How Bitcoin Can Enrich Our Interior Lives

Bitcoin can facilitate positive freedom by enabling individuals to retain value of their savings and feel more fulfilled.

This is an opinion editorial by Logan Bolinger, a lawyer and the author of a free weekly newsletter about the intersection of Bitcoin, macroeconomics, geopolitics and law.

“I’m more interested in asking the question, is the world that we want to live in one where we need to hyperfinancialize every aspect of an individual’s life because financial conditions on a macro level are such that you have to financialize your whole being in order to keep up or get ahead? Is that truly a victory for democracy and for the kind of psycho-spiritual wellbeing of all of us and the lives we want to live? Versus something like Bitcoin, that’s a definancializing force that basically says because we think a world might be better where you’re actually able to save money and you don’t just have to spend it or go invest or speculate on some stuff, would that unlock ways for you to feel more fulfilled or satisfied as a person and would you then be able to pursue other things? I think ultimately the end of Bitcoin is that we all think collectively less about money and more about other things that we’re interested in.”

I made these statements on a recent episode of the “What Bitcoin Did” podcast in a discussion about Bitcoin and the ways I think it can catalyze positive changes in our interior lives, as contrasted with the contemporary state of Web 3.

We frequently discuss and theorize the ways in which Bitcoin can reshape or reconfigure our external realities, whether they be political, monetary, legislative, etc. But I don’t think enough attention is paid to how Bitcoin can initiate a similarly monumental reshaping of our interior lives, a process which, in the aggregate, can lead to a trickling up of priorities and values.

I want to talk about two different conceptions of freedom to illustrate why I think we fixate so much on one of them. When folks describe themselves as “freedom maximalists,” they’re primarily referring to the idea of negative freedom, a freedom from intrusive external constraints. This type of freedom is obviously of fundamental, paramount importance. Without freedom from certain external constraints, meaningful pursuit of self-realization, what we would refer to as positive freedom, is difficult, if not impossible to pursue.

We tend to get so focused on the negative freedom aspects of Bitcoin that we fail to fully appreciate the positive freedom that Bitcoin facilitates. Which is to say we get so fixated on the ways in which Bitcoin precludes external intrusions or constraints (freedom from) that we don’t explore the ways in which Bitcoin can create an environment that allows us to more rigorously pursue the fullest expression of our selves (freedom to).

[N.B. for my humanities/philosophy friends: Yes, I am drawing on the work of Isaiah Berlin with these positive/negative freedom terms]

I would argue that freedom maximalism is not sustainably fulfilling long-term, because it’s not really an end state. It’s a necessary liminal posture, a means to achieving a certain environment in which positive freedom can be productively exercised. However, negative freedom without positive freedom is like having an infinite number of TV channels but no idea what you want to watch. It’s like having the freedom to pursue anything you want without any way of determining what you actually want to pursue or what’s worth pursuing.

Americans are particularly attuned to ideas of negative freedom, but not particularly adept when it comes to positive freedom. We can see this everywhere, including in the Bitcoin space. If one makes a living, builds a following, or crafts an entire identity around being a “freedom maximalist,” one’s livelihood and sense of self depends on the continuing existence of external constraints for one to decry. One can unwittingly (and mostly subconsciously) become the bird that has grown to love its cage, as author Lewis Hyde once wrote of irony.

So while freedom maximalism (negative freedom) is vitally important, we should also pursue and prioritize what my wife has aptly coined intentionality maximalism (positive freedom), which is a perspective and a way of living in our interior lives. Bitcoin does not get enough credit for its ability and its potential to foster this type of inward-looking change.

What does intentionality maximalism look like in our everyday experience of life? One salient example is our relationship with the unbridled consumerism endemic in a fiat monetary system.

Allow me to share some statistics that illustrate just how warped this relationship has become:

Per the Los Angeles Times, there are 300,000 items in the average American home.

Per NPR, the average size of the American home has nearly tripled in size over the past 50 years.

Nevertheless, one out of every ten Americans rent offsite storage, which is the fastest growing segment of the commercial real estate industry over the past four decades.

British research found that the average 10-year-old owns 238 toys but plays with just 12 daily.

The average American family spends $1,700 on clothes annually, while also throwing away, on average, 65 pounds of clothing per year.

You get the idea. There is practically no end to the data showing the absurd amount of shit we own and the growing space (physical and mental) that this shit occupies.

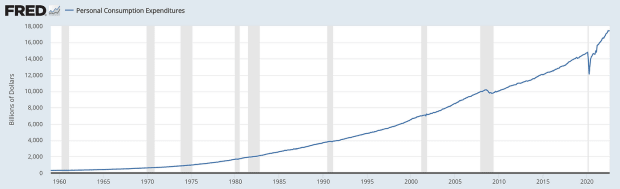

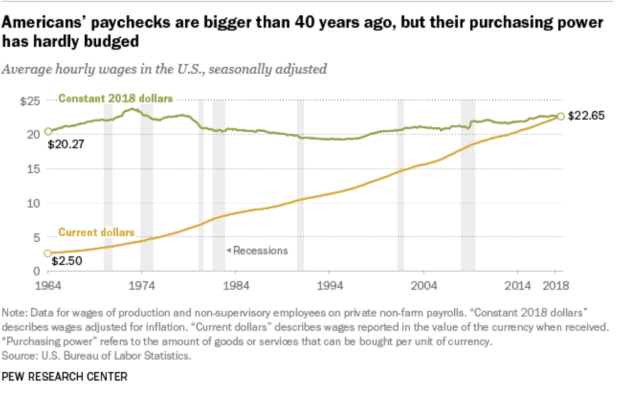

Americans are consuming more than ever.

