How 4 Undergrads Are Using Crypto to Solve Two Of Nigeria’s Major Financial Problems

Four young students in Nigeria decided to ride the cryptocurrency wave and harness this technology’s potential to build a better future for their country.

Ben Eluan and Osezele Orukpe were two university students who, like many in Nigeria, shared an interest in cryptocurrencies. It is not surprising; interest in technology careers and courses has been on the rise in the region, and the use of Bitcoin has reached record numbers, to the point of taking a prominent place in national politics.

Crypto Remittances: A Potential Gold Mine

Eluan and Orukpe found a golden opportunity in the country’s financial situation: Nigeria’s struggling economy, the chance to improve the remittance services industry, and the growing interest in cryptocurrencies even in the face of government threats, all came together in Flux, a cryptocurrency remittance company that promises near-instant, secure and much cheaper remittances than traditional remittance alternatives.

The idea began to materialize when the duo teamed up with Israel Akintunde and Ayomide Lasaki and devoted full time to fine-tuning all the project’s intricacies. The goals are ambitious, but Ben Eluan believes they are perfectly possible:

“We dropped out to focus on our startup and scaling it into a $1 billion company. We believe the opportunity here is huge. So for us, the right thing to do is to get the job done well. Startups need time so dropping out was inevitable.”

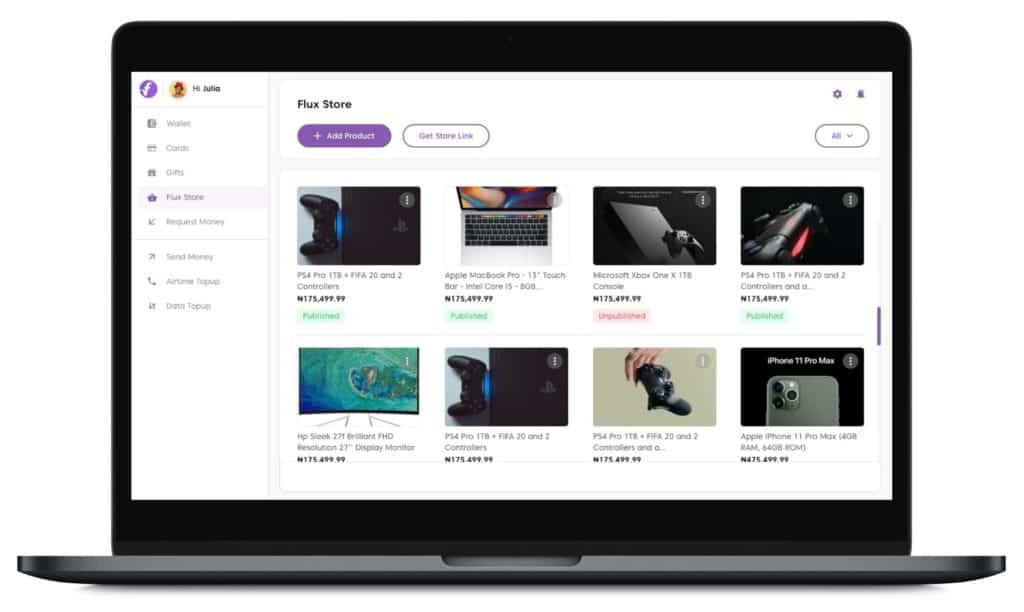

Besides remittances, Flux has a local payment processor. In this way, they expand the use cases of cryptocurrencies and reach out to a broader target audience.

Offering solutions to merchants also comes with its own set of advantages. There is a high rate of unbankability in the country, and the use of alternative means of payment has started to become relevant in the face of payment difficulties.

For example, there are some restrictions for online purchases using cards. Nigerians cannot spend more than $100, and withdrawals cannot exceed this limit either.

Why Nigeria?

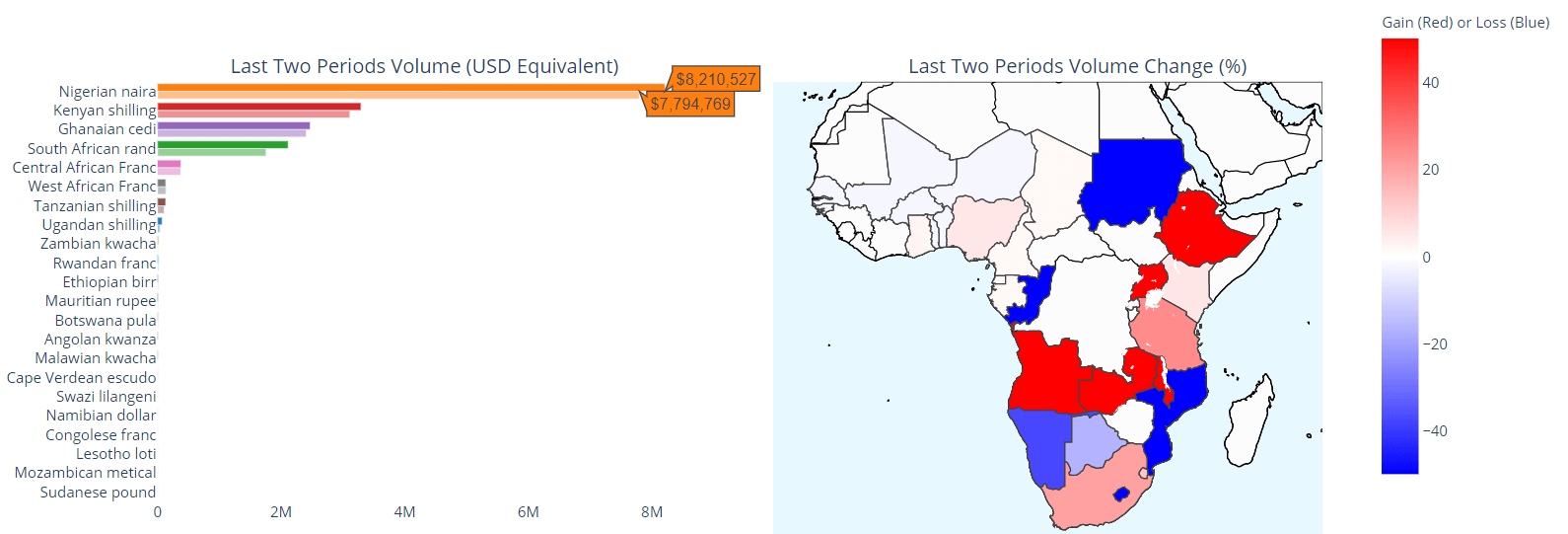

Nigeria’s case has set an example for the cryptocurrency industry. The country has managed to monopolize the Bitcoin market in sub-Saharan Africa, mobilizing more funds than the rest of the countries in the region combined.

According to data from Usefultulips, Nigerians traded more than $8 million in Bitcoin last week alone. The second-largest volume in the region is held by Kenya, with just over $3 million.

Regarding remittances, PwC estimates that it could grow up to a $34.8 Bn industry in 2023. At the moment, it is estimated that Nigerians move about $29.8 Bn dollars a year in remittances, so it’s not too crazy to think that if Flux takes just a fraction of that market, the dream of these four Nigerian entrepreneurs could grow into the billion-dollar industry they can only imagine today.

That is, of course, if the Nigerian government doesn’t change its view on cryptocurrencies again.