How High Can BTC Go Following The New ATH Above $44K? (Bitcoin Price Analysis)

Following the $1.5 billion Bitcoin purchase announcement coming from Tesla, the primary cryptocurrency saw a huge hourly surge of almost 15%: from the $39K range to a new all-time high at $44,899, according to Bitstamp.

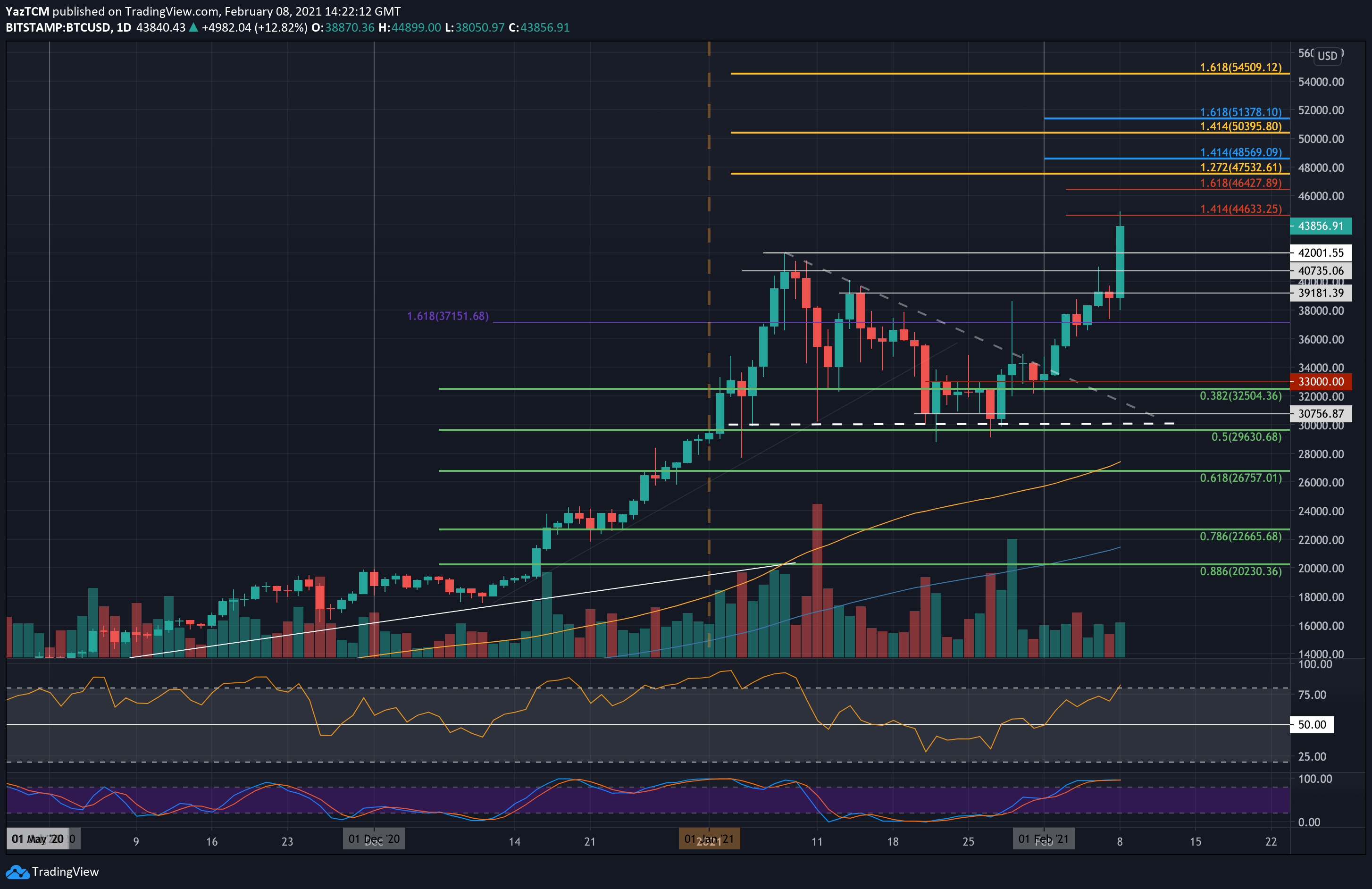

Quick recap: bitcoin surged to its previous ATH of $42,000 on the 8th day of January. From there, it started a consolidation phase as it formed a descending triangle pattern with a floor at $30,000, which held nicely as the bottom of the triangle.

After a false breakout signal toward the end of January, when Elon Musk changed his bio to “#Bitcoin,” the coin had finally penetrated the triangle’s upper angle at the start of February. Since the breakout, which took place around $34K, Bitcoin price had gained a total of 30% to the current price level of around $43,800.

Today, in a filing with the SEC, Tesla revealed that it had purchased over $1.5 billion of BTC in January. This was more than enough to send BTC to a new ATH.