Despite their purchasing power not meaningfully growing.

What explains this? One factor is that we measure our economic health by how much we spend, a singularly fiat and Keynesian way of gauging economic vitality. Consumer spending is roughly 70% of GDP. If we spend less, the metric we use to gauge economic health drops.

There’s also the fact that we see more ads than ever.

But, most importantly, there’s a widespread high time preference that is, I think, part of the very fabric of our culture.

Here’s where I think Bitcoin comes into play. So much of this rat-race orgy of consumption is high-time-preference behavior incentivized by the fiat monetary system, which ensures your money loses value over time. Since your purchasing power is sand in an hourglass, and since you work harder than ever just to keep up, consumer spending serves both a practical and a pacifying purpose. In other words, we are incentivized to spend because not spending or investing means our money just sits and loses value. And if we work so hard, many of us at jobs we don’t particularly enjoy, just to keep up, shouldn’t we also buy all the new cool stuff to make us feel like it’s all worth it?

If we remove ourselves from some of the rat race stuff it clears space for us to think less about money, which means we can be more intentional about everything else. Hence the idea of intentionality maximalism. We sort of reclaim our positive freedom, our freedom to pursue the highest expression of ourselves. Bitcoin, in my opinion, is ultimately about looking for a sustainable alternative to the rat-race model.

It’s really a contrast of values. Consumerism is a value of the fiat system. It is both literally a value, since we measure economic health in large part by measuring consumption, and also an ingrained mode of behavior. By disincentivizing mindless, reflexive consumption and incentivizing a lower time preference, Bitcoin, if it continues to grow in adoption, offers the promise of a cultural foregrounding of deeper things, like fulfilling pursuits, relationships, creativity, contribution to community, presence, etc.

When it comes to this interior transformation, this intentionality maximalism, and the ways in which Bitcoin moves us in that direction, I think Bitcoin shares some fundamental principles with minimalism, a movement that has deep, ancient roots, but has been gathering more popular momentum in the last decade or so. Proponents of minimalism, mindful of the constraints unchecked consumerism can place on our lived experience, pursue lives with fewer unused, unnecessary possessions in order to reclaim freedom and mastery over one’s life and the space to pursue what’s important. Which is to say the pursuit of a more intentional life.

Joshua Fields Millburn, co-founder of theminimalists.com, describes minimalism as “the thing that gets us past the things so we can make room for life’s important things—which aren’t things at all.”

The promise of Bitcoin, to borrow Millburn’s articulation, is to be the money that, through its soundness, allows us to get past thinking about money all the time so that we can make room for life’s important things – which tend to get lost, neglected, and/or sacrificed in consumption and the systemically coerced pursuit of more and more money.

We spend so much time thinking about money (how to get it, how to get more of it, how to make it grow, how to keep up with inflation, how to invest it, how to spend it, what to spend it on, how to get rich quick, how to pay the bills, etc). And to a certain extent this will always be true. I am not advocating for the Platonic form of communism here.

But when money does not hold its value, when it is continuously debased, when the sovereign debt is so massive it must be inflated away, and when the economic health of a country is measured by how much it consumes, it creates an environment in which money is practically all we think about.

This is why I have been so critical/skeptical of some of the proposals in other corners of the crypto world, many of which seem to be seeking to financialize every corner of our lives. I think this perpetuates, and perhaps intensifies, our high-time-preference environment.

In contrast, the implications and downstream effects of collectively lowering our time preference, which I think necessarily involves less consumerism, simply cannot be understated. Imagine an entire population finally able to save in a sound money and to spend more time and energy on the things that mean the most to them.

Now, again, I’m not envisioning a utopian end-state here where we’re all singing songs around the campfire (though I do enjoy songs and campfires). I’m talking about returning some headspace and some presence back to folks who have, by necessity, grown accustomed to spending every waking moment thinking about money and consumption. I’m talking about a transformation of our interior lives, one that clears space for more intentional living. And I think an under-appreciated aspect of Bitcoin is its potential to catalyze such a transformation.

So be a freedom maximalist, because it’s important. But don’t stop there, because that alone won’t keep you full, long-term. Be an intentionality maximalist, too.

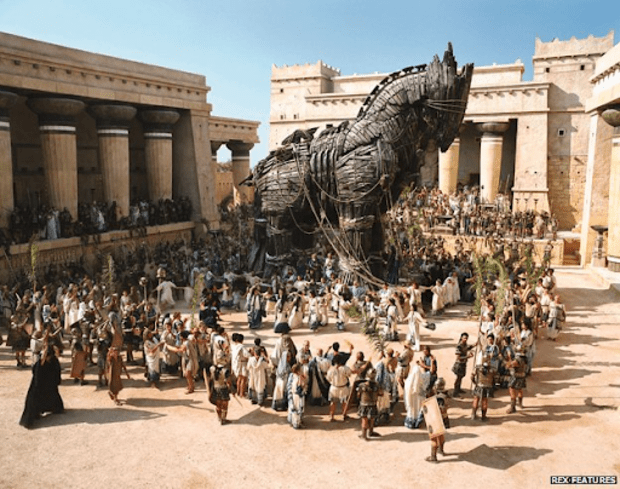

Many people live lives like this – compelled, constrained, and unintentional within a fiat system:

Happiness

I think Bitcoin is about escaping this.

This is a guest post by Logan Bolinger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.