How Bitcoin Fits With ‘Beautiful Mind’ Mathematician John Nash’s Ideal Money

Pioneering mathematician John Nash laid out a concept for “Ideal Money” that has parallels with Satoshi Nakamoto’s Bitcoin.

“I think of the possibility that a good sort of international currency might EVOLVE before the time when an official establishment might occur….

Here I am thinking of a politically neutral form of a technological utility rather than of a money which might, for example, be used to exert pressures in a conflict situation comparable to ‘the cold war’.”

–“Ideal Money And Asymptotically Ideal Money”

The Age of MMT And Money Printing

In the age of Keynesian economics evolving toward Modern Monetary Theory, where governments confidently try to print their way out of the “COVID crisis,” seemingly with impunity, we can understand how Bitcoin would be favored from the libertarian viewpoint. This is something that Satoshi foresaw when Bitcoin was in its infancy, writing that, “It’s very attractive to the libertarian viewpoint if we can explain it properly.”

It’s also generally believed that Satoshi designed Bitcoin as a technology that would run counter to the concept that governments should act as their own lenders of last resort. This belief comes from the fact that Bitcoin’s genesis block is timestamped with the headline, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

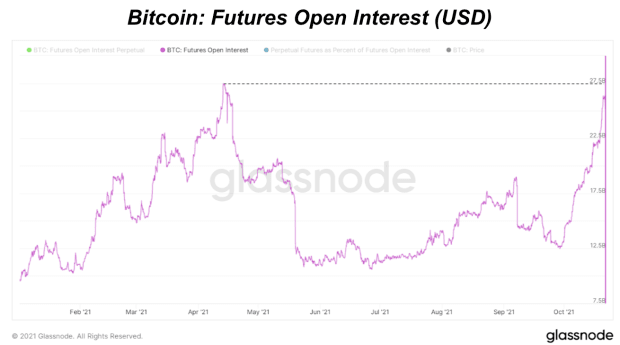

From a mainstream economics viewpoint, however, Bitcoin is not an “ideal money.” In fact, to most mainstream economists and central bankers, Bitcoin is a very bad money. This is because it has no value stabilization mechanism (aka, inflation control).

In response to this mainstream contention on the viability of bitcoin as a globally-adopted currency, the early libertarian Bitcoiners began to propagate a narrative about Bitcoin that has been dubbed the “maximalist” view. This view often draws on Austrian economic themes, as well as what has been formally dubbed by Daniel Krawisz as “Hyperbitcoinization.”

In short, the Bitcoin maximalist believes that eventually the citizenry will get so sick of the degradation of the purchasing power of their respective national currencies that there will be a perpetual and self-accelerating process of leaving their respective currencies in order to hold bitcoin, a currency with a destiny to perpetually increase in purchasing power terms (coincidentally, adherence to a “hyperbitcoinization” mindset fits into the definition of the “Nash equilibrium”).

However, as bitcoin’s market cap grows, it’s starting to reach people of different political stances, and thus the narrative about what Bitcoin is and should be seems to be evolving.

Ruritania And Hal Finney’s View On Bitcoin

In 2010, Hal Finney commented on what he foresaw as being the future for bitcoin in regard to its existence with the legacy financial system, writing, “Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins.”

Finney envisioned, à la George Selgin’s “The Theory Of Free Banking”, that Bitcoin would serve as the base settlement layer between banks which themselves serve a privately-issued currency. Interestingly, and counter to the maximalist narrative, Finney believed, “…such a system would be stable, inflation resistant and self-regulating.”

Selgin’s work on free banking involves a thought experiment about a fictional land called Ruritania, in which the initial premise is that there is no monopoly issuer on the base money supply. Although from a national perspective such a premise wouldn’t apply, from a global perspective, and especially with Bitcoin in play, it cannot be said that there exists a single monopolist issuer of money.

Enter: John Nash

Off the cuff, most people won’t recognize the name John Nash, however, most from the western world will perk up when they are reminded of the movie “A Beautiful Mind” starring Russell Crowe.