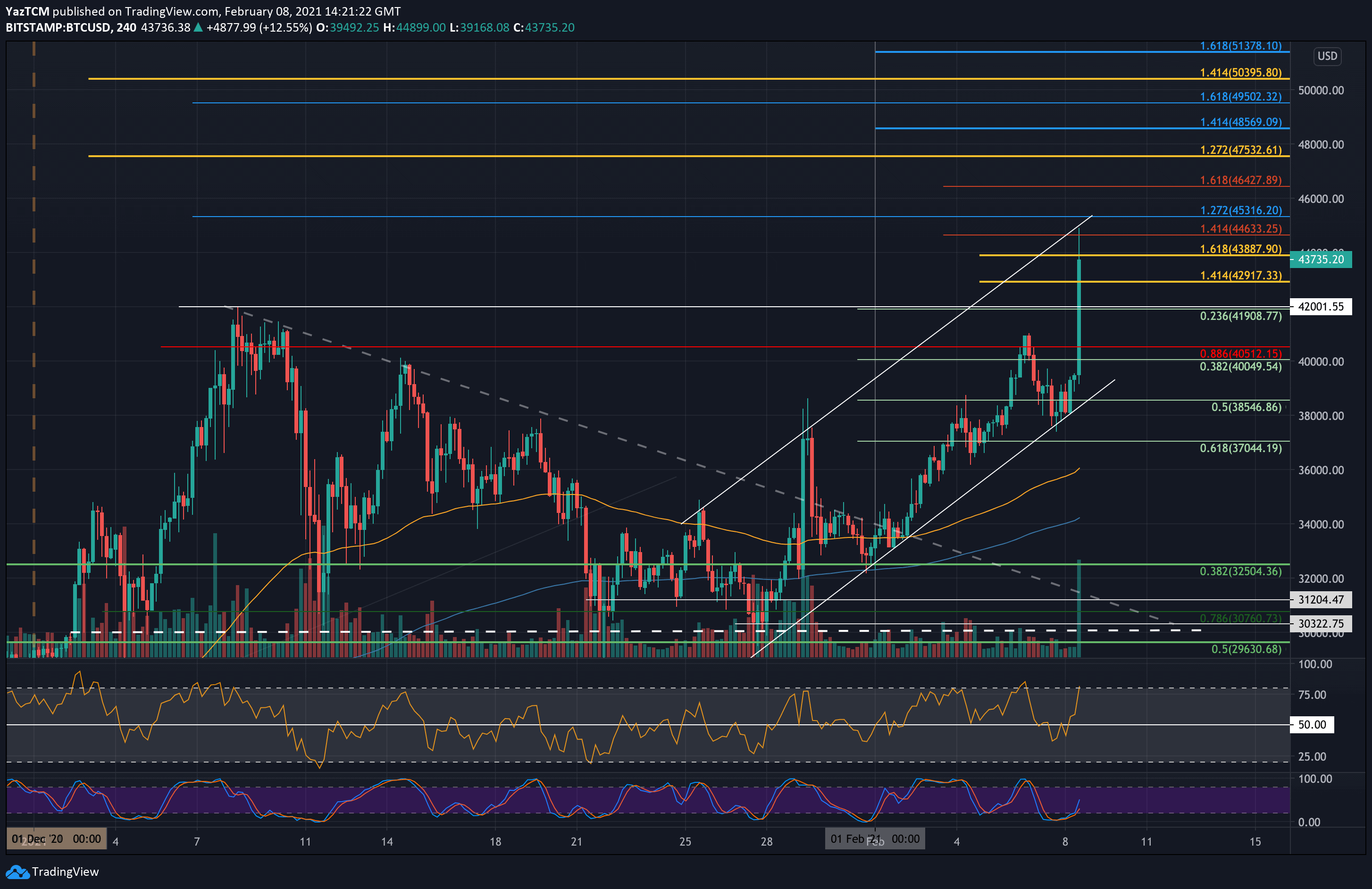

On the short term charts (4-hour), Bitcoin is now trading within an ascending price channel. It bounced from the lower boundary at $38,000 at the beginning of this week and following today’s surge, BTC touched the upper boundary of the price channel. It is now trading around $43,887 (1.618 Fib Extension) resistance.

Where Next? BTC Price Support and Resistance Levels to Watch

Key Support Levels: $42,000, $40,000, $38,550, $38,000, $47,045.

Key Resistance Levels: $43,887, $44,900, $45,315, $46,000, $46,430.

Moving forward, the first level of resistance to break now lies at $43,887 (1.618 Fib Extension – orange). This is followed by resistance at the new ATH price of $44,900 (~$45K), which is also the upper boundary of the ascending price channel.

Beyond the price channel, resiatnce is located at $45,315 (1.272 Fib Extension – blue), $46,000, and $46,430 (1.618 Fib Extension – red). Added resistance is found at $47,500 (1.272 Fib Extension – yellow), $48,670, and $49,500 – $50K (1.618 Fib Extension – blue).

On the other side, in case of a correction, the first support lies at $42,000 (.236 Fib & Previous ATH). This is followed by $40,000 (.382 Fib), an ascending trend line, and $38,550 (.5 Fib). Added support lies at $38,000 and $37,045 (.618 Fib).

The daily RSI shows Bitcoin is now in overbought conditions but still has room to continue higher before becoming extremely overbought. This shows that the buyers are in complete control of the market momentum and are still not overextended – hinting that there is room for BTC to spike towards $50K.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart