How Mining Pools Adapt To Changing Market Conditions

Miners need to be flexible to changes in the market, including global cultural differences and adversarial legal frameworks when countries ban Bitcoin.

Mining pools are important to the Bitcoin ecosystem because they allow small bitcoin miners to collect rewards for their hash rate. Small-time miners are very unlikely to find a block and receive the block reward on their own. Mining pools improve the chances of individual miners finding a block because the pool groups the hash rates of all the miners in the pool, acting as one big miner.

A group of mining pool specialists sat down together at the mining stage at Bitcoin 2022 to discuss the state of mining pools and ways that the pools are evolving for both retail and industry miners. The panel consisted of Leo Zhang, the founder of Annica Research, Nick Hansen; the CEO and co-founder of Luxor; Jay Beddict, the director of research at Foundry; Denny Xing, the business development manager of Poolin; and Edward Evenson, the head of business development at Slush Pool and Braiins.

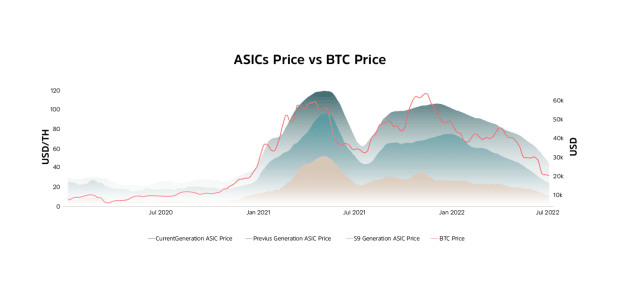

The panelists started off discussing the major changes that occurred due to hash rate migration. Panel moderator Zhang said, “The past year has been a very interesting year in the distribution of the mining industry, especially with the China ban.”

After the China ban, “Companies had to prepare for a large influx of American hash rate,” said Hansen.

Xing expanded on this idea when he said, “You see the migration of hash rate not only from China, but Kazakhstan and Ukraine. Stability and security will be an important factor for hash rate and that’s why people are moving to the U.S.”

The conversation evolved to discussing renewables. Xing said, “People are calling for renewables and reusing the heat from mining which is new for us.”

Evenson elaborated, “The narrative used to be that bitcoin was funding terrorists and criminals and now it’s that bitcoin mining is boiling the oceans.”

But the desire for renewables is not limited to wind and solar power. Beddict shared, “Foundry does advising work and we are certainly seeing more interest from those [renewables] groups, but what’s more interesting to me is the flare gas.”

Evenson added, “The recent trend is pools trying to be ‘green pools.’ It makes more sense to me for that to be done on the miner level because mining pools don’t consume very much energy.”

After a short discussion about green energy, the panelists moved on to talk about cultural variance between Chinese and American miners. Hansen said, “One of the biggest differences between Chinese miners and American miners is treasury management. It seems like most of the American miners are trying to hold the bitcoin. For Chinese miners, it seems like they’re trying to at least sell to cover their operation expenditure.”

In addition to cultural differences, there are regulatory differences that impact hash rate and where miners choose to set up their operations. Hansen spoke about OFAC compliance, “The market seemed to indicate that maybe an OFAC compliant pool would be desired, but it quickly became clear that that was not the case and the pool switched back.”

Beddict added, “Over-complying will lead to a more negative outcome. By participating in the bitcoin mining network, by putting a block on top of another one, you are providing security to all the transactions before it.”

This means that even if a block is mined within OFAC compliance, the previous as well as the following blocks will contain non-OFAC compliant blocks within the chain, rendering the OFAC compliant block pointless. Zhang concluded, “There’s a lot more money, there’s a lot more interest to push for a more friendly regulatory environment.”

At the end of the conversation, all of the panelists expressed excited about the Stratum V2 protocol being further developed.

Bitcoin 2022 is part of the Bitcoin Event Series hosted by BTC Inc, the parent company of Bitcoin Magazine.