The movie portrays a brilliant mathematician that slowly begins to realize he has descended into madness. The movie is based on the life of Nash, however, there are some curious inaccuracies. At the end of the movie, Nash is depicted as taking medication in order to deal with his delusional state of mind. In real life it is well documented that Nash didn’t recover using medication, rather, as he put it in his autobiography, “… gradually I began to intellectually reject some of the delusionally influenced lines of thinking which had been characteristic of my orientation. This began, most recognizably, with the rejection of politically oriented thinking as essentially a hopeless waste of intellectual effort. So at the present time I seem to be thinking rationally again in the style that is characteristic of scientists.”

But perhaps a more curious mistake in the movie is in the scene in which Nash’s wife tries to explain to him that the letters he has been writing in correspondence with American intelligence were actually never sent. This is provably wrong, as in more recent times one such letter was declassified by the NSA and is published on NSA’s website. It is interesting to note that Ron Rivest and Adi Sharmir (part of the team that invented RSA encryption) have presented that, in this letter, “Nash anticipated the birth of complexity theory a decade later, and the birth of modern cryptography two decades later.”

In the letter, Nash explained, “The significance of this general conjecture, assuming its truth, is easy to see. It means that it is quite feasible to design ciphers that are effectively unbreakable.” He went on to write, “The nature of this conjecture is such that I cannot prove it… But this does not destroy its significance.”

Here, Nash saw something in regard to an unprovable conjecture and later in the letter he suggested, “…we should try to keep track of the progress of foreign nations towards ‘unbreakable’ types of ciphers.”

In one of his last interviews he reminisced on this concept, “…the game is, [governments] don’t want it to be understood, where their position is in terms of cryptological competence.”

In another correspondence with American intelligence, this time posted on the RAND website, Nash wrote about an insight he called “Parallel Control” in which, “…the idea is to decentralize control.”

This paper is interesting as it seems to contain a scaling insight in regard to how computers and computing might evolve in the future, “…isn’t it much better to have one machine [comprised of 100 computers] that takes a day for a problem than 100 which take 100 days for a problem?”

Both letters are from the 1950s, just before Nash’s friends, family and colleagues would start to see him as being delusional.

The Birth Of Ideal Money

“Here Argentina and El Salvador can be mentioned. They are adopting (at least temporarily) expedients that put the value of their domestic money on a fixed relation to the U.S. dollar. And of course Panama has had such a situation for a long time previously. This is not ‘ideal money’ because the U.S. dollar is not an ideal standard for money value…

…if, for example, all of the countries of the world would base the value for their national currencies on the value of the British currency then this situation would appear singular and unstable, while it was not so singular for a lot of countries to base their currency value on gold.”

–“Currencies Of Improving Quality”

Nash eventually received a Nobel prize for another paper from the same time period called “Non-Cooperative Games.” The Nash equilibrium concept he presented in this paper eventually became ubiquitously referenced across many different fields, especially in economics. It is said to be one of the most-cited papers in existence and so much so that often the reference will be used with no formal citation given.

In a fourth notable work — in addition to the letter declassified by the NSA, the concept of “Parallel Control” and “Non-Cooperative Games” — Nash presented a solution he called “The Bargaining Problem” which seems to effectively show the value of money in trade.

These four papers laid the groundwork for an idea that Nash had at the time, which he eventually called “Ideal Money.” It was at this time, near 1960, that Nash decided to flee to Europe, to exchange his American dollars for Swiss francs, which he felt had a better future quality as measured by the concept he conceived. He was also trying to renounce his American citizenship. It is well written in his biographies that the U.S. military tracked him down and brought him back to his homeland (as he says) “in chains.”

He won the Nobel prize in 1994 for “Non-Cooperative Games” and began touring the world, speaking and writing about “Ideal Money” in 1995.

Speaking Cautiously

“…my talk linking the ‘ideal money’ with the choices and actions of ‘thrift’ or ‘savings’ by persons or by ‘economic agents’ was influenced by concerns that it would be wise not to speak too incautiously of ‘the Keynesians’ when the times are such that massive public opinions may be supporting actions by which a state administration can act without going through the parliamentary processes to write new legislation…

Therefore, I had arranged for 2012 to talk more cautiously in relation to whatever would impact with ‘the Keynesians’ and with the political interests relating also to the scholarly factions allied with (or forming) ‘the Keynesians.’ And this caution carries over naturally to 2013 also.”

