How to Trade Crypto on BYDFi: A Complete Guide

Cryptocurrency trading is becoming more and more popular as the market matures and dives into the mainstream.

This is evident by the growing trading volume across the board over the past couple of years. The demand is increasing, and so new players emerge to attempt to provide a more streamlined user experience.

One such relatively new cryptocurrency exchange is BYDFi. The platform was launched in 2020 and is focused on delivering professional, convenient, and innovative cryptocurrency trading features.

From copy trading to derivatives trading, BYDFi offers a wide suite of options for both beginners and seasoned traders. The following is a complete overview and a guide on how to use the BYDFi exchange.

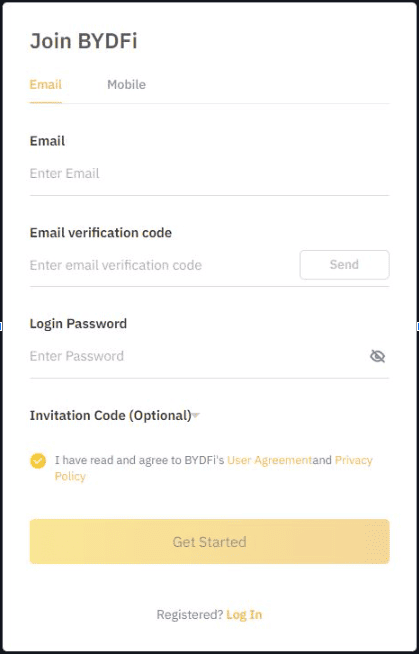

How to Register on BYDFi

Registering a new account on BYDFi is quite seamless. Once you go on the official website, you will find a button on the top right where you can register.

This is the screen that you will get:

Make sure to enter a valid email address because you will need to verify it through a code immediately in order to register. Also, keep in mind that it might take a few moments to receive the code itself. If you fail to get it the first time, you can always request a new code in a minute.

Once you have your account created, the first thing you should do is go through all possible security measures.

From the Account Security tab, hit the Manage button under the security center and go through all of the steps, which include:

- Phone number verification

- Email verification (this should already be done)

- Google Authenticator

- Fund password, and so forth

You can also create a withdrawal address whitelist for additional security and only use those when you want to take funds out of your BYDFi account.

- KYC on BYDFi

Technically, you can use the exchange without going through the Know Your Customer (KYC) procedure, but the limitations make it hard. If you want to strip these off, make sure to verify your identity – it’s a standard procedure that almost all legitimate exchanges require. It’s also relatively simple, and it’s just a few steps.

Once all of the above is done, you can start using the platform. Let’s first see how to deposit funds.

