How Money Printing Really Works

A Short Introduction To What Influences Money Supply In The Modern Economy

It’s undeniable — the world runs on money. This thought is ingrained in all of us and we all understand it deeply. This is evident by the fact that we spend vast amount of hours every day in order to attain more of it.

In the Bitcoin space, we constantly see news, memes and critiques about how the central banks have printed absurd amounts of money yet again. The truth of the matter is that the monetary system does not work quite as simply as that — there are many more players involved that ultimately decide the net amount of new money creation in the world.

This system impacts our lives greatly — from things like interest rates on our savings accounts, mortgages, inflation and asset prices to global problems like the growing wealth inequality gap. Despite the significance, few understand how this system works. We are not taught about it in school.

In this piece, we will examine credit in depth. After the article, you will better understand why it is the cornerstone of our modern economy and how it is the main driver of money creation and be able to inspect the tools that central banks use to control credit.

Transactions

To understand how money is made, we first need to understand how it’s spent.

We all know what a transaction is — the spending of money for something else , be it a service, a good, an asset or whatever else.

The economy is the sum of all of the transactions in all of its markets.

The economy is the sum of all the transactions in all of its markets.

With that, we can say that money is the basis of each transaction and therefore the basis of the economy.

In order to facilitate a transaction, a person has to spend their hard-earned money for something. Deceptively simple, a transaction is the critical building block of the whole worldwide economic machine.

Because the economy is the sum of all of the transactions and a transaction is driven by a person willing to spend money in exchange for something, we can say that the economy is driven by the spending of people.

The key observation here is that this spent money becomes another person’s gained money.

Think about it — every dollar you earn is a dollar somebody else spent. One person’s spending is another person’s income.

One person’s spending is another person’s income.

This is the basis of an exchange. Everything we do professionally is always building/giving something that gets exchanged for money.

Money

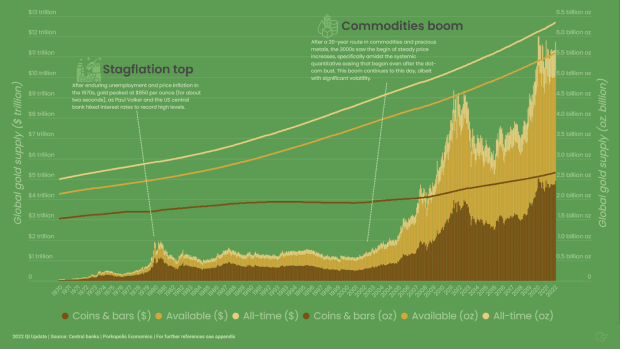

Money is a human invention which has a long, long history. All sorts of things have served as money before — barter, shells, gold coins — and it has continued to change its definition to become things like paper money, digital money and bitcoin.

Disregarding the past and the future, let’s focus on money as what it is most conventionally thought of as nowadays: dollar bills.

This is what people imagine money as, even if in a digital form.

But that’s not entirely correct. Most of what people call money nowadays is actually credit — a sort of temporary money that must eventually be returned to the lender (typically a bank).

Most money nowadays is actually credit.

That’s right. Most money in the economy is actually temporary in its nature.

One must look no further than the official figures to confirm — the total amount of credit in the U.S. is $80 trillion, whereas the total amount of money is around $19 trillion. That’s close to a ratio of 1:4.2 — i.e., there is at least one permanent dollar for every 4.2 temporary dollars.

Note: That number is a lower bound, as it is hard to identify what part of the $19 trillion in M2 money supply is credit and what is not.

Credit

Credit is the biggest, most important and most volatile part of the economy. It is the act of borrowing money which you promise to repay in the future.

There are two terms to describe this interplay of borrowing: credit and debt.

Once credit is created, it is turned into debt.

credit (Middle French for belief, trust) — the act of a borrower taking a loan from a lender.

debt — the money owed (i.e., the liability) of the borrower once he has taken out credit.

