How Inscriptions Impact Bitcoin Block Space

The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin Ordinals And Inscriptions

A recent and somewhat contentious use of Bitcoin is an innovative application of the Taproot soft fork that was merged into the protocol in 2021. Ordinal Theory is a way of serializing each individual unit of bitcoin and labeling these specific satoshis “ordinals.” The creator of this numbering scheme, Casey Rodarmor, described it in his blog saying, “Satoshis are numbered in the order in which they’re mined, and transferred from transaction inputs to transaction outputs in first-in-first-out order.”

By serializing these individual satoshis and utilizing the Taproot upgrade, Bitcoin users can also include arbitrary data directly on the blockchain. While this was already possible with text using the OP_RETURN function, these new “inscriptions” can be anything from jpegs, short sound clips and even simple games.

There is growing debate in the development community about the implications of storing all this data directly on Bitcoin and what that means for users who want to run a full archival node. While this discussion is important, we want to dig into how inscriptions are currently impacting Bitcoin’s fee market and how it might look in the future.

Efficient Use Of Block Space

By their nature, inscriptions are larger files and therefore take up more of the finite space in each Bitcoin block. The users that are creating inscriptions are required to pay the necessary fees in order to send their transactions, however, inscriptions are included in witness data which is given a slight fee discount thanks to the SegWit soft fork in 2017.

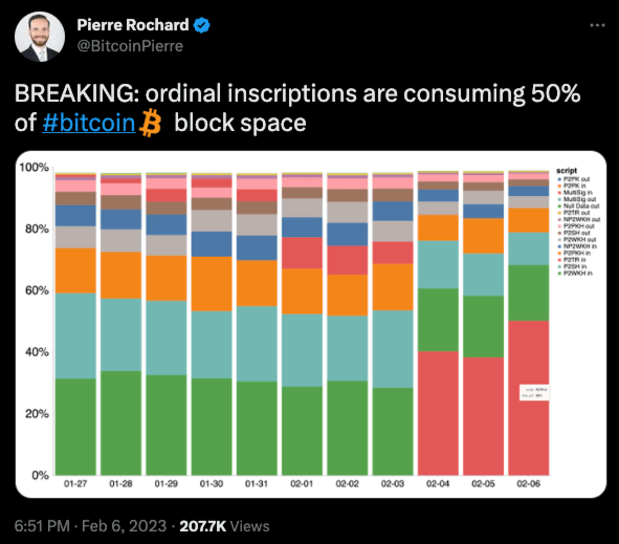

Ordinals officially launched on January 21, 2023. Less than three weeks later, inscriptions are already taking up 50% of Bitcoin’s block space according to Pierre Rochard, vice president of research at Riot Platforms.

Bitcoin’s fee market is a constantly changing landscape. Fees rise when demand to transact on-chain is high and users want to get their transaction included in the next block. Inversely, the fee rate drops when demand is low and users don’t need their transactions confirmed in a timely manner.

Whether or not these inscriptions should be considered an “acceptable” use of Bitcoin, the market will decide the appropriate fee pricing for those who wish to include this arbitrary data into each block. Should transaction fees rise enough, it’s likely that less important or smaller bitcoin transactions will be priced out of the market and move to Layer 2 protocols, such as Lightning. These additional layers were always the game-theoretical hypothesis of Bitcoin’s fee structure, even predicted by Hal Finney in 2010.

Historical Block Weight

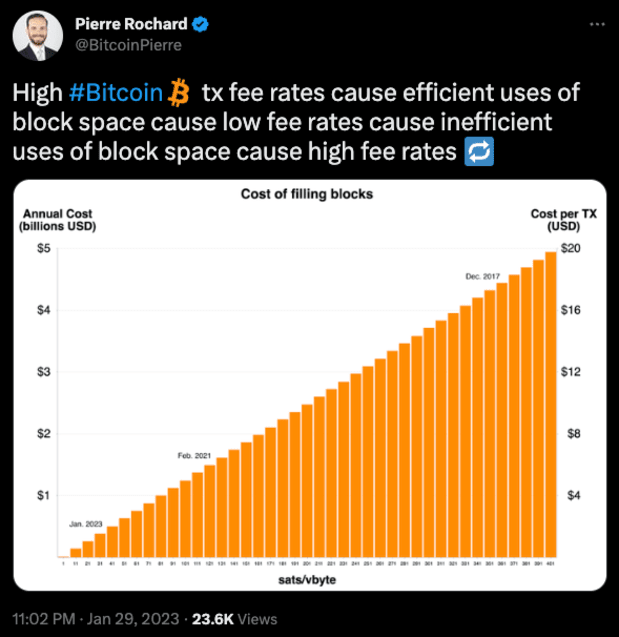

This is not the first time that a significant number of transactions have filled the mempool. As noted, Bitcoin’s fee market is dynamic and the cycle of high fees create efficient uses of block space, create low fees, create inefficient use of block space, create high fees will repeat ad infinitum.

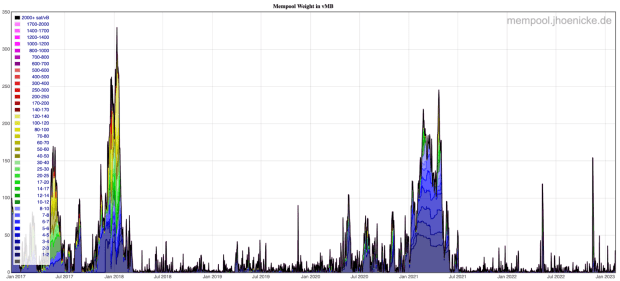

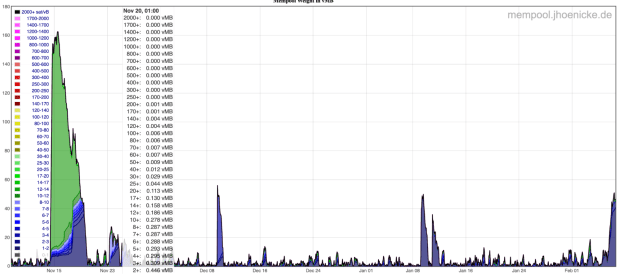

Shown below is mempool data and fee prices going back to the beginning of 2017. Blockspace tends to be at a premium during bull runs as many people are sending bitcoin back and forth from exchanges or cold storage or spending it at the relatively high exchange rate.

Zooming in on the past three months, it’s clear that there was a significant number of transactions happening in the second half of November as bitcoin flew off exchanges with users protecting themselves from any other potential contagion events.

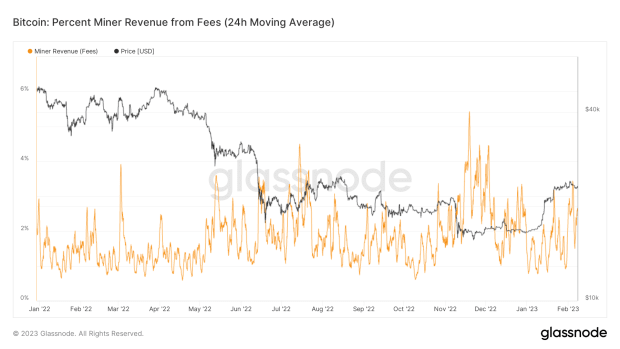

Beyond extreme cases, transaction fees have been low for long stretches of time and have led to questions about Bitcoin’s long-term security budget as the block subsidy dwindles and fees must become a larger percentage of bitcoin miners’ revenue. Again, the hypothesis from Bitcoin proponents is that demand for block space will increase over time as bitcoin gains adoption and scales, causing more usage to migrate to other layers built on top of the protocol.

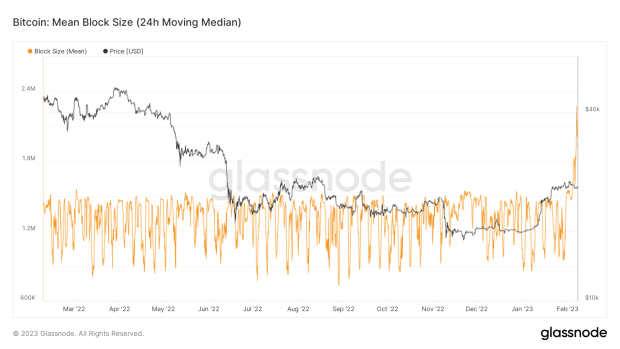

In the last few weeks, the average block size has seen a massive spike.

Even with this major increase in block size, fee market competition has yet to heat up. It’s likely that those who wish to send monetary transactions will increase their fees to get their transaction included more quickly or those who want to mint an inscription without having to wait will do the same. Either way, should fees increase, so will profitability for miners who would collect additional revenue in the block reward in the form of higher transaction fees.

Transaction fees are still an insignificant percentage of the mining block reward, falling somewhere between 1% and 3%. Will fees begin to rise as more and more people attempt to use bitcoin for sending money and minting inscriptions?

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

- State Of The Mining Industry: Survival Of The Fittest

- The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

- Not Binancial Advice

- This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle

- BM Pro Market Dashboard Release!