How Elizabeth Warren’s Beef With Facebook Could Benefit Bitcoin

Warren in South Carolina, via Ali Powell

How Elizabeth Warren’s Beef With Facebook Could Benefit Bitcoin

Sen. Elizabeth Warren is crusading against big banks as one of her core platforms for the 2020 presidential election, but it’s her social media policies that may have the most direct impact on bitcoiners.

Namely, she’s taken a hard stance against bank overreach, wants to reduce risky corporate lending and weaken the “monopoly influence” of companies like Citibank, Wells Fargo and Google. On Friday, Feb. 21, she tweeted: “Giant banks won’t stop cheating until execs fear jail time & regulators show some backbone – & I have a bill for that.”

The Massachusetts lawmaker rose to national prominence in the wake of the 2008 financial crisis, just like bitcoin (BTC). She was chair of the five-person Congressional Oversight Panel created to oversee the implementation of the Emergency Economic Stabilization Act in 2008, then built the Consumer Financial Protection Bureau from scratch. Even before entering politics, Warren spent the 1970s, 1980s, and 1990s teaching law at several American universities and researching issues related to bankruptcy.

In Congress, she developed a reputation as a liberal crusader against corruption in the banking industry. Now her campaign platform states: “I have promised to expand and aggressively enforce our antitrust laws by breaking up big tech companies and big agribusinesses…to end Washington corruption bans giant corporations, banks, and market-dominant companies from hiring senior government officials for at least four years after they leave public office.”

In this way, her stances echo some of the most common critiques lobbied by bitcoiners against the government about corruption. Warren has apparently not made any public statements directly related to a clear policy on bitcoin. Yet, it’s her platform on curtailing rampant disinformation campaigns – the promotion of falsehoods online for political or commercial ends – that relates most directly to the bitcoin market. Digital media experts believe current market conditions for cryptocurrency are shaped by social media chatter, some of which is deliberately designed to misinform and misdirect.

In a blog post last July, she warned our “precarious economy…built on debt” is vulnerable to shocks. Likewise, her 2020 campaign platform promises to “push to convene a summit of countries dedicated to addressing” disinformation and create “a standard for public disclosure when the government identifies accounts conducting foreign interference so that Americans who have interacted with those accounts are notified.” That could mean everything from Russian interference in elections to under-the-radar campaigns to influence market sentiment, and therefore swing prices in a certain direction.

Oumou Ly, a staff fellow at Harvard’s Berkman Klein Center working on the disinformation research program, said disinformation campaigns impact “financial markets and stock market movements.” It stands to reason that bitcoin markets are not an exception.

“We don’t, at this time, have great metrics for how to measure the impacts of disinformation,” Ly said. “As a starting point, I think Warren has the strongest platform related to finding misinformation.”

Warren’s staff did not respond to requests for comment by press time.

Misinformation

The type of misinformation Warren is fighting could impact elections and generate noise that taints bitcoin-related data sets.

As Alicia Wanless, the co-director of the Partnership for Countering Influence Operations, wrote, the 2020 election is already overflowing with “questionable information about presidential candidates.”

Warren already felt the impact of pro-Trump bot armies herself in 2016, as these campaigns often use sexist language to try to discredit rivals. Donald Trump’s son may have encouraged this type of online harassment again in February 2020 by tweeting that Warren kicked her opponent’s ass as part of a fetish. The New York Times reported Russian propaganda campaigns are working to thwart her nomination.

Meanwhile, independent researcher Geoff Goldberg said there is “definitely connectivity” between political propaganda bots and Crypto Twitter. “It’s all connected and the accounts give the campaigns similar traits,” he said.

This is especially true for bots related to pro-Trump and “fake” Iranian opposition groups, which is relevant for bitcoin because Iran is one of the few nations where bitcoin has seen rampant growth among users seeking censorship-resistant tools. Persian journalists have faced escalating online harassment since 2016. Some of these social media campaigns are clearly inspired by the Trump administration.

Even more concerning, Bloomberg reported Trump supporters behind the investment firm Elliott Management Corp. recently purchased a sizable stake in Twitter Inc. with the intention of influencing the platform’s governance. The information war is heating up, whether it’s Trump versus Warren, Russia versus the U.S., or bitcoiners versus token fans.

From Ly’s perspective, when it comes to propaganda, it’s crucial to understand the difference between causation and correlation. A misinformation campaign doesn’t need to focus strictly on bitcoin to impact crypto communities. One study by Otto Beisheim School of Management in January 2020 claimed to find a correlation between anxious headlines related to the Trump administration and market volatility across assets.

“Disinformation is used, not just on political issues, but also to sow chaos and confuse issues that have a high level of interest to specific groups or the general public,” Ly said.

During the World Economic Forum in January 2020, European Central Bank President Christine Lagarde said we still don’t understand how social media impacts investment decisions. Confusion could hinder organic growth among bitcoin users beyond traditional institutions.

One Swiss liquidity provider working with leading exchanges, who requested anonymity to protect professional relationships, said news-driven trades don’t materialize into long-term trends. Political social media trends do impact bitcoin markets, but rarely in terms of authentic demand.

“The news impacts price in the short term because there are automated bots trading, just reacting to Twitter buzzwords,” he said. “This isn’t retail investors turning to bitcoin as a hedge.”

Matthew Hanzelka, a Texas-based Warren supporter and avid bitcoiner, said he believes Warren’s calls for financial transparency are “in some ways antithetical to bitcoin.” This interventionist approach also applies to Warren’s stance on social media, proposing governments should be involved in defining and policing misinformation. Bitcoiners tend to prefer self-sovereign solutions over criminal penalties for those who contradict the state-sanctioned notion of truth.