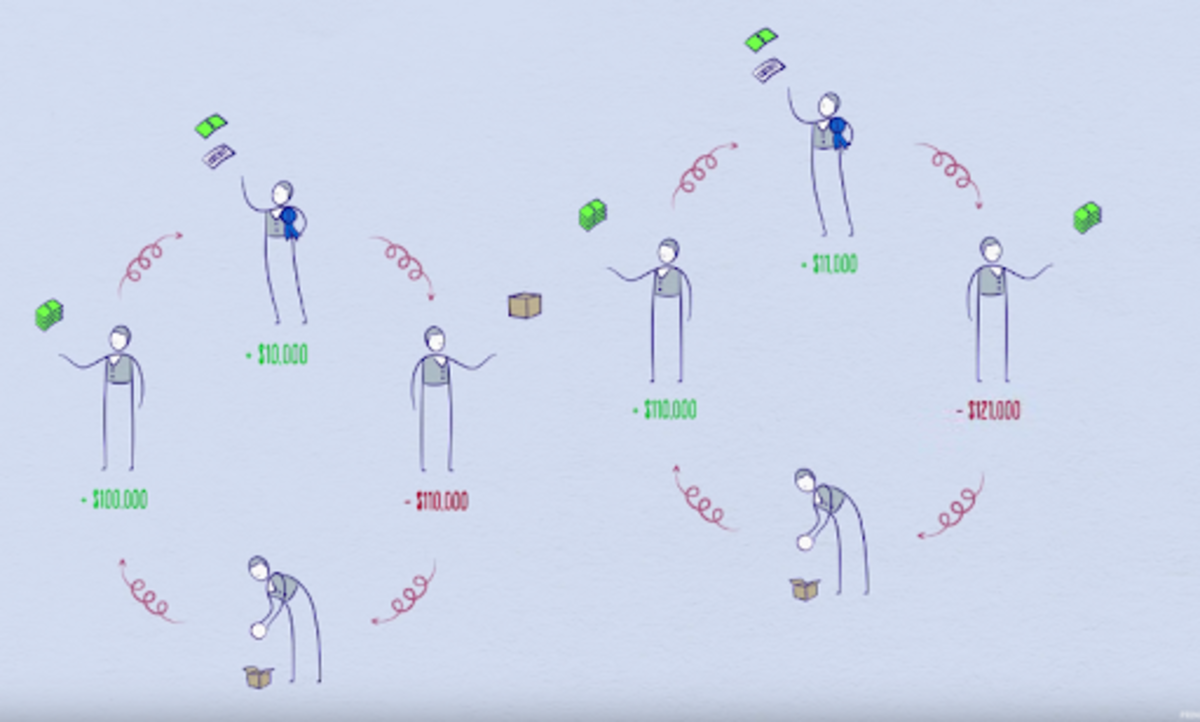

Credit is what enables an upward spiral of spending in our economy.

If you’ve earned $100,000 and you take a $10,000 credit, you can suddenly spend $110,000! Because one person’s spending is another person’s income, this means that another person just earned $110,000! Imagine that they also take credit, and so the cycle continues.

Credit is what enables an upwards spiral of spending in our economy.

This fact is fundamental to everything else.

If you continue the spiral long enough, you can see how it translates into more and more spending, and therefore, more and more income!

The more credit is taken, the more money appears in the system. Since credit is typically used for spending, the more credit is taken the more incomes in the system rise. Through that lens, taking credit can be seen as a good thing.

But also, the more credit that is taken, the more debt that is created .

Tying this back to the 1:4.2 ratio, you can imagine how far along we’ve continued the cycle of credit creation.

You may be asking yourself: “Where does this magic credit come from, then?”

Fractional Reserve Banking

Look no further than our banking system for some credit!

Let us examine a system of banking that’s been used since at least as far back as the 15th century, with the U.S. widely adopting it in 1863.

This form of banking is called fractional reserve banking — it states that banks are allowed to lend out a fraction of the money they have in deposits from other people.

This is where we open Pandora’s box — money that’s lent by banks is created out of thin air. If Alice deposits dollars in a bank and the bank lends out part of them to Bob, both Alice and Bob have money in the bank — the sum of which is greater than what was initially deposited.

In other word — banks don’t physically have all of the money they’re giving you when you’re taking credit. The money they’re giving you when you take a credit is digital and freshly created.

Note that banks cannot print new physical money, they can only create new digital money — after all, they’re just updated entries in their databases.

In the end, banks are also not free to create as much digital money as they want — there are constraints.

They have a reserve requirement — a minimum percentage of the money they’ve loaned out that they’re legally required to hold in reserves. This is typically 10 percent.

A bank’s reserve requirement is the bottleneck that dictates how much loans they can give out.

For every $1 that a bank has in reserves, it could have given out close to $9 more in credit. That’s why it’s called fractional reserve — it’s reserving only a fraction of the actual money it’s “giving” to people.

On to some examples: If you deposit $1,000 to a bank, it has the ability to loan out $900 of that. This is literal creation of money, because in your eyes, you still have $1,000 in the bank, and in the eyes of the borrower, they have $900 in the bank — but only $1,000 was ever deposited. The result of that is that the bank has people with $1,900 in aggregate deposits in it, but actually has $1,000 worth of “real” money.

Here is a visualization of the system at play:

The example above illustrated part of the journey of a bank deposit. This is how banks make money off of deposits — they lend them out for interest not once, but continually as this new money cycles throughout the system.

Looking at it from a systemic level, we can say that when loans are given out, money is created. When loans are paid, money disappears.

Think of it like a balloon which can be inflated up to a point and deflated. In that sense, money created out of credit can be thought of as temporary, as it will eventually be returned back to the bank.

When loans are given out, new money is created in the system.

When loans are paid back, money disappears from the system.

That’s quite the mind bender for some. It takes a while to have this sink in and realize how it works.

Note On Reserve Requirements

This crisis brought change to a lot of things and fractional reserve requirements was one of them. It was abolished in the U.S. in March 2020. This is not unprecedented — a lot of other countries do not have a reserve requirement (Australia, UK, Canada), a lot of others have miniscule requirements (Europe : 1 percent) and the U.S. was moving toward an “Ample-Reserves Regime” regardless.

Even without a reserve requirement, banks are not free to print as much money as possible. They are still constrained, this time by the so-called capital requirements. In the U.S., capital requirements denote that an adequately capitalized institution must have a capital-to-risk-weighted assets ratio of at least 4 percent — i.e., a bank must have at least 4 percent in capital (common stock, disclosed reserves, retained earnings) out of the worth of all its assets. (Credit typically constitutes around 75 percent of a bank’s assets.)

In that sense, a bank’s reserves (i.e., money it has in its Federal Reserve account) are part of its capital, since it is a disclosed reserve.

The difference is that this disclosed reserve is no longer a single bottleneck on how much they can lend out — it is only a part of it now.

Regardless of specific regulations, the fractional reserve example should give you a good sense of how new money enters the economy through credit. Whether there is a reserve requirement or not is just the limit on how much credit can be created.

Controversy Around Fractional Reserve Requirements

With the recent abolishment of the fractional reserve requirement, there is currently a lot of outdated/mixed information online.

Further, if one takes the time to dive into the economic literature of the past century, they will be surprised to see that economists have cycled through numerous theories about the way private banks create money, all of which has been based on theoretical models.

The first study giving an explanation supported by empirical data was published in 2014!

There seems to be a fair bit of dispute over how this system works and it is frankly shocking to learn that much of modern banking policy, regulation and reforms are based on theory, not fact.

Empirical data seems to support that banks have the ability to create money out of thin air, which nevertheless does not dispute the fact that the money they can create is bounded by the regulatory (capital/reserve) requirements banks are faced with. The only difference is that they are not necessarily required to lower their reserves once a loan is given out.

Takeaways So Far

- The economy is the sum of all of the transactions in all of its markets

- Credit helps boost growth in an economy

- Most money nowadays is actually credit

- When a loan is given out, new money is created in the system

- Banks’ reserve requirements were the bottleneck for credit creation for a long time but most recently, that system has given way to a more complex and vague mechanism of ample reserves

Summary So Far

We have learned about the importance of a transaction and the fact that transactions are the single building block of an economy. We explained what credit is and how it helps boost transactions’ value (spending), which in turn boosts income.

