Tracking your cryptocurrency portfolio isn’t exactly a walk in the park. If you’re anything like the average token-holder, you’re likely to use multiple exchanges and wallets while transacting several different currencies.

Bitcoin might be your favorite, but you’ve probably got some dubious altcoins to your name too, which makes reporting your crypto taxes at the end of the financial year even more of a head-scratcher.

Why You Need to Take Crypto Tax Seriously

If you’ve failed to maintain accurate records every step of the way faithfully, you’ll have to work backward, laboriously wading through your transaction history and calculating the tax on your gains and losses. The alternative? Keeping quiet and hoping to stay off the radar.

If you’ve been keeping abreast of the news of late, you’ll be aware that this latter course of action is becoming ever more difficult and is not advisable. For example, the IRS has started adding a question to their 1040 forms: “At any time during the year, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?” That doesn’t leave much wiggle room for an ambiguous answer.

It’s not just the IRS: governments throughout the world have realized that citizens might owe significant sums based on their trading activity, and they are tightening enforcement as a result. In the UK, a special Cryptoassets Taskforce has been created and, following the lead of the IRS, letters were dispatched to significant crypto exchanges last year demanding the names of UK-based investors. Tax authorities in Denmark and Australia have also drafted warning letters to suspected tax evaders, urging them to get their house in order – or face the consequences.

This might all sound like a witch hunt but it should be taken seriously: especially as tax bodies have started employing sophisticated technology to track bitcoin and other crypto transactions covertly.

Even if your government has yet to crack the whip, it’s high time you got into the habit of maintaining detailed records of all your digital transactions. In practical terms, this means you should routinely calculate the value of the cryptocurrency in question when you acquire it and again when you trade, sell or convert directly into fiat.

Keep a log of all trades, complete with dates, values, and calculation methods, and be prepared to “open the books” when the taxman comes calling. This is all the more vital if you mine or trade virtual currencies as part of your business, whereupon profits will be liable to income tax.

If the very thought of painstakingly maintaining such records opens a valve in your body from which your soul slowly escapes, perhaps you should consider using dedicated crypto tax software. Nobody wants to surrender their soul, after all – especially not to tax officers.

