How to Prepare for the Next Bitcoin Bull Market: 10 Tips You Must Know

Bitcoin bull markets are typically categorized by tremendous price swings, and even though the direction is up, corrections also take place.

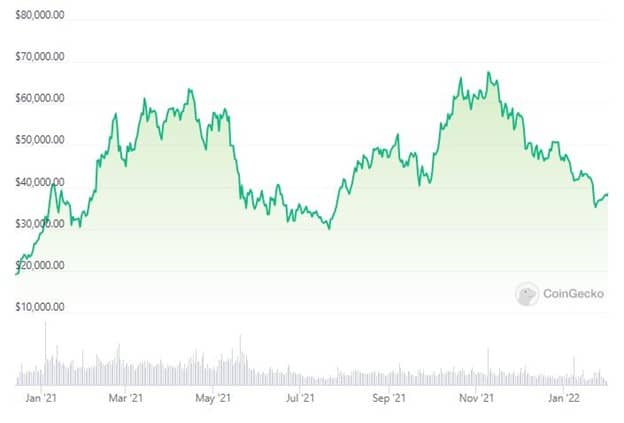

During the last Bitcoin bull market that took place in 2021, the BTC price reached an all-time high just shy of $70K. It started the year trading at around $20K, exploded above $60K on a couple of different occasions, retraced by almost 50% toward the middle of the year, and shot up once again to almost touch $70K in November.

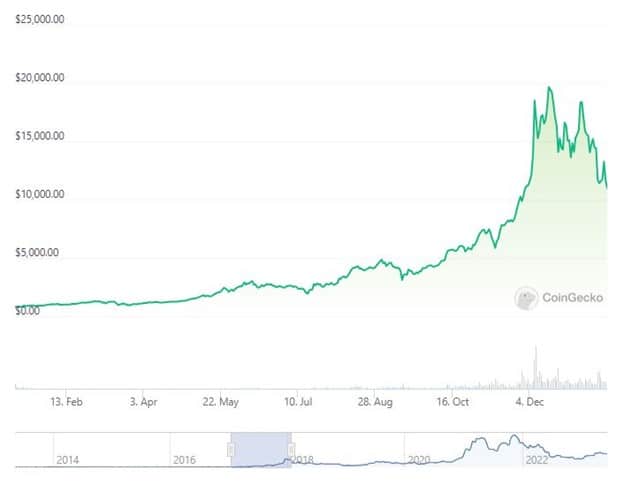

The previous bull market was back in 2017 and the beginning of 2018. Bitcoin had reached a high of around $20,000, but its chart looked a lot differently:

As you can see, each cycle has its own intricacies, and playing it correctly could make or break your bankroll. Riding an uptrend can be a lot more challenging than just holding on to your assets. There’s knowledge involved as to when is the right moment to sell or reposition yourself to bets preserve your gains.

The last thing you want is to be left holding a bag of an altcoin that’s down 99% since its all-time high and pray that it will go there once again.

With this in mind, we’ve prepared 10 tips that everyone should know, and they should help you to better navigate the next Bitcoin bull market.

10 Tips For the Next Bitcoin Bull Market

Educate Yourself

Regardless of what you invest in, gaining sound knowledge of its underlying merits is step number one in any investor’s playbook. You absolutely must know what you invest in, and the same goes for Bitcoin (or any altcoin, for that matter).

Familiarize yourself with Bitcoin’s fundamentals, such as its total limited supply, utility, and adoption rates.

You can also analyze historical price patterns, market cycles, and factors that tend to influence Bitcoin’s price. This knowledge will definitely help you make more informed decisions.

A great place to start learning more about the BTC fundamentals is our section called Bitcoin for Beginners. It contains a lot of helpful information, such as who created Bitcoin, who is eligible to create an account, how to store Bitcoin, is it safe, and much more.

Research and Analyze

Once you have the fundamentals down, it’s important to stay informed about both Bitcoin and the broader cryptocurrency market. Think about it this way – if you’re investing in land, you will undoubtedly analyze the factors that could impact it. These include the condition of the land, what you can grow on it, but also – who your neighbors are, the general area where it’s located, and so forth.

The same goes for investing in Bitcoin. You should stay informed about what’s going on in the market. You can read books, follow reputable news sources, join online communities, and in general – do a ton of other things that will help you learn about the technology.

In turn, this will help you anticipate market trends and potential catalysts, which can maximize the return on your investment in Bitcoin.

Define Your Investment Goals

What are your plans for the money invested in Bitcoin? When do you want to cash out? Can you afford to lose it?