We explained how the reserve requirement works in a fractional reserve banking system and learned that, to this day, economists have not settled on a theory which dictates how money is created.

Okay, then, who dictates how much new money is created?

Money Creation

Central banks are generally in charge of creating money.

In the U.S., the Federal Reserve’s official goal is to conduct monetary policy such that the country achieves sustainable long-term growth. In other words, it wants to control money printing in a way that is conducive to growth.

Said newly-created money can either be physical in the form of bills (i.e., U.S. dollar bills) or digital, in the form of numbers in a database.

Physical Money Creation

In regards to dollar bills in the U.S., it is the Department of the Treasury that literally prints those. The Federal Reserve decides how much should be printed in accordance with physical money demand — it then orders the Treasury to print that amount of dollars. This newly-minted money is then transferred to the Fed’s 28 cash offices and from there it is distributed to all the banks.

Actual paper money is decreasingly negligibly — it is only 11 percent of the total money supply. ($1.75 trillion out of $15,333 trillion, as of the end of 2019).

That’s right — most money in the world is digital. The way digital money is created is much more nuanced and less directly controlled by the Fed.

Let us dive deeper to understand how the rest 89 percent of the U.S.’s money supply is created.

Digital Money Creation

If you remember, we mentioned that credit is money that is loaned into existence. Since it is the private banks that loan money to the broad public, we can say that they possess the power to create money digitally.

If most money in the world is digital, then it must be the private banks that create most of the money supply in the world.

That’s exactly how it is — the vast amount of new money is created via credit issuance from private banks. This is contrary to popular belief and media headlines, which claim that central banks print massive amounts of money.

New money is created via credit issuance from private banks.

That being said, it is still up to the central banks to control this in accordance to their monetary policy.

Central Banks’ Role

Central banks still have great influence in how much money is created, they just control it indirectly by incentivizing the private banks appropriately and tweaking the money supply.

The Federal Reserve has three main ways of controlling the new money creation rate:

- Capital requirements

- Federal funds rate

- Quantitative easing

Let us go over them:

Capital Requirements

Capital requirements inherently limit how much credit a bank can give. Previously it was the reserve requirement that would be the bottleneck, but as we mentioned, banks are now only limited by their capital requirements.

If the Fed wanted to decrease the amount of credit in the system, it would increase the capital requirements of banks, thus further shrinking the amount of credit they are allowed to give out with their current capital.

Conversely, if it wanted to increase the amount of credit in the system, the Fed could lower the capital requirements to allow banks to lend out more with what capital they currently have.

Of course, allowing banks to lend out as much as possible does not guarantee that loans will be made. After all, you need to incentivize the public to take out more loans as well.

Federal Funds Rate

If you’ve ever read financial media, you would have surely seen headlines like “Fed Lowers Interest Rate.”

The interest rate commonly mentioned is in fact the federal funds rate, a fundamental interest rate to our economy that serves as a benchmark and influences all other rates. To best understand how it works, we need to first understand where it is used.

Private banks, along with a myriad of other institutions, trade with one another every day at the so-called overnight repo market.

overnight — short-term, typically for the duration of a day (hence, over the night)

repo (short for repurchase agreement) — a secured loan where one party sells securities to another and agrees to repurchase them at a higher price. In the overnight market, the securities most commonly sold are U.S. treasuries.

reverse repo — a short-term secured loan where one party buys securities from another and agrees to sell them at a higher price. It is the other side of the repo trade.

For the bank selling a security and later repurchasing it, is it a repo. For the bank buying that security and later selling it at a higher price, it is a reverse repo.

The overnight market has many participants besides banks, but its main purpose is to help banks balance out their reserves after a day of operations.

It exhibits some of the lowest interest rates out of the whole economy, partly because the loans on it are so short.

Banks need reserves for a variety of reasons — in order to meet intraday payment needs, regulatory constraints (e.g., capital requirements), internal risk management constraints and more.

In any given day, a bank can give out more loans that it is comfortable with in the short-term — it settles this on the next day via the overnight market. An example:

Institutions have reason to lend money out in the overnight market as it is one of the safest investments out there. Banks with excess reserves similarly have an incentive to lend that money out in order to earn interest on it.

