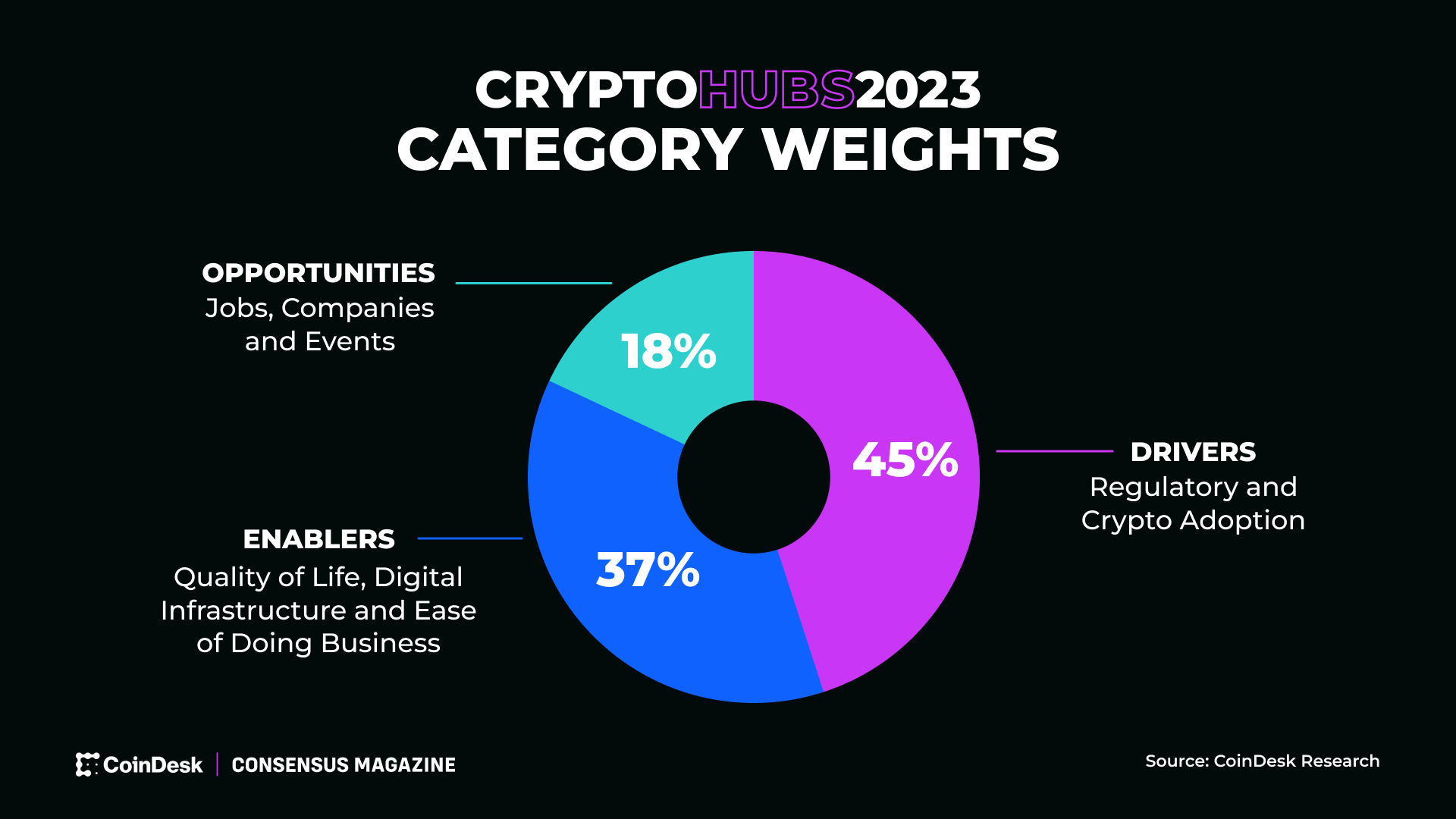

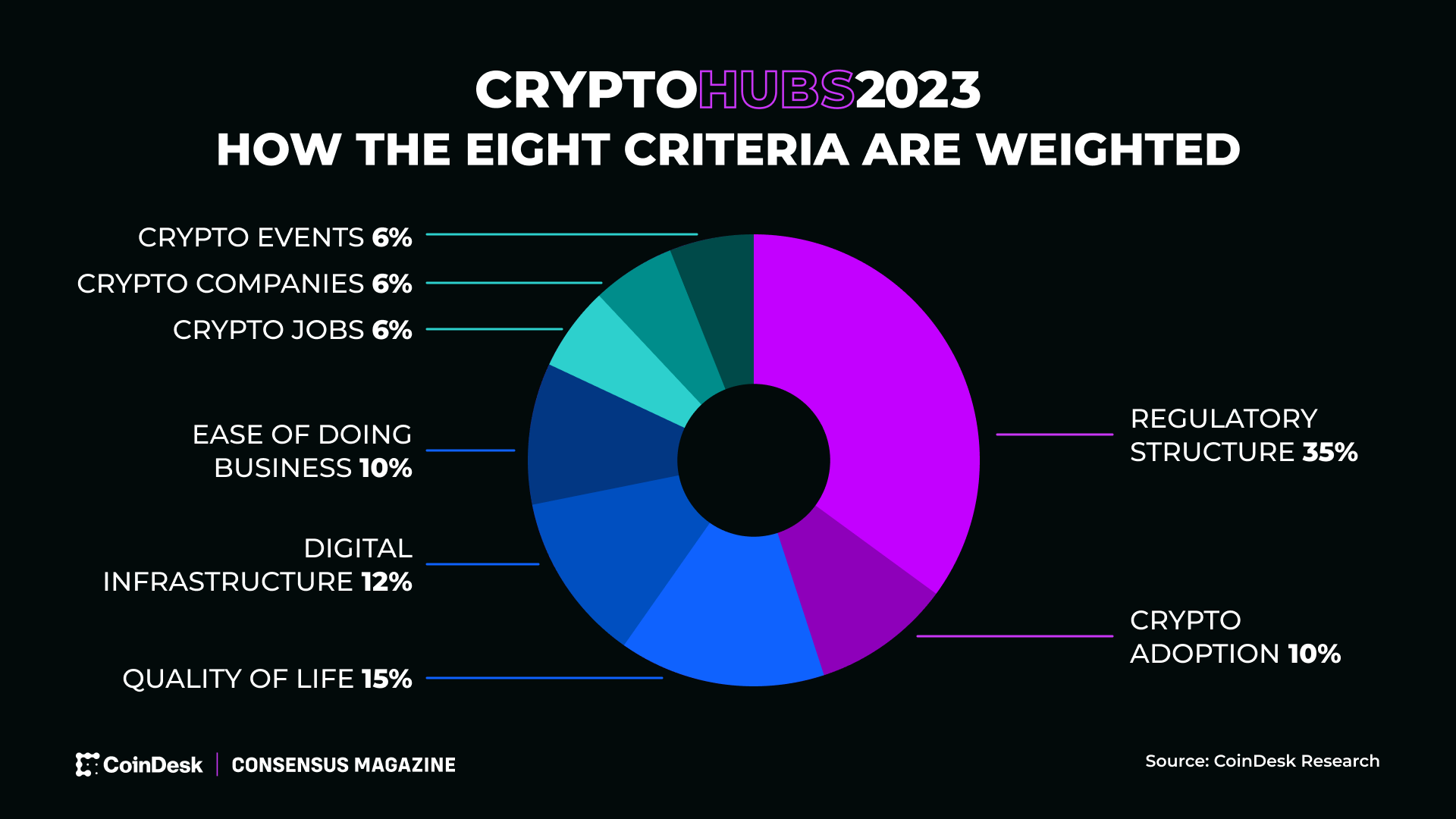

Next, the team reviewed the comments from the experts on the reasons they gave why certain hubs were among the top in the world. Looking at all factors we found, combined with what other previous crypto rankings had examined and our own internal discussions, we identified eight indicators across three primary categories: Drivers of Crypto Growth, Base Enablers and Crypto Network & Opportunities. Below we discuss the criteria and data sources in more depth.