Yet, Hanzelka’s view of the misinformation platform is particularly nuanced. “I generally oppose censorship like this, but also want egregious, division-inducing falsities stopped,” Hanzelka said of Warren’s proposed social media regulations.

Hanzelka added an anti-bitcoin and pro-nationalism disinformation campaign could hamper adoption and entrench bitcoiners who staunchly believe in cyberpunk principles. The possibility of an anti-bitcoin campaign doesn’t seem far-fetched considering President Trump tweeted in July 2019 that bitcoin was an unstable asset for “unlawful behavior.”

“Powers that be could use a disinformation law to try to attack bitcoin,” Hanzelka said. “But we still need some kind of disinformation regulations, just not so robust that it could be weaponized against any dissenters to the status quo.”

Bitcoin is supposed to be an uncorrelated asset. Protecting this potential may require policies that discourage manipulative propaganda while clearly distinguishing between startup tokens and decentralized, digital cash.

Maximalist leanings

To that end, Warren may have more in common with bitcoiners than initially meets the eye.

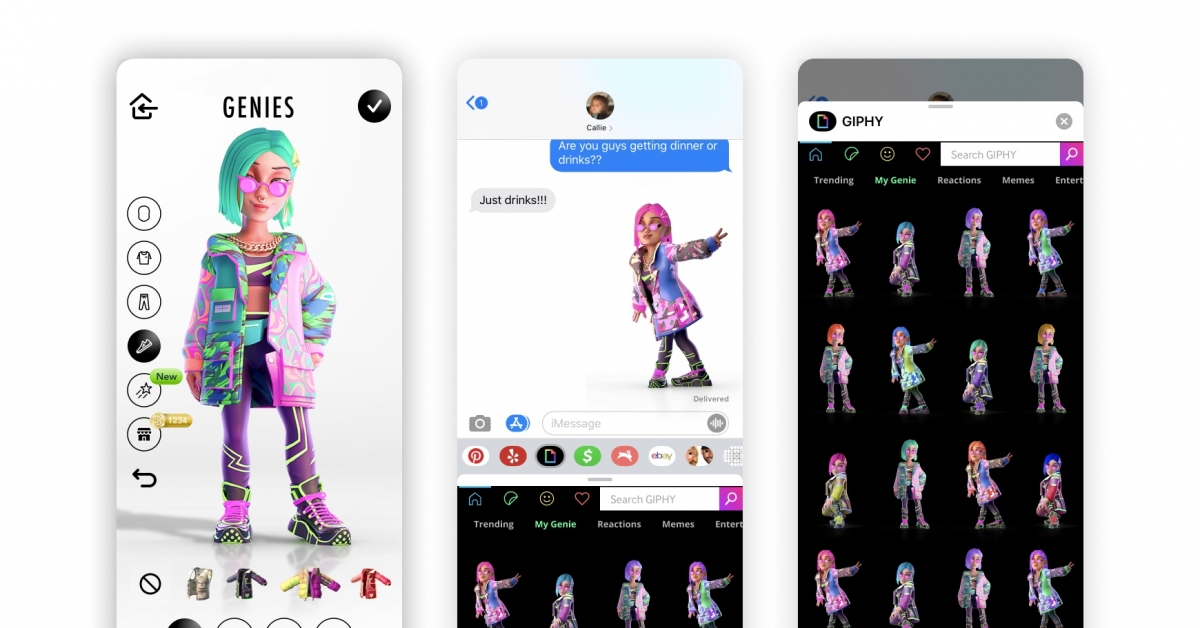

Compared to rival presidential candidate Michael Bloomberg’s public statements about prioritizing a regulatory framework for cryptocurrencies, Warren’s approach may be more inclined toward bitcoin than startup tokens. She was critical of token funding models during the hearing with Securities and Exchange Commission Chairman Jay Clayton, asking why more tokens weren’t subject to registration by the SEC.

“The challenge is how to nurture productive aspects of crypto with protecting consumers,” she said during a 2018 Senate Banking Committee hearing, according to Forbes. Her biggest concern about the cryptocurrency market was “consumers getting hurt,” a subtle dig at the token craze.

Likewise, her criticisms of Facebook’s Libra project revolved around monopolistic power and corporate responsibility, concerns that don’t apply to bitcoin. Warren even proposed legislation that considers the idea of jail time for CEOs over privacy failures, echoing a widespread concern in the bitcoin community.

During the 2018 senate hearing on how to regulate cryptocurrencies, Warren harped on whether cryptocurrency networks can be significantly decentralized. She asked whether regulations can help discourage oligopolies within these networks.

“These new technologies create new opportunities,” she said. “But if we’re not careful, they make the rich richer and they leave everybody else behind…why are cryptocurrencies so easy to steal? And what can we do to secure it?”

Coin Center’s Research Director, Peter Van Valkenburg, replied, “Bitcoin wasn’t involved in that,” adding he agrees with a stricter approach to token sales. Warren supporter Tyler Campbell agreed with Hanzelka that her policy approach includes both problematic aspects and potential boons for bitcoiners.

“She’s a double-edged sword because her policies do involve some facet of government intervention at every turn,” Campbell said. “I think she’d absolutely love that bitcoin is accessible…the irony of bitcoin being painted as an illicit tool when cash is far worse wouldn’t be lost on her.”

He added that he likes Warren’s approach is consumer protection-oriented rather than “dismissiveness to the space as a whole.”

Of course, many bitcoiners don’t agree Warren would have constructive policies related to bitcoin. Atlantic Financial CEO Bruce Fenton said, “She’s unlikely to have much of an effect on bitcoin” nor a “reasonable regulatory regime.”

However, since Warren’s campaign team hasn’t referenced bitcoin directly and they didn’t respond to requests for comment, only time will tell how her broader policies relate to bitcoin.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.