House Poised to Vote on Erasing SEC Crypto Policy While President Biden Vows Veto

-

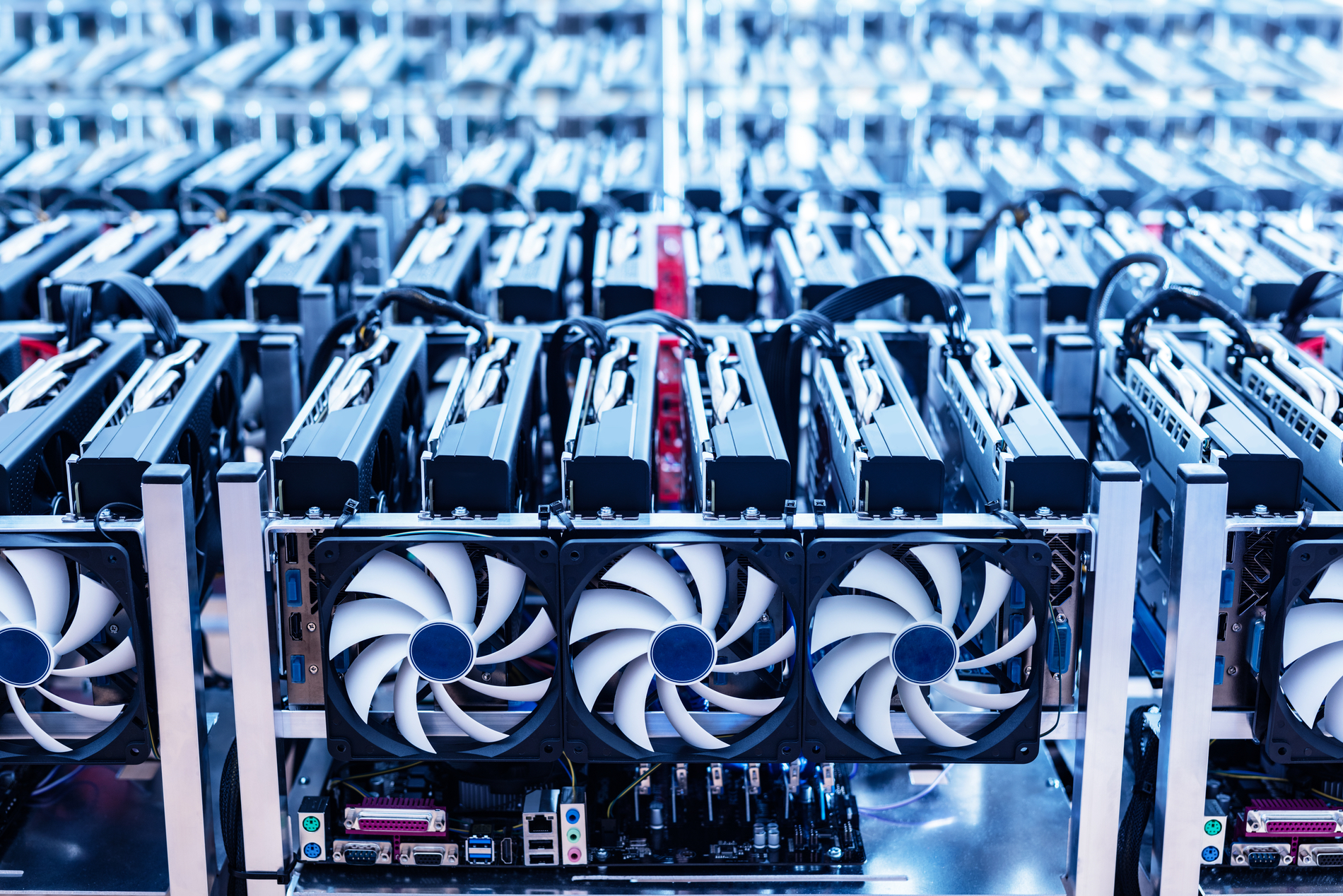

A House resolution would start a formal process to kill the Securities and Exchange Commission’s controversial accounting policy on crypto custody, and a vote was expected Wednesday.

-

President Joe Biden said he’ll veto the resolution if it reaches his desk for approval.

The U.S. House of Representatives is poised to vote on a resolution Wednesday to reject the Securities and Exchange Commission (SEC) cryptocurrency accounting guidance that the industry said has deterred banks from handling crypto customers, but President Joe Biden is already promising he’ll veto the effort if it hits his desk.

The SEC’s Staff Accounting Bulletin No. 121 – also known as SAB 121 – has been a focus of criticism from digital assets businesses and Republican lawmakers since its arrival. The bulletin was meant to clarify accounting treatment for crypto assets, directing a bank holding customer’s digital tokens should do so on its own balance sheet, potentially incurring massive capital expenses. But the policy guidance has since been found in one government review to have been handled badly, though the agency and Chair Gary Gensler have defended it.

“Gary Gensler, in his jihad against digital assets, used what is supposed to be mundane staff accounting guidance to essentially freeze out large publicly traded banks from taking custody of digital assets,” said Rep. Mike Flood (R-Neb.), the effort’s sponsor, in a Wednesday interview with CoinDesk. And the SEC didn’t consult with the banking regulators about it, Flood pointed out, arguing that Gensler “doesn’t have any business in the banking world.”

The White House considers the policy worth defending with a veto, according to a statement from Biden.

“SAB 121 was issued in response to demonstrated technological, legal, and regulatory risks that have caused substantial losses to consumers,” Biden said in a Wednesday statement, saying he “strongly opposes” disrupting the SEC’s work on this.

Flood said he expected the House to vote late in the day to kill the SEC’s policy.

“It made a joke of the rulemaking process and ignored other regulatory agencies,” said Rep. Patrick McHenry (R-N.C.), the chairman of the House Financial Services Committee, in a speech on the House floor on Wednesday, calling SAB 121 “a massive deviation for how highly regulated banks are traditionally required to treat assets on behalf of their customers.”

But a key House Democrat thought the resolution goes too far.

“This bill takes a sledgehammer to fix an issue that may merely need a scalpel, and it does so because my colleagues on the other side of the aisle are not only interested in doing the bidding of special interest groups, they are also interested in attacking and undermining the SEC in every possible way,” said Rep. Maxine Waters (D-Calif.), the ranking Democrat on McHenry’s committee.

SAB 121 was originally introduced as staff guidance, but a subsequent Government Accountability Office (GAO) review determined that the agency should have handled it as a rule, with full public comments and submission to Congress.

Rep. Flood introduced the resolution to formally disapprove of the regulator’s guidance alongside two Democrats, and Sen. Cynthia Lummis (R-Wyo.) has been pushing for a matching resolution in the Senate, which would be needed before the joint resolution could make it to Biden’s desk.

When an agency rule is reversed under the Congressional Review Act, it’s not only erased, but anything similar is forever blocked from future implementation. Waters argued that SAB 121 – apart from the controversial custody component – also provided guidance on crypto disclosures that are necessary and would be threatened if Congress overturns the policy, and Biden echoed the concern about policies that would be blocked.

“By virtue of invoking the Congressional Review Act, it could also inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability,” Biden said. “Limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty.”

Flood called it “disappointing” that the president would approve the improper use of a bulletin to do the work of a full-fledged federal rulemaking. He said he and his allies will “look for every single vehicle between now and the end of the year that will go to the president’s desk and add this language in there.”

Edited by Nikhilesh De.