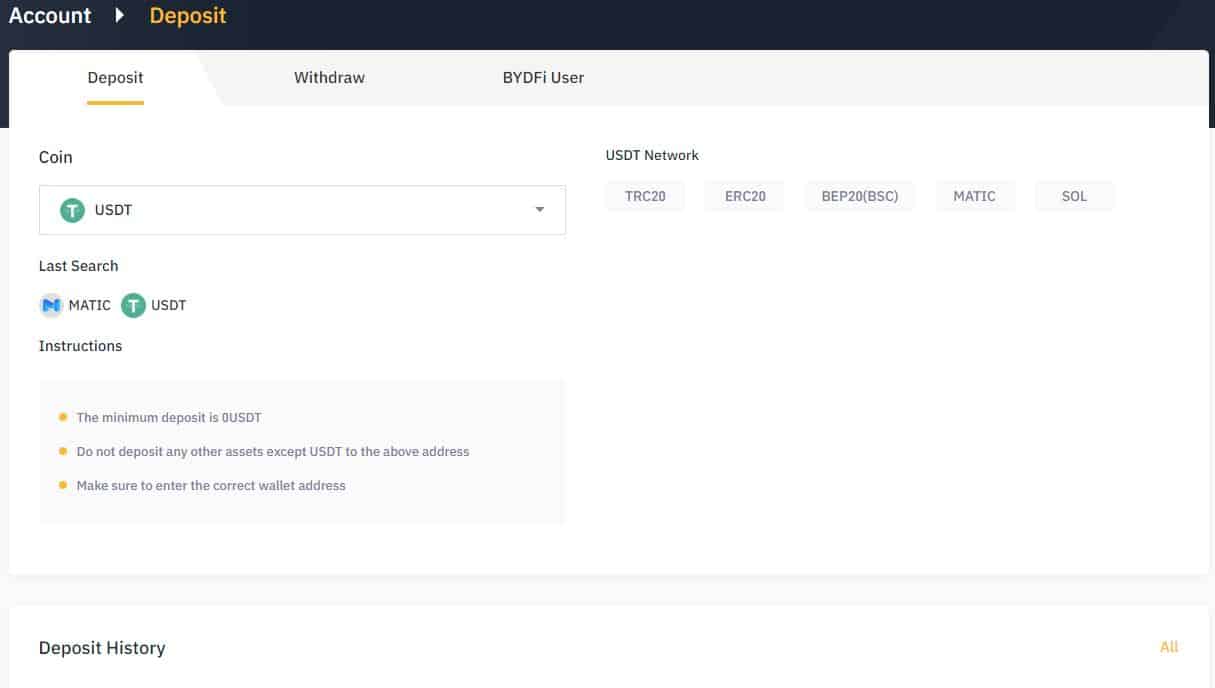

How to Deposit and Withdraw on BYDFi

If you’ve used any other cryptocurrency exchange before, you should have no issues with this particular step.

On the top navigation menu, you will find the Assets tab, and through the drop-down menu that you get after you hover over it, you should click on the Deposit button.

This is the screen that you will land on:

From here, all you need to do is select the network that you want to use. Once you click on it, the platform will automatically generate a respective deposit address that you can use to send funds to.

Note: always double-check the network you’re using. Sending funds through the wrong network or a wrong address can resolve in an irrecoverable loss of funds.

As you can see, there’s no minimum deposit. Network fees apply here.

Once you have funds deposited, you need to transfer them to your respective sub-accounts, depending on whether you want to use the spot exchange, the derivatives exchange, or other products:

Once you have this sorted, it’s time to start trading.