How to Simplify Tax Calculations

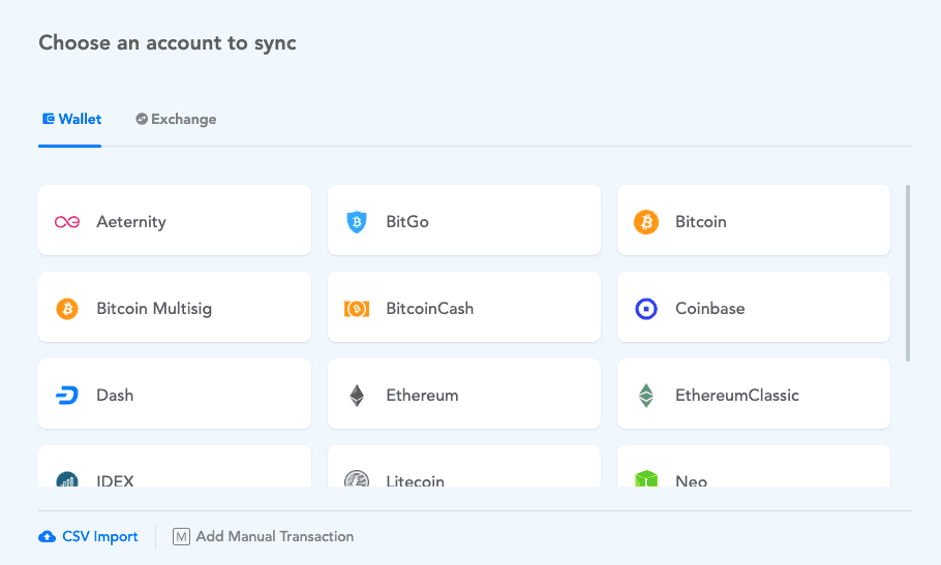

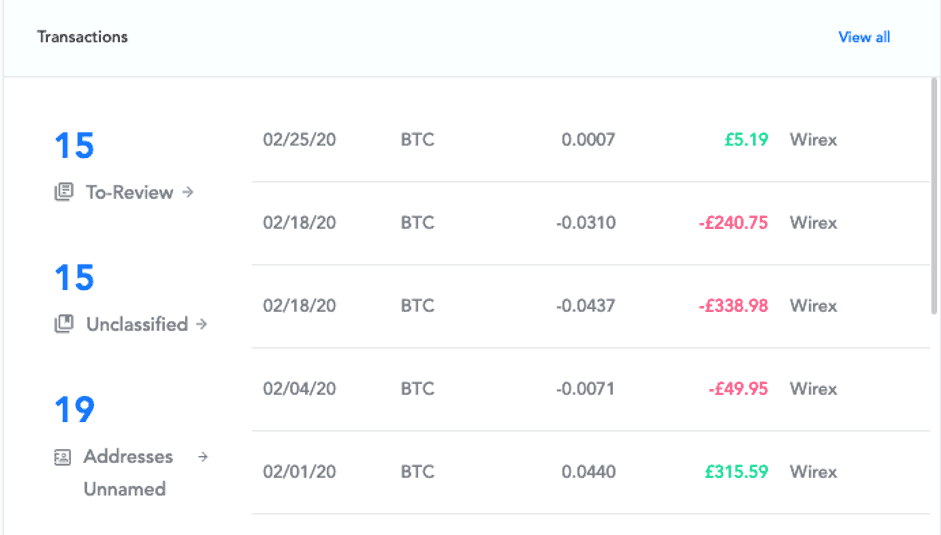

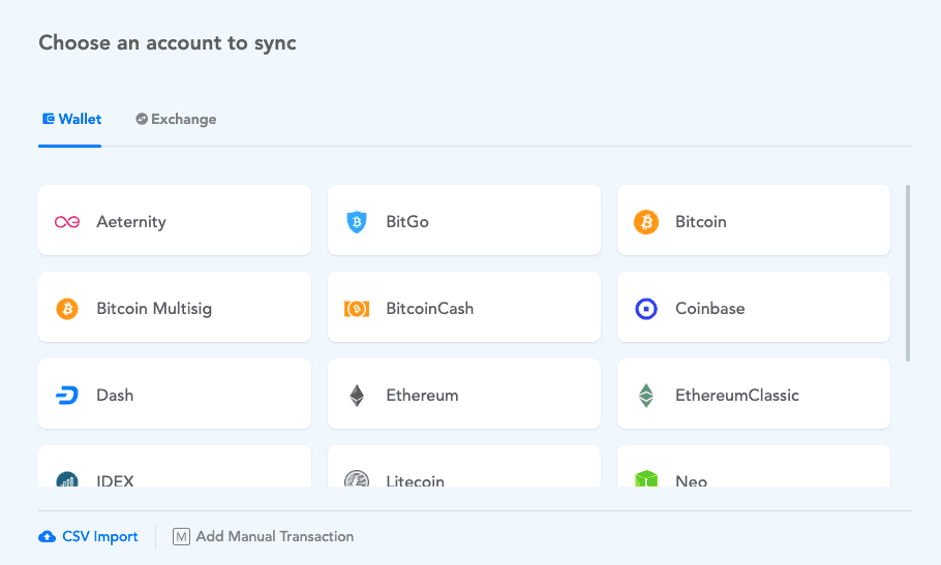

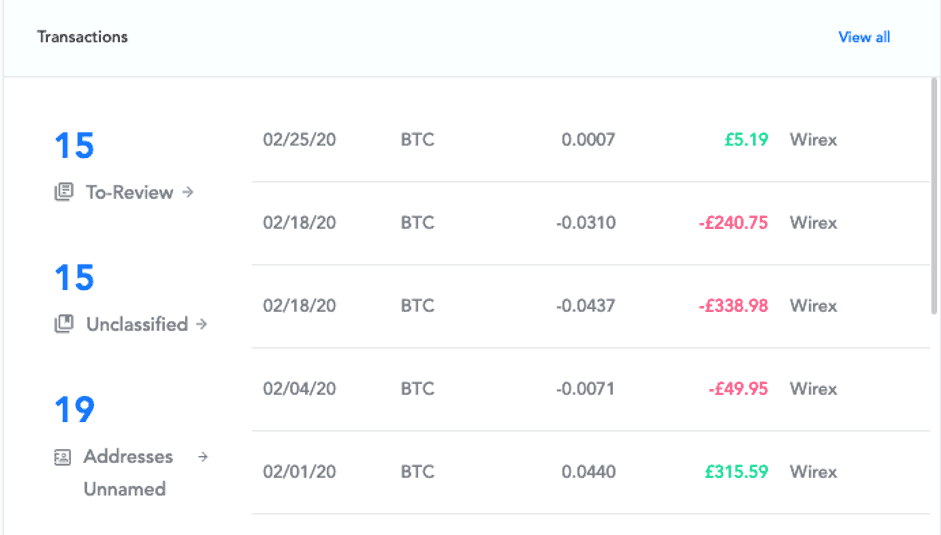

Blox is a popular option for crypto tax reporting. By linking exchange accounts and public wallet addresses, Blox fetches users’ complete historical records in real-time, enabling them to obtain a comprehensive capital gains report in a fraction of the time it would otherwise take.

The platform’s data synchronization makes it a viable automation tool for individual investors as well as miners, crypto funds, and accountants serving clients operating in the cryptosphere. Blox is currently leveraged by leading industry platforms such as eToro, Nexo, Zilliqa, 0X, Paxful, and Decentraland.

If you want to calculate bitcoin tax, simply link your bitcoin wallet(s) and let Blox do its thing. It’s just as easy to link exchange, whether you’ve used Binance, Bitfinex, Bittrex, Gemini, Coinbase, Huobi, or one of the other major players – and you can add manual transactions as necessary. After linking all addresses and wallets, you can review your portfolio from the user-friendly dashboard and export the financial data into a CSV file for reporting purposes.

One of the great things about this portfolio tracking tool is the level of support: Blox employs over 30 employees in four offices, and there is an excellent Knowledge Base on their website that provides plenty of guidance if you get stuck.

It would be downright foolhardy to manually manage your crypto tax when slick tools are available, akin to catching fish by hand instead of using a rod. Automate the process and save yourself a headache.

Enjoy reading? Please share:

The post How to Manage Your Bitcoin and Crypto Taxes In 2020 appeared first on CryptoPotato.