Hopes for Another DeFi Summer Soar as TradFi Markets Suddenly Look Less Appealing

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

DeFi yields have exceeded yields from conventional investments like U.S. Treasuries, raising hopes for rekindled interest and maybe another DeFi Summer.

-

MakerDAO’s DAI Savings Rate provides users with a 15% yield, while riskier corners of DeFi can earn 27% through the likes of Ethena Labs.

-

“The bull market saw prices slowly start going up, and now, two months later, it’s completely opposite again, in terms of looking at rates in DeFi and TradFi,” one expert said.

11:05

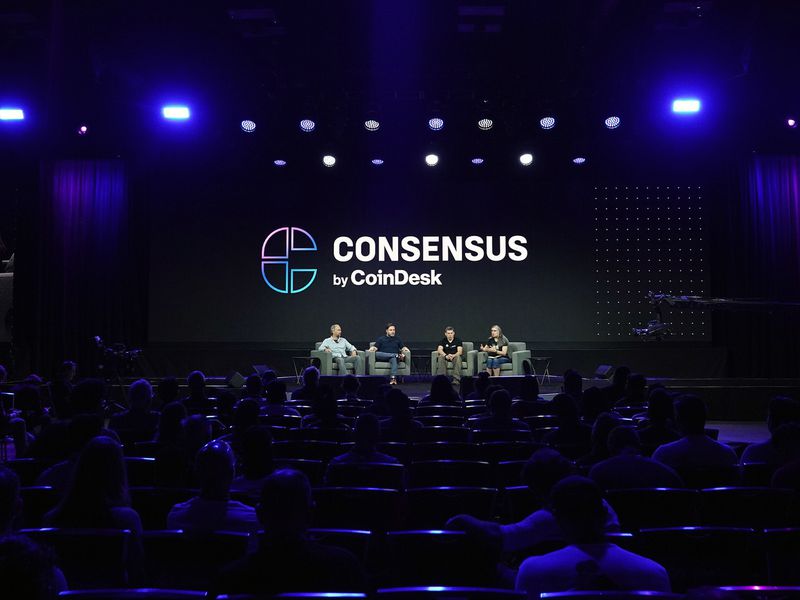

How Spool Is Aiming to Help Institutions Enter DeFi

00:46

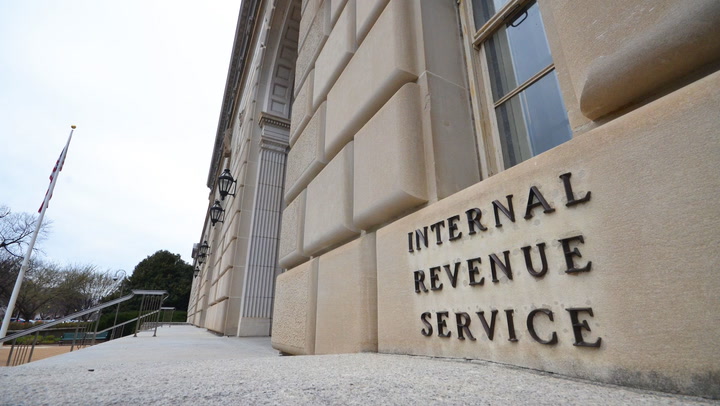

How a New Tax Proposal From the IRS Could Impact DeFi

12:40

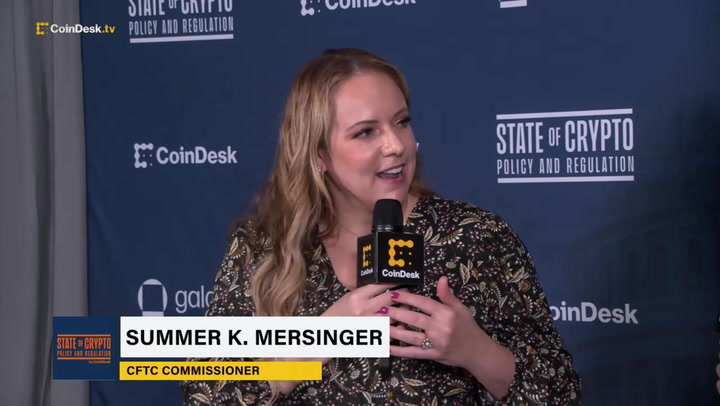

CFTC Commissioner Mersinger Discusses Spot Bitcoin ETF Optimism, Crypto Regulation

13:54

Crypto Spot Market Regulation Gap Unaddressed for ‘Far Too Long’: Former CFTC Commissioner Stump

Decentralized finance, or DeFi, languished in 2023, one of many hardships the cryptocurrency industry faced.