This interest is known as the overnight rate and it is mandated by the federal funds rate (FRR).

As of this writing, the overnight rate is 0.09, which is within the target federal funds rate range of 0.00 to 0.25.

At the start of any business day, banks with excess reserves lend out their money to other banks in an overnight loan. Said loan is typically paid at the start of the next business day after that (hence, overnight). These loans are collateralized with U.S. treasuries.

The overnight rate of these repo agreements is very important to the process of new money creation because it is heavily tied to the interest that banks will offer their customers.

A high overnight rate means that banks will offer higher rates to their customers (otherwise they could only lend out in the overnight market which is safer). The higher the rate, the less demand there will be for loans, the less new money will be created.

Conversely, a lower overnight rate translates into lower interest for customers, thereby increasing demand for loans and driving new money creation.

So how does the Fed control this market?

Back in the fractional reserve days, when there was a reserve requirement, the main driver for controlling these rates were the so-called open market operations.

open market operation — the central bank buying or selling securities to the open market in order to implement monetary policy. This can either be pure transactions (buy/sell) or repurchase agreements (repo/reverse repo).

When the Fed wants to lower interest rates, it prints its own money and uses it to purchase securities from banks. Since the Fed can create as much money as it wants, it can be an endless buyer.

By purchasing securities with newly-printed money, the Fed injects new liquidity into the banking system. Because banks then find themselves with extra cash, there is less demand for loans and therefore the interest rates on loans fall in order to meet demand.

Vice versa, when the Fed wants to raise interest rates, it sells securities to banks, gobbling up cash (reserves) from the banking system, therefore increasing demand for loans. Due to the limited supply of cash, the interest rates rise because banks are ready to pay higher for it.

Nowadays, in the ample reserves regime, open market operations have a lesser effect. This is because of the large quantity of reserve — small changes in the supply no longer influence rates that much.

Rather than doing massive open market operations, the Fed started using other tools to bound the federal funds rate.

First, it introduced a new rule in which it pays banks interest on excess reserves they store in their account at the Fed. This is known as the IOER rate.

IOER (interest on excess reserves) rate — interest that the Fed pays member banks on the excess reserves they have in their account at the Fed.

If the Fed wants to raise interest rates, it can increase the IOER rate that it offers. With that, banks would only lend out money to other banks if it earns them more than parking their money at the Fed.

The problem is that the overnight market has participants which are not banks, therefore they’re not allowed accounts at the Fed and cannot benefit from IOER.

These non bank institutions could still lend out for less than the IOER, so the Fed solved this by doing open market operations in the form of offering institutions repurchase agreements at the Fed’s desired rate — institutions buy securities from the Fed and sell them at a higher price. This is a reverse repurchase agreement from the point of view of the institution.

Since the Fed prints its own money, it can offer whatever high rate it desires in the reverse repos, giving non-bank institutions no incentive to offer loans for lower rates than that (they could sell to the Fed for a guaranteed higher return).

This rate is called ON RRP.

ON RRP (offering rate on overnight reverse repurchase agreements) — interest that the Fed pays institutions when they conduct a reverse repo with the Fed (when they buy securities from the Fed in order to sell it back at a higher price).

Raising both IOER and ON RRP increases the interest rate in the overnight market, because no participant has any reason to offer loans below that rate. They serve as the lower bound of the federal funds rate.

Conversely, lowering IOER and ON RRP stimulates a decrease in interest rates. Banks are incentivized to loan their money out to earn more from it and other institutions are incentivized to seek higher rates from their loans than what the Fed offers.

Both interactions increase the supply of loans which lowers the rates.

Finally, the Fed has another tool to help control rates called the discount rate. This is the rate that the Fed uses to give out loans to banks.

Taking a loan out from the Fed is considered an emergency move, since it means that no other institution wanted to lend the borrower money in the overnight market. As such, the Fed typically prices this discount rate a bit higher than its federal funds rate.Regardless, having the Fed offer loans to banks at a rate it controls gives the system an upper bound on the maximum interest rate. With this tool, the Fed can now very tightly control the interest rate on the overnight market.

