HODL Wins: The Majority Would Prefer Holding Bitcoin Than Gold

When it comes down to investing, Bitcoin and gold have been heavily compared. According to a new poll initiated by the former Congressman of Texas, however, Bitcoin is seriously preferred over Gold and other investment options.

10-year Investment Survey

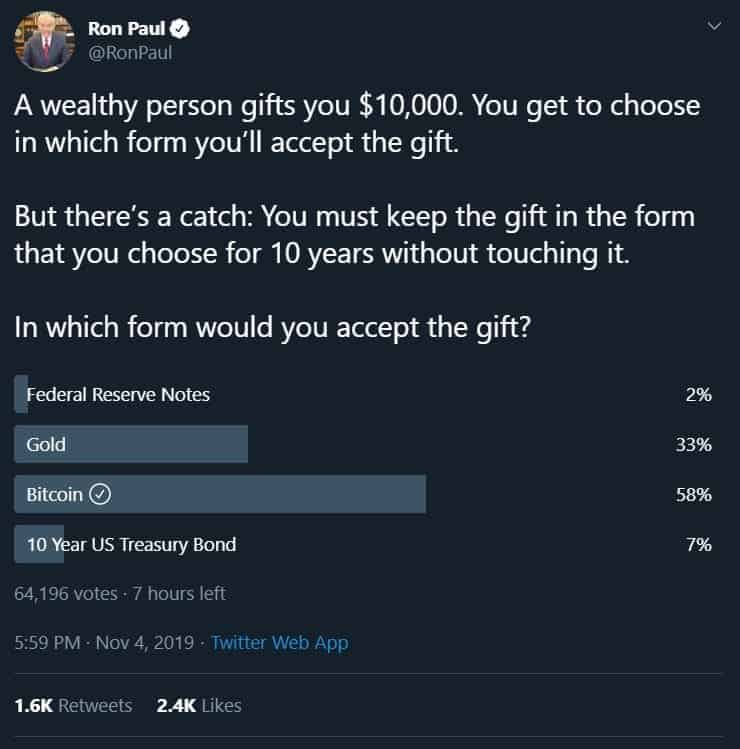

Ron Paul, the former congressman from Texas, initiated a poll on Twitter asking people what they would invest in if a wealthy person gifted them $10,000. The voters can choose between 4 options – 10-year US Treasury Bond, Federal Reserve Notes, Gold, and the largest cryptocurrency by market capitalization – Bitcoin.

At the time of this writing, Federal Reserve Notes have received the lowest number of votes with just 2% and the 10-year US Treasury Bond follows with 7%. The battle for the top comes between gold and Bitcoin. While the former represents 33% of all votes, the latter is far ahead with 58%. Even though the poll is still not over, there are more than 64,000 people who have voted already.

Since the poll asked about 10-year investments, the results are showing that people would rather choose Bitcoin as a long-term holding option.

Why Bitcoin Over Gold?

Over the last several years, these two assets have been compared numerous times. Many people have said that they have similarities, mainly being a store of value. Bitcoin was even officially defined as a commodity recently – the same category as gold.

Another comparison can be made in the scarcity of both assets. Only a finite supply of gold exists in the world and the same is true for Bitcoin. Yet, there are quite a bit of differences as well.

While we don’t know how much gold there is, Bitcoin’s protocol stipulates that only 21 million will ever be in circulation, making it the first-ever scarce digital object. Adding to that, the online currency can also be easily transferred online, while gold, being a physical asset, could present transportation and protection issues due to its weight in larger quantities.

The total supply could be viewed from a different perspective as well. Bitcoin is preprogrammed to cut in half the rewards given to miners every four years in a process called Halving. Basically, every time this event takes place the speed of creating new bitcoins will decrease with 50%, meaning that in just 12 years, that speed will be 90% less than what it is now. Simple economic principles dictate that when the supply of a certain asset decreases while the demand for it remains the same or increases, its price should go up. Two halvings have occurred so far, both pushing Bitcoin’s price to go up and the next one will happen in 2020.

The post HODL Wins: The Majority Would Prefer Holding Bitcoin Than Gold appeared first on CryptoPotato.