Determining your investment objectives is paramount because it will also impact other important decisions, such as how much risk you’re willing to tolerate and the time horizon.

Despite being the largest and, supposedly, most secure cryptocurrency, it’s still considered very risky relative to investments in traditional finance. Please refer to the charts above – the BTC price went on to gain 300% and then lost 50% of it in a matter of less than six months. This tumultuous performance can be hard to stomach, so being aware of it in advance and being able to tolerate it is something you should consider.

Develop an Investment Strategy

Once you have the above all clear, you should be more or less ready to develop an overall investment strategy.

There are multiple ways to invest in Bitcoin. One of the more popular strategies is the so-called Dollar Cost Average (DCA).

We have a dedicated guide and a video explainer of DCA that you can find here. In general, though, it represents a way to buy Bitcoin in similar increments over a similar period of time. For example – you can buy $100 in BTC every month. The benefits of it are that over a long-enough time period, you get the best average price.

There are also other strategies to invest in Bitcoin. For instance, the so-called value averaging suggests adjusting your investment amounts based on market performance. E.g., you can buy more Bitcoin when there’s a bigger dip.

In all cases, you must set guidelines for when to buy, hold, or sell BTC based on your own risk appetite and analysis.

Set a Budget

Now that you know how you will invest in Bitcoin, the next step is to set your budget – how much do you want to spend?

This is incredibly personal and depends entirely on your current and projected financial situation. Setting up a budget and sticking to it will help you better track your investment and also manage your risk tolerance.

The most important takeaway here, however, that is specific to investing in Bitcoin for the next bull market is to understand that BTC is a risky purchase. That said, you should never invest more than what you can afford to lose without significantly impacting your overall financial stability.

Secure Your Investments

Crypto scams and hacks happen regularly. Not only that – what were generally considered reliable firms (such as FTX and Celsius) have failed and left investors empty-handed and in search of reparations.

Here is a breakdown of the industry’s most shocking events. You’ll surely notice that some of them are related to platforms being hacked or having failed.

Make sure to use reputable cryptocurrency exchanges or platforms to buy Bitcoin. Once you’ve bought, make sure to move your stash off-chain and keep it in a hardware wallet.

9 Tips for Securing Your Bitcoin and Crypto Wallets You Must Follow

Diversify Your Portfolio

As you might have probably noticed, Bitcoin bull runs also result in a massive expansion of the broader market capitalization. For reference, it reached over $3 trillion in 2021.

This means that other cryptocurrencies are also benefitting from the Bitcoin price increase.

It’s worth considering having your investment diversified by including other promising cryptocurrencies or even blockchain-related assets. Keep in mind, though, that if Bitcoin is volatile and risky, other cryptocurrencies are even more volatile and risky.

However, a properly diversified portfolio can spread your risk and even capture additional opportunities.

Practice Risk Management

The crux of this guide is to help you practice better risk management. The cryptocurrency market is one that’s characterized by volatility, and it is very easy to get caught up in traders posting tremendous ROI screenshots. Approach these with tremendous caution.

There will always be missed opportunities, no matter how much time and effort you spend or how well-educated you are. However, there will also be new opportunities. Do not FOMO, do not panic sell, and do not let your emotions get the better of you.

Employ a risk-management strategy and stick to it. Determine your exit strategies, use stop-loss orders (if it’s a shorter-term leveraged investment) to limit your potential losses, and make sure you follow your rules.

Stay Disciplined

Staying disciplined is just as important as making the decision to invest in Bitcoin. It’s important to remain committed to your strategy and not be swayed by any type of short-term market hype or the fear of missing out (FOMO).

Remember that emotional decisions probably result in impulsive actions and most commonly lead to potential losses.

Stay Informed and Adapt

Remain involved in the industry, at least to some extent. Keep up with the latest news, market trends, and regulatory developments in the broader cryptocurrency space.

Make sure to adapt your strategy, if it’s necessary, based on new information or changes in the broader market landscape.

Conclusion

Investing in Bitcoin should be regarded as investing in multiple other asset classes, but it has its intricacies and specifics. The sheer volatility of the BTC price makes it a lot tougher to stomach overnight swings in your portfolio, but if you have your sight set on the bigger picture, these become easier to go through.

One sign that you’re overinvested is that you’re constantly on your phone, checking the prices every hour.

If done correctly, investing in Bitcoin can be stress-free, and all of the above tips are aimed at exactly that.

The post How to Prepare for the Next Bitcoin Bull Market: 10 Tips You Must Know appeared first on CryptoPotato.