As you can see, the Fed now controls both the lower- and upper-bound of the overnight rate, effectively pinning it to whatever range it desires.

Quantitative Easing (QE)

And now, the final tool in the Fed’s arsenal — the one we’ve heard all about — quantitative easing!

While it sounds complex, it is relatively simple in actuality — it is the process of the Fed buying assets from its member banks with newly-created money.

It is the same as an open market operation — the only difference is that quantitative easing is done at a much larger scale and is thus not considered a normal day-to-day operation like open market operations.

These new assets go on the Fed’s balance sheet — this is precisely what causes the Fed’s balance sheet to expand, as many media headlines note.

quantitative easing (QE) — the act of the central bank expanding its balance sheet by conducting large-scale open market operations funded by newly-created money. It is typically used for buying long-term (10 year to 30 year) U.S. treasuries from member banks.

The effect of this is that it injects new money into member banks’ reserves, boosting their capital and allowing them to loan out much more than they could have with respect to their capital requirements.

The more banks can loan out — the more they will, hence supply of loans increases. Demand falls since less banks need liquidity.

QE makes it so that interest rates fall.

Side Note: Quantitative Tightening

Each aforementioned tool is useful both for raising and lowering rates. Since QE can only lower rates, it has a counterpart named quantitative tightening (QT) which is the exact reverse — the act of the central bank shrinking its balance sheet by selling off assets which results in raising interest rates.

The interesting part is that QT is the only tool we’ve mentioned that has never before been done at scale. As there have not been many practical applications of it, we have to turn our attention to experiments.

The Fed has experimented with QT throughout 2018 and 2019 when it sold off some assets in its balance sheet but it had to abruptly end it pretty shortly after, once it noticed a slowing down economy.

The other living experiment which exhibits quantitative tightening qualities is Bitcoin.

Summary

In this long piece, we learned a ton about how money is created in the world, how transactions power our economy (one person’s spending is another’s income) and the fundamental importance of credit on boosting economic growth and new money creation.

We covered how, contrary to popular belief, the Fed does not outright print money and distribute it to the world. The way money creation works is much more complex, vague and indirect. Further, it is not immediately obvious that money creation is bad, as credit has its benefits to an economy.

We learned that credit issuance is the mother of new money creation and therefore interest rates are fundamental to it.

We briefly touched on some of the money creations mechanisms at play — fractional reserve banking, the ample reserves regime, the overnight market and the way the central bank uses its tools to interact with these mechanisms in order to control the interest rate, namely capital requirements, open market operations, IOER, ON RRP, the discount rate and quantitative easing.

All Takeaways And Summarized Bullet Points

- The economy is the sum of all of the transactions in all of its markets

- Credit helps boost growth in an economy

- When a loan is given out, new money is created in the system

- Most money nowadays is actually credit

- Banks’ reserve requirements were the bottleneck for credit creation for a long time but most recently, that system has given way to a more complex and vague mechanism

- The vast amount of new money creation is done through credit issuance from private banks

- The interest rate that the broad public gets on loans is largely determined by the overnight repo market’s interest rates

- The overnight repo market’s interest rates are tightly controlled by the federal funds rate

- The Federal Reserve controls the federal funds rate via multiple tools, lower-bounding it via IOER/ON RRP, upper-bounding it by the discount rate and tweaking supply/demand of loans via QE

- Because the interest rate influences the demand for loans, it influences the rate of new money creation. The Fed therefore influences the rate of new money creation.

Next time you see a large M2 number, know that it is not the Fed that printed $18 trillion of M2, but rather it might be that the Fed gave the private banks money such that they can lend out a lot more and increase the money supply.

While it’s easy to blame the central bank, the crux of the issue is that the whole system is inherently flawed. If the complexity and obscurity isn’t enough to prove it, the fact that we operated a banking system based on theoretical models which changed three times throughout the past century should be testament enough to prove that this system is not sound.

Opt out, buy bitcoin.

This is a guest post by Stanislav Kozlovski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post How Money Printing Really Works appeared first on Bitcoin Magazine.