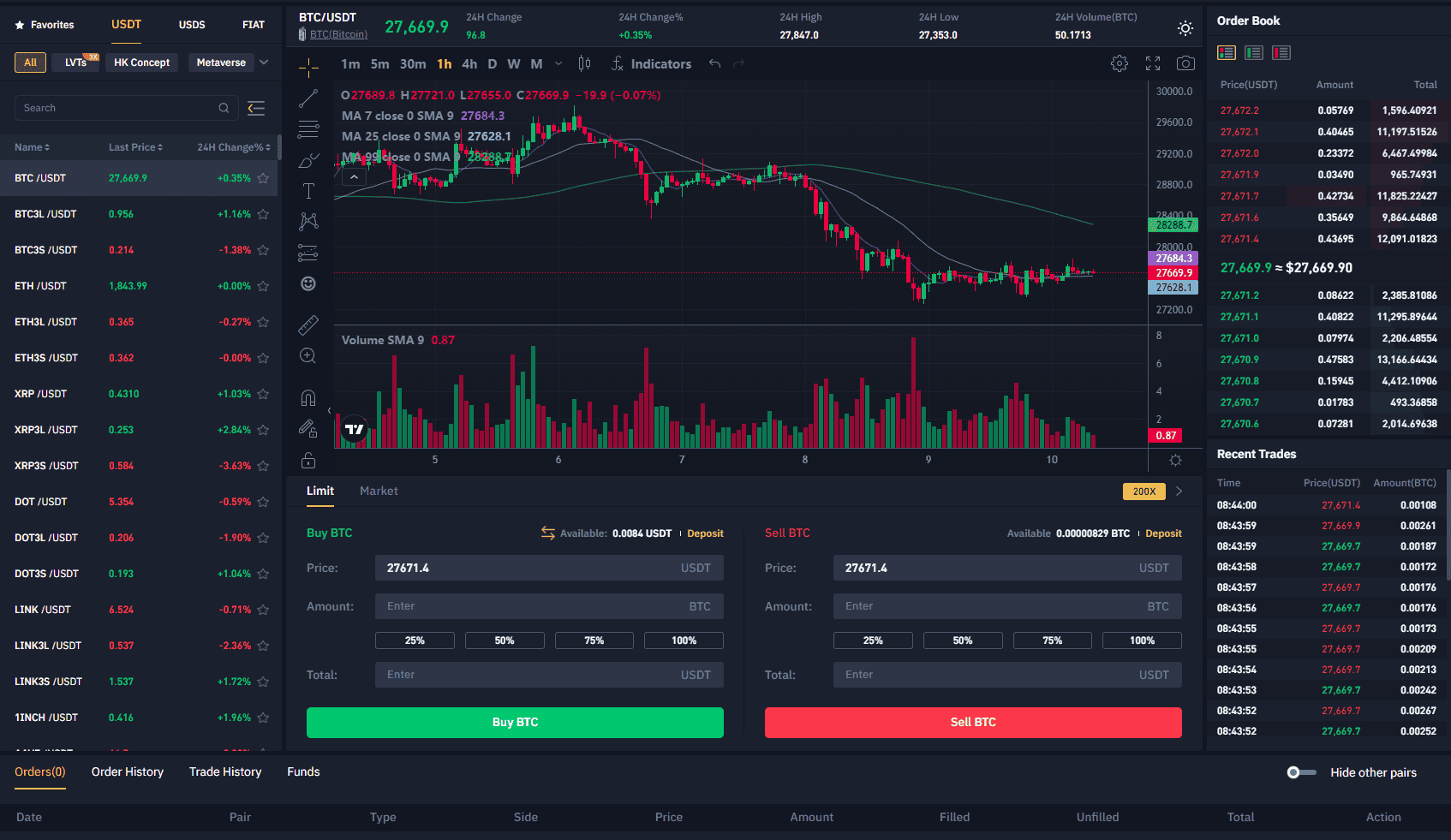

How to Trade on BYDFi (Spot)

First things first, we will go through the spot trading platform, and after that, we will look at the derivatives.

BYDFi has an advanced version of their spot trading platform, but we will stick to the classic as that’s what the majority of the users are likely familiar with and comfortable with. This is what the interface looks like:

As you can see, it’s pretty standard. On the left side, there’re the different cryptocurrencies that are available, in the middle, there’s the chart, as well as the order types, and on the right, there’s the order book.

BYDFi supports a range of different cryptocurrencies on its spot platform, such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Cardano (ADA)

- Polkadot (DOT), and many others.

There are two order types that you can use:

- Limit order – use this if you want to open a position at a specified price. This order is placed in the order book and executed as soon as the price reaches it, given there’s enough liquidity. Limit orders can be partially filled.

- Market order – use this order if you want to open a position immediately at the best available price from the order book.

How to Open a Position

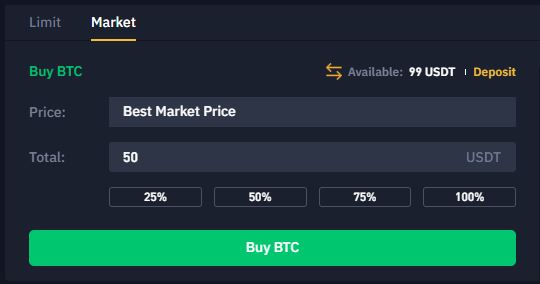

For the sake of this guide, we will open a position using a simple market order, and it looks like this:

As seen in the image, we want to buy BTC for 50 USDT. As soon as we hit the Buy BTC button, the order will be executed and we will have 50 USDT worth of BTC. At current prices, this got us exactly 0.0017 BTC.

