How Bitcoin could impact financial inclusivity among minority groups

From an obscure footnote known to only the more tech-savvy in a much more insular internet, Bitcoin has transformed into an important player in today’s financial landscape.

However, while we’re all keenly aware of BTC’s impact on financial markets (a more or less permanent fixture of the news cycle), we often forget to take a step back and look at how this new frontier affects real change and real people.

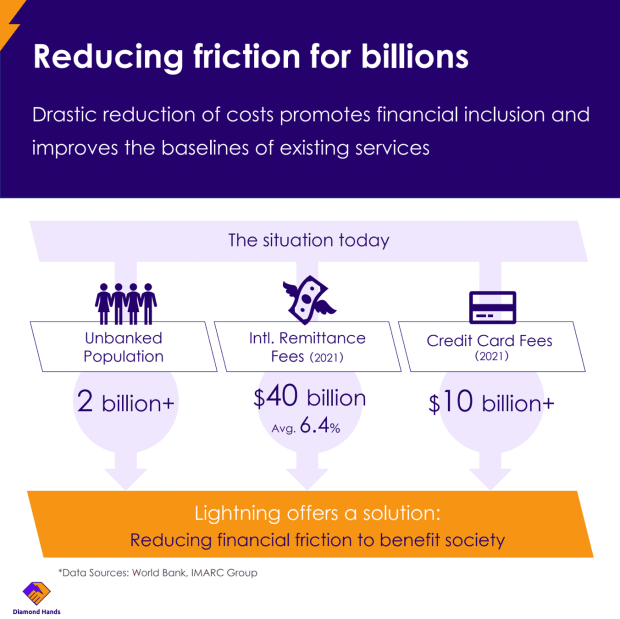

For those historically marginalized by traditional banking due to barriers like poor credit or lack of accessibility, BTC has emerged as a vital financial tool. Its impact is most profound in developing countries, where access to banking still poses a challenge for many.

Here, Bitcoin serves as more than a currency or an investment; it’s a means to engage in essential financial activities, such as sending and receiving money, that would otherwise be out of reach.

Forget, at least for a minute, the speculative potential in terms of financial gain—the true value of Bitcoin lies in its potential to level the financial playing field, offering access to financial tools that were previously exclusive to those with more established economic backgrounds.

Amid its fluctuating value, the enduring promise of Bitcoin is its contribution to financial inclusivity, making it a beacon of hope for more equitable access to financial services worldwide.

Historical context of Bitcoin and financial inclusivity

Bitcoin was born out of the financial turmoil of the late 2000s, with its creator(s) aiming to forge a decentralized currency that could bypass traditional banking systems and help society at large traverse a repeat of the 2008 financial crisis.

This vision was not just technical but deeply ideological, seeking to empower individuals with financial autonomy.

At its core, Bitcoin promised to make financial services accessible to anyone with internet access, regardless of their standing with conventional financial institutions.

This promise has seen tangible realization in countries like Nigeria, where traditional banking services are out of reach for many. In Nigeria, Bitcoin has become more than a speculative asset—for instance, with the country’s significant diaspora, Bitcoin facilitates remittances, enabling Nigerians living abroad to send money home more efficiently and at lower costs compared to traditional banking services.

In Argentina, Bitcoin has emerged as a crucial financial tool amidst the country’s ongoing economic challenges, including high inflation rates and currency devaluation. For Argentinians, Bitcoin offers a more stable store of value compared to the national currency, the Argentine peso, which has suffered from significant depreciation over the years.

A similar trend can be noticed in Ghana, where the annual inflation rate is predicted to land in the 13% to 17% range in 2024.

In Venezuela, a country grappling with political instability and economic crises, Bitcoin has found a unique role beyond just a means of preserving wealth against hyperinflation. Here, Bitcoin is being utilized to support microfinance initiatives and charitable donations, directly impacting the lives of those in need. Organizations and platforms leveraging cryptocurrency can bypass traditional financial systems, which are often inaccessible or unreliable for the country’s impoverished populations, to provide direct financial assistance.

Moreover, for entrepreneurs and small business owners the world over, it offers a means to engage in international transactions without the need for bank accounts or the risk of currency devaluation. It’s both a hedge against crisis and a vessel of freedom against authoritarian regimes, but the decentralization schtick isn’t

The rise of Bitcoin ETFs and institutional interest

By allowing investors to gain exposure to Bitcoin’s price movements without the complexities of directly buying, storing, and managing the digital currency, BTC ETFs offer a familiar, regulated avenue for institutional investors to enter the Bitcoin space.

Previously, the volatile and unregulated nature of Bitcoin deterred many institutional investors. However, with the advent of ETFs and other regulated investment products, these entities can now participate in the cryptocurrency market, bringing with them substantial capital inflows and increased legitimacy and stability to Bitcoin and the broader crypto market, which will only increase with further adoption.

This institutional foray into Bitcoin has a dual impact.