–Nash

For the last 20 years of his life, since 1995, Nash had been touring the world cautiously and with obfuscation, professing his idea as to how the global financial system could be arranged in an ideal fashion. It is interesting to compare the ends of Nash’s proposal with Satoshi’s alleged distaste for banking bailouts. Nash explained in “Ideal Money”, “This standard, as a basis for the standardization of the value of the international money unit, would remove, where it would be used, the political roles of the ‘grand pardoners.’”

The Concept Of An ICPI And Common Misconception Of It

“The ultimately launched concept of ‘Ideal Money’ became possible when I conceived of a practical basis for a standardization of the comparison of the value of the currency with an appropriate standard or ideal. And the key to that was the idea of an ICPI or (international) ‘Industrial Consumption Price Index.’”

–Nash, “Asymptotically Ideal Money”

Nash formally entered his proposal for “Ideal Money” in the Southern Economic Journal’s July 2002 edition. Based on the notion that “There is tremendous value in simply having prices quoted conveniently” as outlined in “The Bargaining Problem,” Nash began to consider what he called an “Industrial Consumption Price Index” (ICPI), much like that of the Consumer Price Index (CPI) metric that the central banks of today use to target inflation, but instead, Nash wrote about a single index that all central banks would agree to share. The concept is something that he extrapolated from the favorability of the gold standard, but with an array of prices in order to decentralize some of the weaknesses of the singular nature of a gold standard:

“Nowadays, however, few would propose a return to the actual use of simply the metal gold as a standard, for the following reasons. (i) The cost of mining gold effectively does depend on the technology. Recent cyanide leaching techniques have made it possible again to profitably mine gold at formerly abandoned sites in the U.S. so that it is now a big producer. However, the unpredictability of the cost is a negative factor. (ii) The location of potential gold-mining locations may not be ‘politically appealing’ so it would seem undesirable to make a political choice to enhance the economic importance of those particular areas. (iii) There is some negative psychology about gold such that even if it were the most logical choice after all, the unpopularity of the idea could be very obstructive.”

–“Ideal Money”

The general idea of having a basket of commodities prices that are used to measure inflation, whether on a national level or a global level, is not perfectly unique to Nash’s proposal. Indeed, in a since-deleted tweet, George Selgin said on the matter, “his commodity-basket stnd. Neither novel nor very appealing”.

Coincidentally, in “Ideal Money And Asymptotically Ideal Money,” Nash almost seems to respond, “….on a topic with such a universal relevance to human affairs, it is difficult, really, to say something new. But there can be novelty in the details and in terms of the context and the times.”

Saifedean Ammous, famous for his narrative entitled “The Bitcoin Standard,” also opined on the concept of Nash’s “Ideal Money” and ICPI, tweeting, “It’s just another centrally planned currency, based on ridiculous price stability index measurements.”

However, although Nash did invoke the concept of the ICPI in his proposal, he didn’t actually propose it as the basis for his argument. Instead, he explained that he saw a different way that the world currencies might find inter-relational stability (bold emphasis added):

“It seems possible and not unlikely, however, that if two states evolve towards having currencies of more stable value as measured locally by national CPI indices that then also these distinct currencies would tend to evolve towards more stable comparative relations of value. Then the limiting or ‘asymptotic’ result of such an evolutionary trend would be in effect ‘ideal money’ but this as a result achieved without the adoption of anything like an ICPI index as a basis for the standard of value.”

Of “Ideal Money,” pioneering Bitcoin advocate Adam Back has tweeted, “also not convinced Nash’s ideal money ideas are that much to do with bitcoin. If i understand he just proposed 0% inflation as objective and kind of SDR variant, but somehow linked to ICPI basket of commodities as a way to construct it.”

It’s interesting to see the willingness of people to opine on Nash’s proposal and to see how few of them have actually traversed the works.