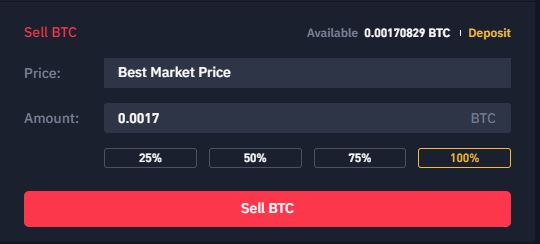

How to Close a Position

If you want to close your position in a spot exchange, all you have to do is sell your crypto (in this case – BTC). Again, we will use a simple market order to do so:

As mentioned above, the 50 USDT bought us 0.0017 BTC, and if we want to close the position, all we have to do is sell all of it. Please note that you can also partially close it and only sell a portion of your holdings.

That’s all there is to trading on the spot platform. Using the limit orders is also very simple, as the only difference is that you input a specified price, and you have to hope for the market to reach it and fill it.

Now, let’s see how to use the derivatives platform.

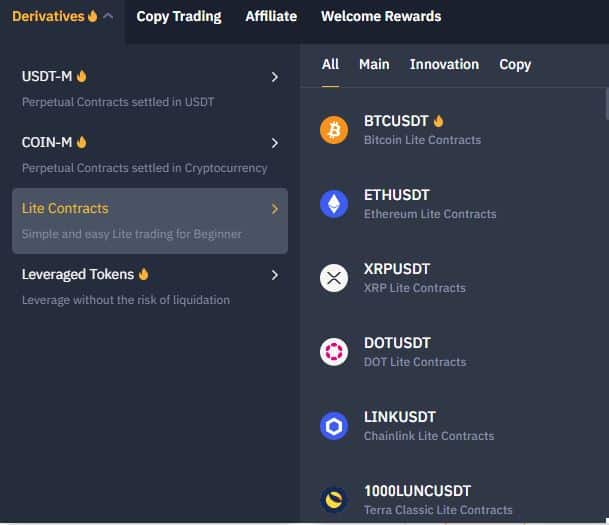

How to Trade on BYDFi (Derivatives)

As you will notice when hovering over the derivatives button on the main navigation menu, you get a few options:

USDT-M allows you to trade perpetual contracts denominated in USDT. COIN-M provides perpetual contracts settled in crypto, while lite contracts are simplified, and leveraged tokens provide other opportunities. In this guide, we will focus on the USDT-M option.

First, it’s important to note that a perpetual contract is a futures contract with no expiration or settlement date. This means you can buy and sell it whenever you want to, making it quite versatile.

Derivatives trading also enables the usage of leverage, making the entire thing a lot riskier. It carries a massive risk of capital loss, so it should only be practiced by experienced users. Using leverage of above 5x is extremely risky and should be practiced with heightened caution.