On one hand, it introduces a level of stability and liquidity previously unseen, potentially making Bitcoin a more attractive asset for both retail and institutional investors.

On the other, it represents a shift from Bitcoin’s original ethos of decentralization and democratization of finance.

Another point to consider is that institutional interest isn’t limited to private, for-profit enterprises—with countries like El Salvador, which recently took custody of its national Bitcoin treasury showcasing that, slowly but surely, the general attitude of governments towards cryptocurrencies is also changing with the times.

Potential impacts of institutionalization on accessibility

On the one hand, these developments can enhance Bitcoin’s appeal by contributing to market stability and reducing volatility—a key concern that has deterred a broader demographic from embracing cryptocurrencies.

The entry of institutional investors can also increase liquidity in the Bitcoin market, potentially making it a more reliable asset for individuals and businesses worldwide.

However, the flip side of institutionalization is the potential increase in barriers to entry for marginalized groups.

The very essence of Bitcoin’s appeal to these groups is its accessibility: the ability to participate in the financial system with nothing more than a smartphone and an internet connection. As regulatory frameworks become more stringent and the market more institutionalized, the processes for acquiring and using Bitcoin could become more complex.

Requirements such as rigorous identity verification and compliance with financial regulations, while necessary for fraud prevention and financial security, could inadvertently sideline those without formal identification or those living in regions with less regulatory clarity.

Moreover, the shift towards institutionalization might lead to a concentration of wealth and power within the Bitcoin ecosystem, reminiscent of traditional financial systems.

This concentration could undermine the decentralized ethos of Bitcoin, making it less about empowering the individual and more about serving institutional interests.

The challenge lies in finding a balance: leveraging institutional interest to bring stability and legitimacy to Bitcoin while ensuring that its revolutionary promise of financial inclusivity remains intact.

Financial inclusion and cryptocurrency adoption

Sub-Saharan Africa, with its blend of limited banking infrastructure and high mobile penetration, has emerged as a fertile ground for cryptocurrency adoption. The region, marked by its smaller overall market size in terms of traditional financial metrics, shows a significantly high level of grassroots cryptocurrency usage.

Nigeria, for example, not only ranks second on the Global Crypto Adoption Index but also leads Sub-Saharan Africa in raw transaction volume, as well as the world in P2P exchange trade volume ranking. Other countries like Kenya, Ghana, and South Africa also feature prominently on the index, underlining the widespread acceptance of cryptocurrencies as viable financial instruments

The adoption is driven largely by practical necessities rather than speculative interests, with cryptocurrencies serving as a hedge against inflation and currency devaluation.

In Ghana, where inflation surged to its highest level in two decades at the tail end of 2022, and in other nations like Nigeria, Kenya, and South Africa facing similar economic challenges, cryptocurrencies have become an attractive means of preserving wealth. The shift towards digital currencies, particularly Bitcoin, and more recently, stablecoins, reflects a broader search for financial stability and freedom

Peer-to-peer transactions, especially prominent in Sub-Saharan Africa, account for a significant portion of crypto transactions, underscoring the region’s unique position in the global crypto landscape. This high rate of P2P transactions is attributed to the everyday use of crypto for retail payments, remittances, and commercial transactions.

The preference for crypto over traditional banking and financial services is not just a matter of convenience but a necessity in regions where local currencies are losing value, as seen in countries like Nigeria and Kenya

Through bypassing traditional financial barriers, cryptocurrencies offer expanded finance options to underserved markets, exemplified by initiatives like Empowa and Pezesha in Mozambique and Kenya that utilize blockchain to facilitate real estate development and connect MSMEs with global lenders.

Balancing institutional interest and financial inclusivity

As Bitcoin continues to navigate the waters between grassroots empowerment and institutional adoption, its future landscape presents a dichotomy.

On one side, increased institutional interest brings stability and credibility, potentially making Bitcoin a more viable and trusted financial asset globally.

On the other, this shift could challenge the very inclusivity that has been a cornerstone of Bitcoin’s appeal, particularly among minority groups and in regions with limited access to traditional banking services.

To ensure that Bitcoin remains a tool for empowerment, a balanced approach is necessary. One potential pathway is the development of regulatory frameworks that encourage inclusivity.

Regulations could be designed to protect consumers without stifling innovation or access to cryptocurrencies. Additionally, the continued support and promotion of peer-to-peer platforms can empower individuals by facilitating direct transactions without the need for traditional financial intermediaries.

Conclusion

As Bitcoin evolves amidst rising institutional interest, its foundational role as an agent of financial inclusivity faces both challenges and opportunities. Ensuring that Bitcoin continues to serve marginalized communities requires a delicate balance, blending the stability brought by institutional involvement with its potential as a democratizing force.

One thing is certain—the future of Bitcoin hinges in large part on maintaining its essence as a lifeline for financial empowerment across the globe.

This is a guest post by Kiara Taylor. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.