The Problem Of A Miracle Energy Source

In fact, it is Nash himself who defeats his own concept, the ICPI, showing that he only named it so that he can speak to it for the lack of a better comparison:

“We can see that times could change, especially if a ‘miracle energy source’ were found, and thus if a good ICPI is constructed, it should not be expected to be valid as initially defined for all eternity. It would instead be appropriate for it to be regularly readjusted depending on how the patterns of international trade would actually evolve. Here, evidently, politicians in control of the authority behind standards could corrupt the continuity of a good standard…”

Put another way, if the cost of the production of one or some commodities in the ICPI was dramatically reduced by a technological advance, the composition of the internationally-chosen basket of commodities would need to be readjusted. As Nash noted (above in regard to gold), the location of the production of commodities can be a source of political tension if they are “monetized” (i.e., selected as part of the index), therefore political conflict would be expected to arise at each re-adjustment period of the basket.

Although useful as a notion, the ICPI is a political non-starter. Nonetheless, Nash left us with the advantages and weaknesses of the concept.

The Crux Of The Genius Of Satoshi’s Design

“The price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more. At the same time, the increased production would increase the difficulty, pushing the cost of generating towards the price.”

–Satoshi Nakamoto

Here we consider the possibility of using the price of bitcoin as the sole commodity in an internationally-held inflation target. Firstly, in regard to the weakness of the geographical location of “Bitcoin mines” we can note that “bitcoin-to-be-mined” do not reside in any certain physical location.

More importantly, we can consider the effect of a “miracle energy source” if bitcoin was used as a measure of purchasing power stability of major currencies — if the cost to mine bitcoin decreased dramatically, miners would flood the network looking to profit, however, the difficulty adjustment algorithm would eventually increase the cost to mine.

From this view, it becomes apparent that Satoshi solved the problem that Nash outlined.

On The Concept Of A Zero-Percent Inflation Target

“If in each of the corresponding states the authorities were using, in some sense, ‘inflation targeting’ then necessarily they would have some sort of a price index that could be related to their issued currency. But it would ALSO be very natural for each state to look at the comparative behaviour, in terms of value, of the other leading currencies.

Thus second order index comparisons become possible where the authorities in a state would look not only at domestic prices but also at international value comparisons.

And now we have only to imagine that a ‘groundswell’ of ‘popular demand’ for minimal inflation…

…the responsible authorities and governments so that they would so control the ‘supply side’ of their money management activities so as to achieve that (supposed to be popularly desired) result.”

–“Ideal Money And Asymptotically Ideal Money”

Paul Storcz, famous for his drivechain BIP, gave his contention with Nash’s proposal, saying that Bitcoin can’t be a basis for Nash’s “Ideal Money” because it is expected to have a deflationary nature (purchasing power increases over time) and Nash’s proposal calls for 0% inflation as it’s target.

However, this view conflates definitions in a way that is difficult for some to understand. Inflation has many different definitions. One of the relevant definitions is a general decrease in the purchasing power of the money considered. A central bank has a similar but slightly nuanced definition of inflation because it further defines inflation through a set of prices which it uses as a specific lens for comparison.

If the exchange price of bitcoin was used as the new metric for inflation, then 0% inflation would be achieved if the exchange price of the respective currency was stable in relation to bitcoin. This would be called “0% inflation” even if it were obvious that the respective currency was increasing in purchasing power by the definition of a general decrease in prices.

Was Nash Satoshi?

“…and little by little, specialists were becoming more to the point… and… he was putting everybody to contribution, as a conductor you know, ‘Hey my friend I need you to prove this and this. I think that you are the expert and you can give me this, I can use it to prove something more…’ As a conductor who would give assignments you know, ‘Here you are the violin player you play this and this. You are the trumpet you play this and this.’ Each one does their part, nobody understands the great plan except when the orchestra starts to play. And Nash had the whole plan for this. And everyone was amazed when it was six months… putting all the people to contribution. Everyone knows this as the Nash inequality. The truth is, Nash didn’t prove this inequality. He asked one of his colleagues… to prove the inequality… an expert in this kind of thing. ‘You want this inequality, yeah let me prove it for you, here’s how you do it’. ‘Thank you.’ And Nash would use it in that problem of distribution. He was a genius in these kind of integrating parts…”

–Cedric Villani

This article doesn’t intend to opine on whether or not Nash had anything to do with the creation of Bitcoin. However, given the consideration, it is often asked if Nash would have been capable of creating the code for Bitcoin.