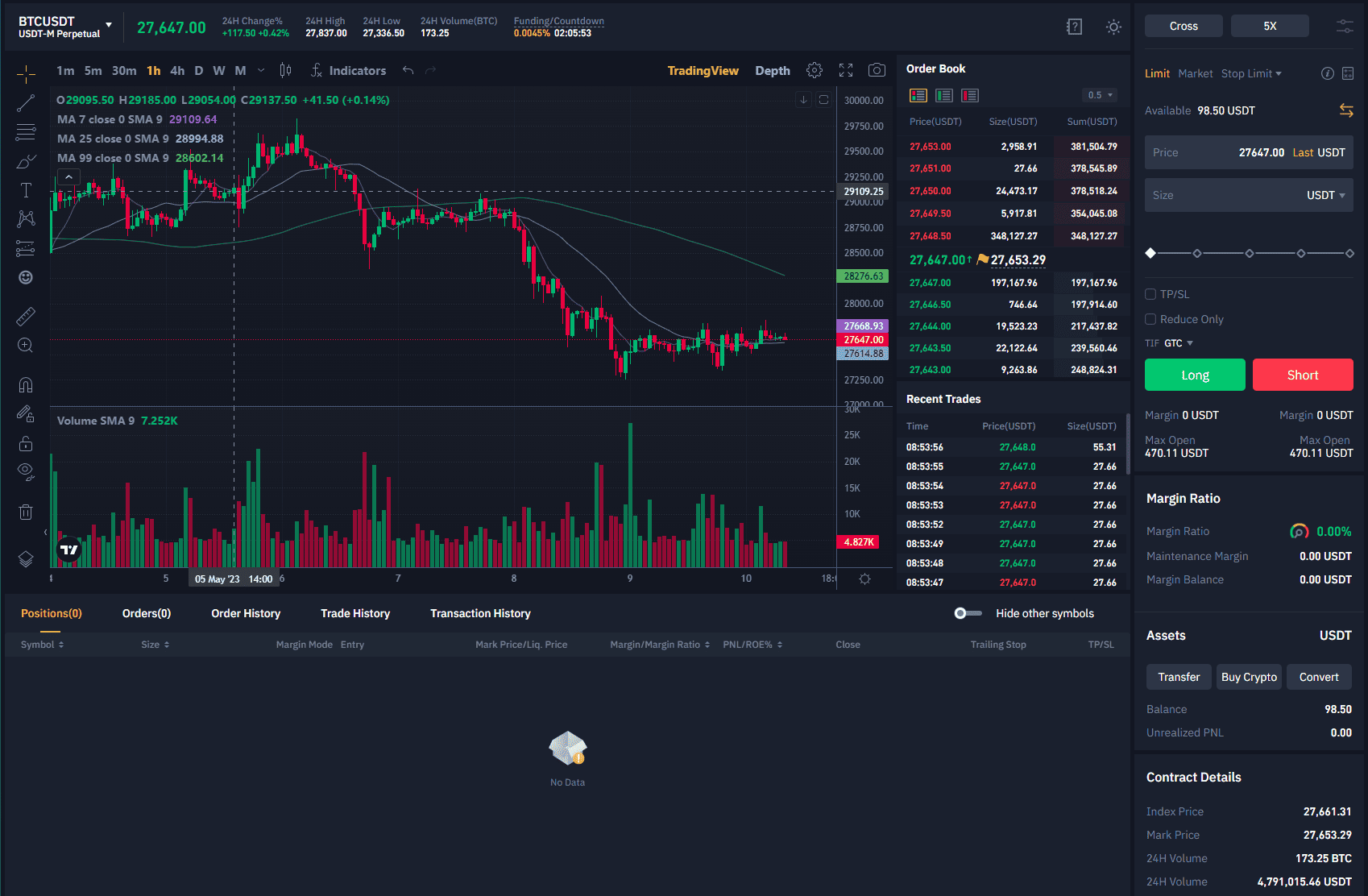

This is what the derivatives trading interface looks like:

As you can see, there are a few differences, particularly in the right part of the screen, where you’re now able to use more order types and adjust your leverage.

For their BTC trading pair, BYDFi has the option to use as much as 150x leverage, but we will only use 5x, for the reasons explained above.

The way leverage works is that it amplifies your position size by the factor of your leverage. So 5x means you open a 5 times greater position using the same capital. For example, you can use $10 to open a $50 position.

However, the catch is that if the price starts moving against you in a way that you lose your initial capital (also known as margin), you get liquidated. So, in the above example, if the price moves against you and you lose $10, your entire position will get liquidated. In the case of using 5x leverage, the price needs to move 20% against you. The higher the leverage, the lower this percentage and the more riskier your trade is.