Because the Federal Reserve and other central banks were hiking interest rates, conventional – and, in many cases, less risky – investments looked more appealing. Why stick your money in some DeFi pool when safer U.S. Treasuries had higher yields?

But DeFi now looks ascendant, triggering memories of 2020, aka DeFi Summer, when the space bustled with activity.

Whereas the median DeFi yield, averaged over seven days, dwelled below 3% for most of 2023 and dipped below 2% several times, earlier this month it leapt to almost 6%, according to data from DefiLlama. Plugging collateral into MakerDAO’s DAI Savings Rate provides users with a 15% yield. Those comfortable enough to delve into the riskier corners of DeFi can earn 27% through the likes of Ethena Labs.

These higher levels exceed the Secured Overnight Financing Rate, or SOFR, the interest rate banks use to price U.S. dollar-denominated derivatives and loans, which is currently around 5.3%.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VLUR7PBU3JCTPBAIZFD3XSGBPE.png)

Strong institutional tailwinds have driven the current crypto bull market, which was kicked off by the January arrival of spot bitcoin exchange-traded funds from the likes of BlackRock and Fidelity, but also by traditional financial firms’ interest in the so-called tokenization of real-world assets – representing ownership of conventional assets via blockchain-traded tokens.

Over the past year or so, with yields from fixed-income products rivaling what was on offer at DeFi platforms, traditional finance firms like JPMorgan and BlackRock and crypto startups like Ondo Finance have focused their crypto efforts on tokenizing higher-yielding assets like U.S. Treasuries and money-market funds.

But crypto and DeFi began heating up in October, according to Sébastien Derivaux, co-founder of Steakhouse Financial. It was the point at which DeFi rates began to compete with and later outgun SOFR. Crypto-native DeFi products, rather than tokenized conventional financial products, began looking more appealing.

“It is customary that when there is a bull market, rates go up in lending protocols,” he said via Telegram. “It was even more in perpetual markets (assuming it is because retail degens find it easier to use offshore exchanges providing perp markets than leveraging on DeFi).”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/25G6ZE36BJDB7IK436NFGK25C4.png)

The couple months following the approval of spot bitcoin ETFs have seen this trend intensify, a parallel to the relatively rapid hike in interest rates that followed the intensification of the Covid crisis in early 2020, said Lucas Vogelsang, CEO of Centrifuge, a firm that has pioneered the tokenization of real-world assets, or RWAs.

“We’ve actually had two complete changes in the market. You had the Fed change rates overnight, basically; at least it went from zero to 2% or 3% pretty quickly and that completely changed the face of DeFi,” Vogelsang said in an interview. “The bull market saw prices slowly start going up, and now, two months later, it’s completely opposite again, in terms of looking at rates in DeFi and TradFi.”

Because the crypto industry remains relatively small, there’s simply not enough capital to lend to people who are bullish and, as a result, they don’t mind borrowing at high rates. While institutions are clearly interested in crypto, they are not actually filling gaps in market demand, Vogelsang pointed out. “A money market off-chain wouldn’t yield 12% just because there’s a lack of supply; someone would fill it. On-chain, that’s not the case,” he said. “It’s a sign of immaturity in that way.”

Some DeFi lending rates might look unsustainably high, an uncomfortable reminder of crypto projects that blew up in years past. But the loan-to-value (LTV) ratio is relatively low on platforms like Morpho Labs, for instance, said Rob Hadick, general partner at Dragonfly.

“I don’t actually think lending is back; I think deposits are back,” Hadick said in an interview. “I think that’s because people want yield. But there’s not as much rehypothecation happening right now as there was a few years ago.”

Hadick, whose firm is an investor in Ethena Labs, pointed out the super-high yields available on that platform are not underpinned by pure leverage, but rather follow a basis trade – long spot markets and short the related futures.

“As the markets change, the rate might come down. But it’s not like leverage in the traditional sense,” Hadick said. “People are just going to unwind the trade when it’s no longer economic, as opposed to ‘I’m going to blow up and my collateral is gonna get liquidated.’ That’s not a thing that happens in this type of trading.”

Edited by Nick Baker.