The above attestation by Villani is interesting to consider in this regard and indeed Nash was working on a different research project which happened to involve the same programming language that Satoshi used to implement Bitcoin. Nash was, in fact, quite familiar with computers. When asked if he considered himself a technophile, he once answered, “I’d like to think of myself that way… I was working with computers, it was sort of my big pastime… it was my cognitive therapy in my early days.”

Why Bitcoin Isn’t A Ponzi

“So it occurs to me to think that that which is not achieved by a grand action of establishment by ‘fiat’ may alternatively tend to come into existence as a consequence of a process of evolution. And of course, after a certain degree of progress by ‘evolution’ the rest of the progress could possibly be realized by a convention or a process of ‘fiat.’”

–“Asymptotically Ideal Money”

Mainstream economists are often quoted as saying that Bitcoin is no more than a speculative Ponzi scheme. This would certainly be the conclusion if you believed the intention of Bitcoin is to replace the existing major currencies.

However, it simply cannot, as it is inherently volatile with no accurate stabilization mechanism. Nonetheless, the cost and speed to settle with Bitcoin versus traditional systems (and especially with something like gold) doesn’t compare if we consider high-value transactions. From this view, it is only the liquidity and market cap that make bitcoin inferior to the legacy settlement media. As Bitcoin’s market grows, settling the highest-value transactions that happen in our global economy becomes very attractive (cheap and fast) using Bitcoin.

At this point, considering Selgin’s Ruritanian view, Bitcoin will asymptotically begin to stabilize the existing major legacy currencies. We should expect this to happen, not because of cooperation and political altruism, but as the process of settlement allows the international markets to favor the higher-quality (lower-inflation) currencies over those that are not managed as well in this regard.

That this would happen through the direct competition of the currencies (and want of central banks to survive!) rather than the will and morality of the central banking system seems to defeat the idea of Erik Voskuil, a contention he calls the “Ideal Money Fallacy” in which he argues, “States only surrender this [inflation] tax under extreme duress and in such cases only briefly.”

The ICPI As A Metaphorical Device

The script or plan for my talk linking “Ideal Money” with the choices and actions of “thrift” or “savings” by persons or by “economic agents” was influenced by concerns that it would be wise not to speak too incautiously of the Keynesians when the times are such that massive public opinions may be supporting actions by which a state administration can act without going through the parliamentary processes to write new legislation.

Nash’s argument is difficult to understand. He seems like an awkward speaker, he uses an old style of English. But he also has a past that would provide a very good reason to fear state reprisal — namely, through insulin shock therapy.

These days, it might be easier to see how it would be wise to speak cautiously about such a proposal that, “would remove, where it would be used, the political roles of the ‘grand pardoners,’ the state authorities that can forgive the debts.”

“The ultimately launched concept of ‘Ideal Money’ became possible when I conceived of a practical basis for a standardization of the comparison of the value of the currency with an appropriate standard or ideal. And the key to that was the idea of an ICPI or (international) ‘Industrial Consumption Price Index.’

–”Asymptotically Ideal Money”

Nonetheless, we understand the proposal through the ICPI, not the misconception of it being the basis for the proposal, but rather by using it to construct an ideal basis for our global monetary systems. We consider the strengths of such a proposal and then recognize the weaknesses are fatal — that if the cost to produce relevant commodities dramatically changed, it would take a politically-based cooperative to readjust the globally held basket of commodities. And, finally, not that Satoshi’s difficulty adjustment algorithm solves this weakness while retaining all of the stated strength of the ICPI.

i·de·al: existing only in the imagination; desirable or perfect but not likely to become a reality.

This is a guest post by Jal Toorey. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.