How to Open a Position

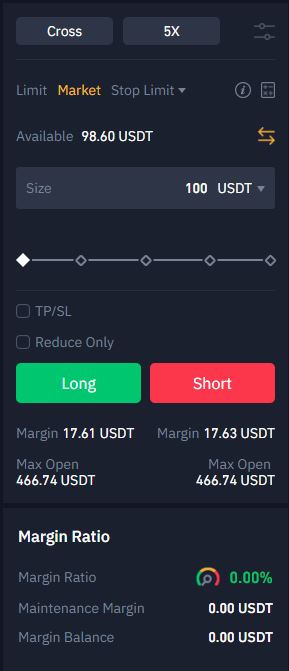

Following our previous example, we will use a simple market order to open a position:

As soon as we hit the Long button, we will be buying BTC worth 100 USDT but only postin 17.61 USDT as collateral because of the leverage that we use.

Please note that with derivatives, you can also bet on the price going down. To do so, you have to hit the red Short button, and your position will yield a profit if the price declines.

How to Close a Position

Right below the chart, you will find the tab where you can manage your positions:

Here, you can monitor your size, margin mode, entry price, liquidation price, margin ratio, as well as your PNL. To close your position, simply hit the market button on the side or place a limit order with the desired exit price.

Stop Loss/Take Profit Orders

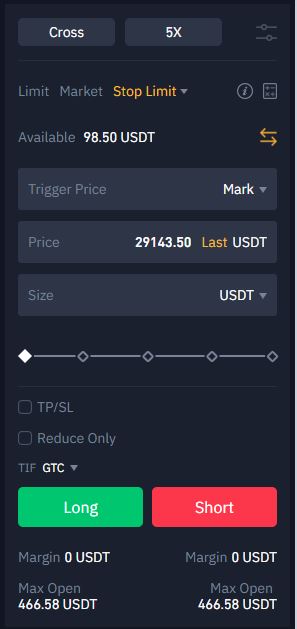

In addition to the above, you can also use a stop-loss or take-profit orders so that you don’t have to close your position manually. To do so, hit the stop limit button and select an order type.

The Stop Limit itself looks like this:

Copy Trading on BYDFi

Copy trading is a type of social trading where you will automatically follow the trades of other people. While this can be profitable, it’s important to keep close tabs on your positions and make sure to follow them closely because there are multiple factors that you have to account for.