For a hub to be a vibrant place for the crypto community it is reasonable to expect the governing bodies in the region to have created regulatory support for the industry and that there is popular support among residents to engage in crypto ownership and trading.

Crypto Regulation Perhaps the most widely discussed and debated topic in crypto is the state of the regulatory environment in jurisdictions around the globe. While places like Hong Kong, Dubai, the United Kingdom and Europe have made waves in recent months for their proactive attempt to create a regulatory environment conducive to successful crypto markets while also protecting retail users, the U.S. has been making headlines for the U.S. Security and Exchange Commission’s regulation-by-enforcement approach and lack of regulatory clarity.

We reviewed several solid attempts to create objective ratings of crypto regulation worldwide but each of them had a serious drawback for our purposes, whether it was lack of inclusion of a large number of our 25-hub initial sample, outdated results that did not factor in developments such as Dubai’s VARA or the European Union’s MiCA, or a lack of nuance in scoring (according to one source we examined, 24 of our 25 hubs had the same regulatory score).

We ultimately decided that no single source was sufficient, so we developed our own scoring system that leaned or borrowed from the PWC Global Crypto Regulation Report (published in Dec. 2022), Solidus Lab’s Global Crypto Regulation Index (published in Summer 2022) and discussions with consultants knowledgeable about newer developments in crypto regulation around the world. We landed on a five-point scoring system: a nation received full credit if it had national crypto regulation in place with an operating history of at least one full year. Hubs received lower credit for having national regulations in place less than a year, local regulations only, not recognizing crypto as money, or having no established regulations at all (regulations pending).

Crypto Adoption The annual Chainalysis Crypto Adoption Index aims to quantify the level of grassroots, retail adoption of crypto in 172 countries via three metrics: 1) on-chain crypto currency value received; 2) on-chain retail value transferred; and 3) peer-to-peer exchange trading volume.

Even a ranking of places to live and work in the tech industry must consider general factors such as quality of life, digital infrastructure (particularly having fast internet capability) and ease of doing business.

Quality of Life We chose Numbeo’s quality of life index as our source of data due to its approach of collecting data from expats around the world on key lifestyle metrics such as: Cost of living and purchasing power, pollution, crime, health care and traffic. Numbeo’s data allowed us to find an index number for nearly every hub on our list. And, when we could find no results for certain hubs, or the index number for a hub was based on scant data, we used Numbeo’s suggested next-closest site, or an average of two of them.

Digital Evolution Whether crypto professionals work remotely or in offices or co-working spaces, they increasingly rely on high-speed and reliable internet connectivity. Blockchain engineers, traders, designers and commercial crypto professionals all rely on a growing array of digital tools to participate in the protocols, exchanges, metaverse and dapps driving the crypto revolution.

To obtain a holistic assessment of how the prospective crypto hubs rate in these areas, we relied on the Digital Intelligence Index from Tufts University which collects 160 indicators to evaluate the vibrancy and ubiquity of the digital economy and infrastructure in the majority of countries around the world.

East of Doing Business Since 2005, the World Bank has been scoring and ranking 190 countries by how conducive the regulatory environment is for starting and operating a local business. The 10 criteria for its Ease of Doing Business index include getting a construction permit, registering property, getting credit, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

We wanted to gain a sense of the career and networking opportunities within each hub. So we leveraged data on jobs, companies and events with a focus on crypto in the region. We used the same source and applied the same search terms for each hub and completed all the searches within a single day, which allowed us consistency, but exposes our results to the risk that culture or language might skew the results for some of the hubs. For example, would LinkedIn be the app of choice for placing a job ad in non-English language hubs such as Ljubljana or South Korea? Finally, all of these indicators were converted to per-capita rates to provide more fairness regardless of population size.

Jobs We searched LinkedIn to source open jobs published in the target hub that mentioned the words “crypto,” “Web3” or “blockchain.” This gross number was then adjusted to a ratio based on population.

Companies Similar to jobs, we used LinkedIn to search for companies in the target hub area that mentioned the words “crypto,” “Web3” or “blockchain” in their description. This gross number was then adjusted to a ratio based on population.

Events We used Eventbrite and Meetup to capture the number of “crypto,” “blockchain” or “Web3” related events in each target hub. This gross number was then adjusted to a ratio based on population.