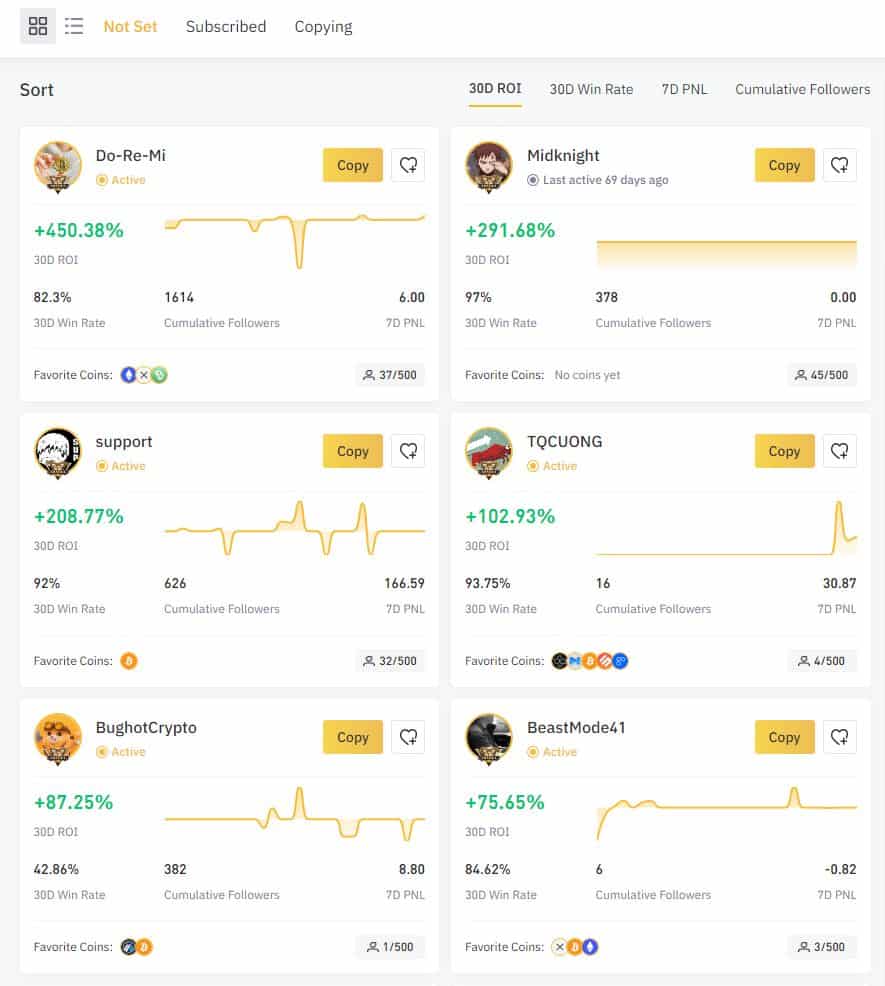

In any case, this is what the dashboard of the best-performing traders looks like:

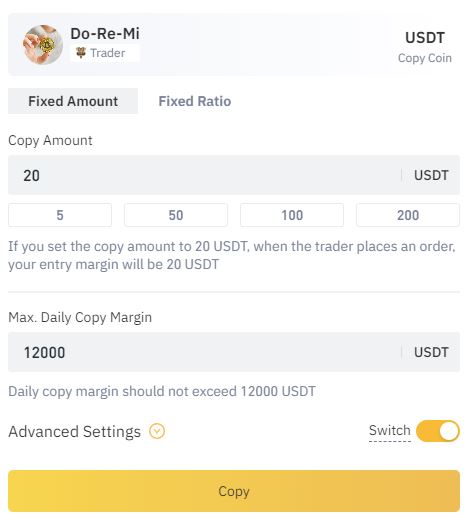

From here, if you want to copy someone, you have to hit the Copy button and input the specifications that most suit your trading style:

What are Fees on BYDFi

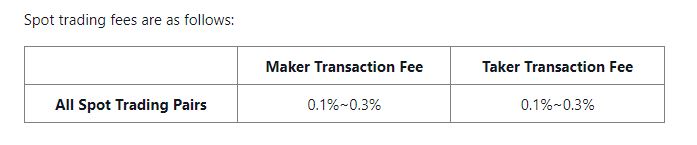

As with any other cryptocurrency exchange, there are fees associated with opening and closing positions.

According to the official page, this is how the spot trading fees are calculated:

For the derivatives, the fees differ based on the platform that you decide to use, so it’s highly advisable to take a look at the page and make sure you keep these in mind.

Security: Is BYDFi Safe?

There are no reports of BYDFi being compromised. The website provides a range of different security measures that users can implement to make sure that their account is protected.

Of course, there are always risks associated with keeping funds on any centralized exchange, so you should only keep what you use for trading.

BYDFi Customer Support

BYDFi has a live customer support service. To test it, we send a random inquiry, and after requesting to speak to a member of the team, someone contacted us almost immediately.

The responses were very quick and adequate, and the person helped us with the imaginary issue with the expected adequacy.

Conclusion

All in all, BYDFi seems like a comprehensive cryptocurrency exchange with a large suite of tools that some of its competitors fail to provide.

The exchange supports all the major trading pairs, and there’s no lack of choice.

Pros

- Multiple additional features for beginners and advanced traders

- Comprehensive and easy-to-use interface

- Very quick customer support

Cons

- There’s no phone customer support

- Liquidity is rather thin at the time of this review

The post How to Trade Crypto on BYDFi: A Complete Guide appeared first on CryptoPotato.