Step 3: Weighting the Categories and Indicators

The most controversial part of the ranking process is likely to be the choice of relative weights of each indicator. Clearly they are not all equal and some categories matter more than others. What makes it even more difficult is some experts we spoke with have substantially different views on what is most important when ranking crypto hubs.

We took the feedback from a range of expert opinions and did our best to develop a weighting system we felt was appropriate.

Drivers of Crypto Growth (Violet, 45% total weight)

This category is the most important for determining the strength of a crypto hub. It reflects openness and interest from both government and the people and is an indicator of the current and future growth of the crypto ecosystem in the hub.

The most heavily weighted criteria in our rubric, the regulatory score reflects the existence of laws on the books, what level of government the laws are in, and whether the laws allow crypto. What we were unable to measure is how effective the laws are and how well they are enforced, both of which would likely lead to different scores for all of our hubs. Enforcement of the laws could be a local quality that no global analysis could determine.

Chainalysis’ methodology of looking at retail adoption of crypto reflects a decentralized view of adoption and therefore is one of our favorite criteria in this project. Reassuringly, the 2022 index included all but one of the countries included in our 25-hub sample. We calculated an approximate 2022 index value for the missing UAE data using its relative placement in the 2021 index.

Base Enablers (Blue, 37% total weight)

This category and the weight we placed on the criteria may be among the most easy to challenge. We debated how heavily to weigh measures that had no connection or impact on crypto at all. But in the end, Crypto Hubs is a ranking of places to live and work, and fundamentally, qualities that reflect the ease or hardship of daily life and business had to be factored in.

A good quality of life is what attracts the creative class to move to a region. This Numbeo index is comprehensive and includes nearly every hub in our sample, but among the factors not included are the quality of schools or the natural beauty of a locale.

Digital infrastructure, especially a reliable network of broadband capabilities, is a must for a crypto-related ranking. While this index from Tufts University does an outstanding job, it was measured in 2020. Furthermore, it did not include the Caribbean or Latin America, which Tufts last measured in 2018. For these reasons, we put less weight than might seem necessary, and also note that in the global south people are overcoming digital divide challenges to become active crypto participants. Ultimately, when crypto is desired, the infrastructure limitations can be overcome.

Ease of Doing Business (10%)

The World Bank’s Ease of Doing Business ranking was last produced in 2020, from which we took our scores. Not only did the list include all of the countries included in our 25-hub sample, but it also gave a separate score for the U.S. territory of Puerto Rico. After the 2020 list was published, however, an investigation revealed that a handful of governments may have interfered with the objective reporting of their data, including the UAE. We did not penalize the UAE, but note that its ranking in the top 10% of all countries may not be an accurate reflection of its ease of doing business.

Crypto Opportunities (Green, 18% total weight)

These criteria were a way to get a sense of the vibrancy of the crypto ecosystem. However, many crypto professionals are digital nomads and the actual presence of crypto companies or crypto jobs within the physical borders of a hub is not important because they can work anywhere in the world.

We put the lightest weight on this criteria because it measured job ads on Linkedin that included the words “crypto,” “blockchain” or “Web3.” This is an indicator for actual jobs, but not a true measure. And LinkedIn, while global and searchable for all 25 places in our hub sample, could have lower utility in the non-English language hubs.

Since we used Linkedin to find crypto companies we were relying on self-reporting rather than an objective measure. LinkedIn, while global and searchable for all 25 of our hub sample, could have lower utility in the non-English language hubs.

While events may seem less important than jobs and companies, we gave it equal weight. If a crypto nomad lives in a city, they don’t care about companies and jobs as much as they care about opportunities to engage with other people from the local and global crypto community on a regular basis.

This is CoinDesk’s first attempt to rank global crypto hubs. We expect – and welcome – rigorous debate over our results and our methodology. The limitations of time, available data and our own resources were all factors at play in the choices we made. Our efforts were earnest and our decisions, we feel, were justifiable. That said, we are eager to hear from policy makers, crypto entrepreneurs, venture funds and the broader crypto ecosystem regarding the best places in the world to put down roots and engage in the crypto ecosystem.